Taxonomy alignment in accounting ensures consistent classification and harmonization of financial data across reporting standards, improving comparability and clarity. Impairment testing involves assessing asset values to determine if carrying amounts exceed recoverable amounts, preventing overstated financial positions. Explore the key distinctions and applications of these processes to enhance financial reporting accuracy.

Why it is important

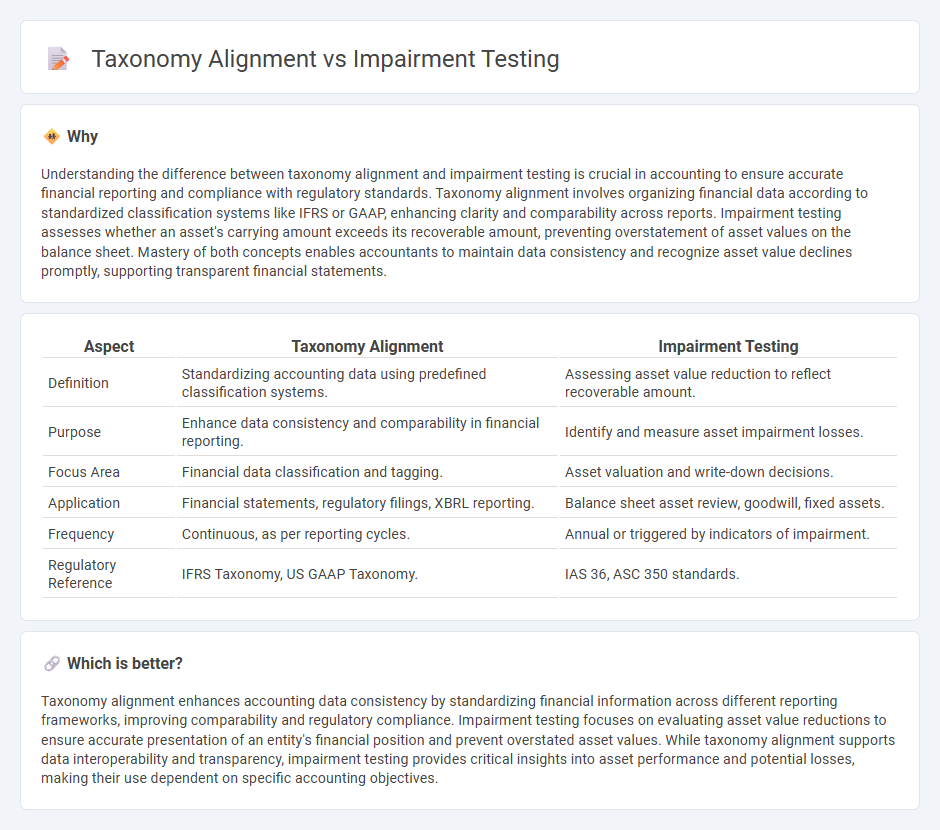

Understanding the difference between taxonomy alignment and impairment testing is crucial in accounting to ensure accurate financial reporting and compliance with regulatory standards. Taxonomy alignment involves organizing financial data according to standardized classification systems like IFRS or GAAP, enhancing clarity and comparability across reports. Impairment testing assesses whether an asset's carrying amount exceeds its recoverable amount, preventing overstatement of asset values on the balance sheet. Mastery of both concepts enables accountants to maintain data consistency and recognize asset value declines promptly, supporting transparent financial statements.

Comparison Table

| Aspect | Taxonomy Alignment | Impairment Testing |

|---|---|---|

| Definition | Standardizing accounting data using predefined classification systems. | Assessing asset value reduction to reflect recoverable amount. |

| Purpose | Enhance data consistency and comparability in financial reporting. | Identify and measure asset impairment losses. |

| Focus Area | Financial data classification and tagging. | Asset valuation and write-down decisions. |

| Application | Financial statements, regulatory filings, XBRL reporting. | Balance sheet asset review, goodwill, fixed assets. |

| Frequency | Continuous, as per reporting cycles. | Annual or triggered by indicators of impairment. |

| Regulatory Reference | IFRS Taxonomy, US GAAP Taxonomy. | IAS 36, ASC 350 standards. |

Which is better?

Taxonomy alignment enhances accounting data consistency by standardizing financial information across different reporting frameworks, improving comparability and regulatory compliance. Impairment testing focuses on evaluating asset value reductions to ensure accurate presentation of an entity's financial position and prevent overstated asset values. While taxonomy alignment supports data interoperability and transparency, impairment testing provides critical insights into asset performance and potential losses, making their use dependent on specific accounting objectives.

Connection

Taxonomy alignment standardizes financial reporting by categorizing accounting elements, enhancing consistency in impairment testing processes. Impairment testing relies on this structured classification to accurately identify and evaluate asset recoverability under accounting standards like IFRS and GAAP. Precise taxonomy alignment ensures reliable impairment calculations, supporting transparent financial statements and regulatory compliance.

Key Terms

**Impairment Testing:**

Impairment testing evaluates the carrying value of assets to determine if they exceed their recoverable amount, ensuring accurate financial reporting under IFRS and GAAP standards. This process involves estimating future cash flows and discount rates to identify potential asset write-downs due to impairment losses. Discover more about how impairment testing safeguards asset valuation and influences financial statements.

Recoverable Amount

Impairment testing assesses whether an asset's carrying amount exceeds its recoverable amount, defined as the higher of fair value less costs of disposal and value in use. Taxonomy alignment, by contrast, structures financial reporting elements but does not directly affect recoverable amount calculations. Explore further how recoverable amount metrics integrate with accounting standards and taxonomy frameworks.

Cash-Generating Unit (CGU)

Impairment testing evaluates whether the carrying amount of a Cash-Generating Unit (CGU) exceeds its recoverable amount, ensuring that assets are not overstated on the balance sheet. Taxonomy alignment organizes financial reporting elements in compliance with regulatory frameworks, facilitating consistent CGU disclosure and comparability across entities. Explore detailed methodologies and regulations governing CGU impairment and taxonomy alignment for comprehensive financial analysis.

Source and External Links

If and when to undertake an impairment review - This article provides insights into when a detailed impairment test is required under IAS 36, discussing the timing and flexibility of the annual impairment test.

Impairment Testing - A Critical Process That is Often Underestimated - This article highlights the complexity and sequence of impairment testing, emphasizing its importance in evaluating assets during economic fluctuations.

The Challenge of Impairment Testing for Long-Lived Assets - This resource discusses the challenges and considerations involved in impairment testing for long-lived assets, including the appropriate order and recognition of impairment losses.

dowidth.com

dowidth.com