Ledger tokenization enhances data security and transaction transparency by converting financial records into encrypted digital tokens, reducing fraud risks in accounting processes. Automated compliance streamlines regulatory adherence by using AI-driven systems to monitor financial activities and ensure real-time conformity with accounting standards and laws. Explore how integrating ledger tokenization with automated compliance can revolutionize financial management and compliance efficiency.

Why it is important

Understanding the difference between ledger tokenization and automated compliance is crucial for accurate financial record-keeping and regulatory adherence in accounting. Ledger tokenization enhances security by converting sensitive data into cryptographic tokens, reducing fraud risk and data breaches. Automated compliance streamlines adherence to accounting standards and legal requirements, minimizing errors and audit penalties. Mastery of both concepts ensures robust financial management and organizational accountability.

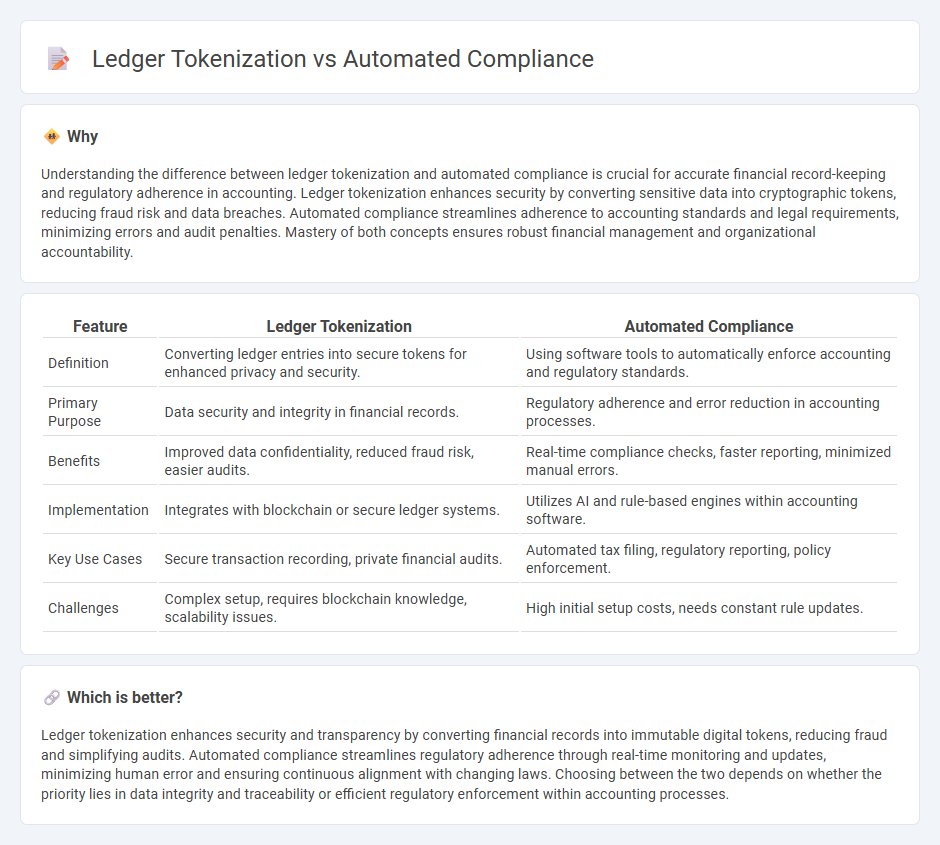

Comparison Table

| Feature | Ledger Tokenization | Automated Compliance |

|---|---|---|

| Definition | Converting ledger entries into secure tokens for enhanced privacy and security. | Using software tools to automatically enforce accounting and regulatory standards. |

| Primary Purpose | Data security and integrity in financial records. | Regulatory adherence and error reduction in accounting processes. |

| Benefits | Improved data confidentiality, reduced fraud risk, easier audits. | Real-time compliance checks, faster reporting, minimized manual errors. |

| Implementation | Integrates with blockchain or secure ledger systems. | Utilizes AI and rule-based engines within accounting software. |

| Key Use Cases | Secure transaction recording, private financial audits. | Automated tax filing, regulatory reporting, policy enforcement. |

| Challenges | Complex setup, requires blockchain knowledge, scalability issues. | High initial setup costs, needs constant rule updates. |

Which is better?

Ledger tokenization enhances security and transparency by converting financial records into immutable digital tokens, reducing fraud and simplifying audits. Automated compliance streamlines regulatory adherence through real-time monitoring and updates, minimizing human error and ensuring continuous alignment with changing laws. Choosing between the two depends on whether the priority lies in data integrity and traceability or efficient regulatory enforcement within accounting processes.

Connection

Ledger tokenization enhances accounting accuracy by converting financial transactions into secure digital tokens, enabling real-time tracking and reducing errors. Automated compliance leverages these tokens to instantly verify regulatory requirements, ensuring adherence to financial standards and minimizing manual audits. Integration of ledger tokenization with automated compliance streamlines financial reporting and strengthens audit trail reliability in accounting systems.

Key Terms

Automated compliance: Regulatory automation, real-time monitoring, audit trail

Automated compliance leverages regulatory automation to ensure adherence to evolving legal frameworks, reducing manual errors and operational risks. Real-time monitoring capabilities enable continuous surveillance of transactions, promptly flagging any irregularities or non-compliance issues within ledger tokenization processes. Explore the benefits and implementation strategies of automated compliance to enhance security and efficiency in your blockchain operations.

Ledger tokenization: Digital assets, smart contracts, fractional ownership

Ledger tokenization transforms digital assets into secure, transferable tokens using blockchain technology, enabling fractional ownership and enhanced liquidity. Smart contracts automate transactions and enforce compliance rules directly on the ledger, minimizing operational risks and ensuring transparency. Discover how ledger tokenization revolutionizes asset management and compliance in today's digital economy.

Regulatory Reporting

Automated compliance streamlines regulatory reporting by leveraging real-time data analytics and AI to ensure timely, accurate submissions that adhere to evolving financial regulations. Ledger tokenization enhances transparency and traceability by recording transactions on immutable distributed ledgers, facilitating auditability and reducing the risk of non-compliance. Explore deeper insights on how these technologies transform regulatory reporting in the financial sector.

Source and External Links

What is compliance automation? | Definition from TechTarget - Compliance automation is the use of technology, often powered by AI, to streamline regulatory compliance workflows, reduce manual errors, and enable continuous monitoring and reporting against standards like HIPAA, GDPR, and CCPA.

Compliance automation: How it works and how to ... - Automated compliance solutions integrate with an organization's systems, use predefined or custom triggers for compliance checks, and provide real-time alerts, centralized dashboards, and cost savings by replacing manual processes.

Top 13 Compliance Automation Tools in 2025 - Compliance automation tools automate tasks such as data collection, monitoring, analysis, and reporting, offer real-time issue alerts, and help organizations efficiently adhere to complex and evolving regulatory requirements.

dowidth.com

dowidth.com