Embedded lease accounting involves integrating lease costs directly within the lessee's operational expenses, ensuring accurate reflection of usage and associated liabilities on financial statements. Direct financing lease accounting, on the other hand, records the lease as a financing transaction, recognizing interest income over time and recovering the lease receivable from the lessee. Explore the differences in recognition, measurement, and financial impact to understand which method suits your accounting needs best.

Why it is important

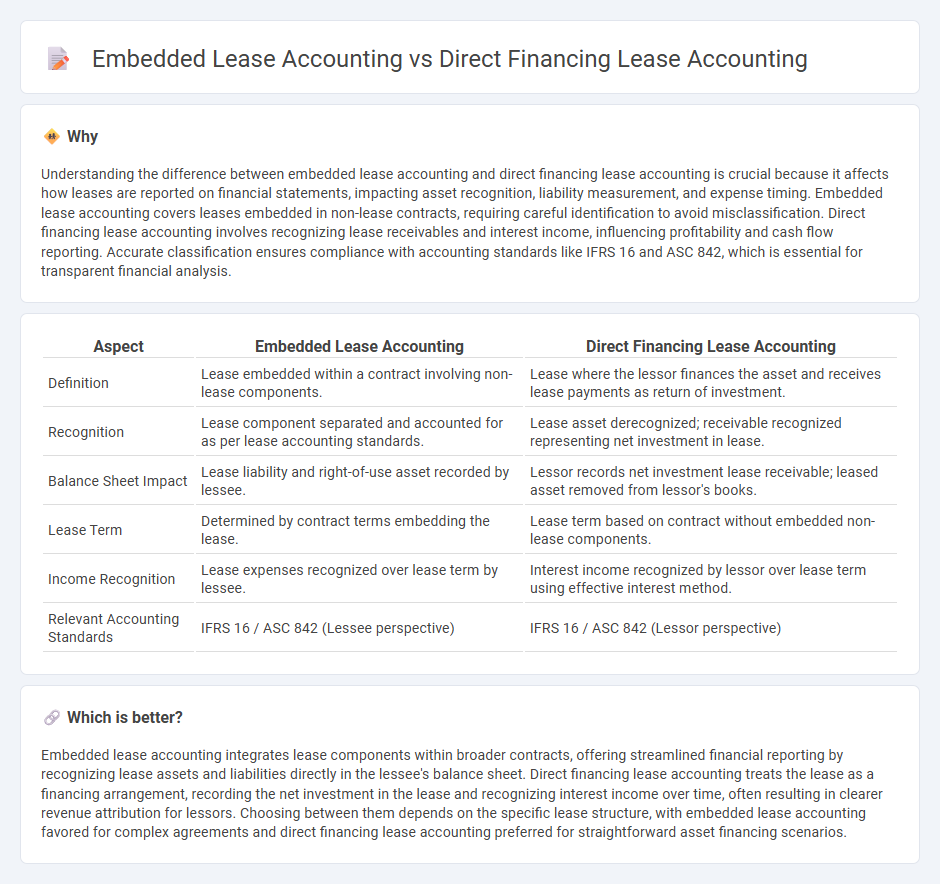

Understanding the difference between embedded lease accounting and direct financing lease accounting is crucial because it affects how leases are reported on financial statements, impacting asset recognition, liability measurement, and expense timing. Embedded lease accounting covers leases embedded in non-lease contracts, requiring careful identification to avoid misclassification. Direct financing lease accounting involves recognizing lease receivables and interest income, influencing profitability and cash flow reporting. Accurate classification ensures compliance with accounting standards like IFRS 16 and ASC 842, which is essential for transparent financial analysis.

Comparison Table

| Aspect | Embedded Lease Accounting | Direct Financing Lease Accounting |

|---|---|---|

| Definition | Lease embedded within a contract involving non-lease components. | Lease where the lessor finances the asset and receives lease payments as return of investment. |

| Recognition | Lease component separated and accounted for as per lease accounting standards. | Lease asset derecognized; receivable recognized representing net investment in lease. |

| Balance Sheet Impact | Lease liability and right-of-use asset recorded by lessee. | Lessor records net investment lease receivable; leased asset removed from lessor's books. |

| Lease Term | Determined by contract terms embedding the lease. | Lease term based on contract without embedded non-lease components. |

| Income Recognition | Lease expenses recognized over lease term by lessee. | Interest income recognized by lessor over lease term using effective interest method. |

| Relevant Accounting Standards | IFRS 16 / ASC 842 (Lessee perspective) | IFRS 16 / ASC 842 (Lessor perspective) |

Which is better?

Embedded lease accounting integrates lease components within broader contracts, offering streamlined financial reporting by recognizing lease assets and liabilities directly in the lessee's balance sheet. Direct financing lease accounting treats the lease as a financing arrangement, recording the net investment in the lease and recognizing interest income over time, often resulting in clearer revenue attribution for lessors. Choosing between them depends on the specific lease structure, with embedded lease accounting favored for complex agreements and direct financing lease accounting preferred for straightforward asset financing scenarios.

Connection

Embedded lease accounting integrates lease components within a broader contract, requiring identification and separation of lease and non-lease elements under ASC 842 or IFRS 16 standards. Direct financing lease accounting applies when a lessor recognizes a net investment in the lease, reflecting present value of lease payments plus residual value, connecting closely to embedded leases by properly attributing lease-related cash flows. Accurate identification and classification between embedded and direct financing leases ensure compliance with revenue recognition principles and asset-liability management in financial reporting.

Key Terms

Lease Classification

Direct financing lease accounting involves recognizing lease receivables and residual assets on the lessor's balance sheet, emphasizing lease classification based on transfer of ownership or lease term criteria under ASC 842 or IFRS 16. Embedded lease accounting requires identifying lease components within broader contracts, necessitating separation of lease and non-lease components to correctly classify the lease and allocate payments. Explore deeper insights on lease classification impacts and compliance nuances in lease accounting standards here.

Right-of-Use (ROU) Asset

Direct financing lease accounting recognizes the Right-of-Use (ROU) Asset based on the present value of lease payments, reflecting the lessee's right to use the asset over the lease term. Embedded lease accounting identifies lease components within service contracts, requiring separate recognition of the ROU Asset even when leases are not explicitly stated. Explore detailed distinctions and accounting implications to optimize lease management and financial reporting accuracy.

Embedded Lease Identification

Embedded lease identification involves analyzing contracts to determine if lease components exist within non-lease agreements, requiring detailed assessment under IFRS 16 or ASC 842 standards. Direct financing lease accounting records leases separately on balance sheets, emphasizing distinct lease recognition, while embedded leases demand careful parsing of mixed contracts for accurate lease classification. Explore our comprehensive guide to master embedded lease identification and ensure compliance with evolving accounting frameworks.

Source and External Links

The Differences Between Sales Type Leases and Direct Financing Leases - In a direct financing lease, the lessor removes the leased asset from its balance sheet and recognizes a receivable at the asset's book value, then recognizes income over time as lease payments are received, dividing each payment into an interest portion recognized as income and a principal portion reducing the receivable, similar to loan accounting.

Sales & financing leases: Journal entries under ASC 842 - Under ASC 842, direct financing leases require the lessor to derecognize the underlying asset and record an investment in the lease, deferring recognition of any selling profit until payments are received, recognizing interest revenue using the lease discount rate, with losses recognized immediately at lease commencement.

Direct financing lease definition - AccountingTools - A direct financing lease is a lease where the lessor, typically a financing institution, acquires an asset and leases it to a customer, earning interest income over the lease term without recognizing initial profit, transferring substantially all ownership risks and rewards to the lessee, with legal ownership retained by the lessor until lease end or purchase.

dowidth.com

dowidth.com