Microtransaction accounting records revenues and expenses in real-time for individual small transactions, enhancing accuracy in cash flow management. Amortization systematically allocates the cost of intangible assets over their useful life for accurate financial reporting. Explore more to understand how each method impacts financial statements and decision-making.

Why it is important

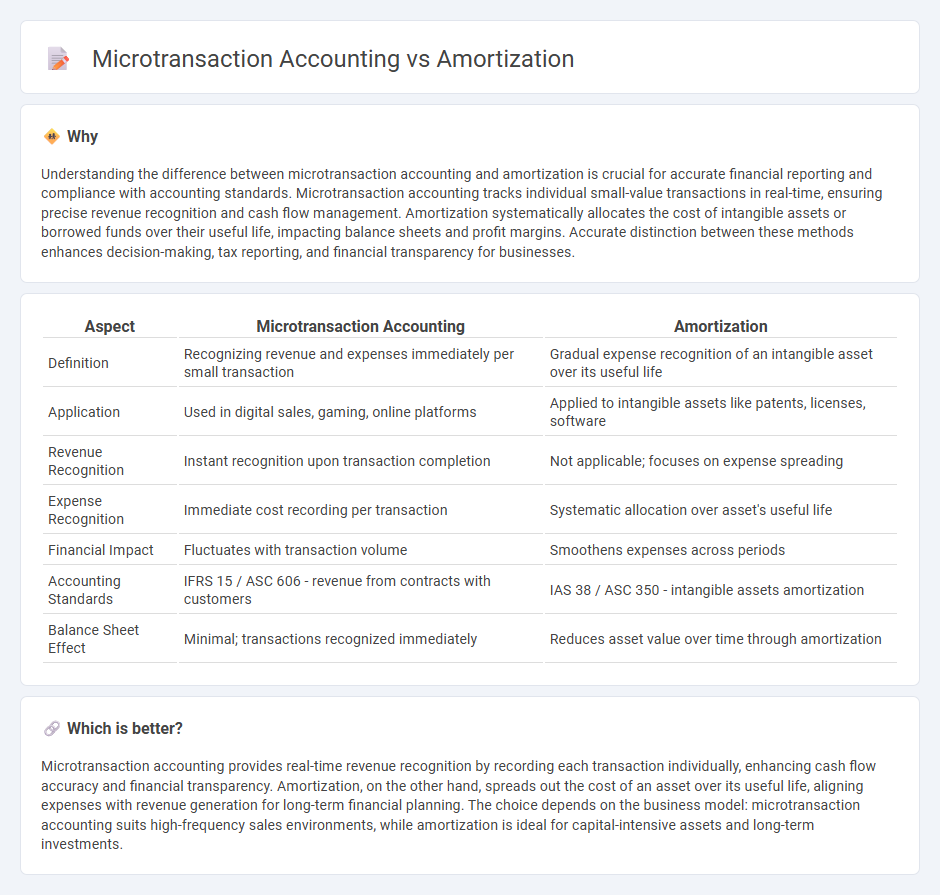

Understanding the difference between microtransaction accounting and amortization is crucial for accurate financial reporting and compliance with accounting standards. Microtransaction accounting tracks individual small-value transactions in real-time, ensuring precise revenue recognition and cash flow management. Amortization systematically allocates the cost of intangible assets or borrowed funds over their useful life, impacting balance sheets and profit margins. Accurate distinction between these methods enhances decision-making, tax reporting, and financial transparency for businesses.

Comparison Table

| Aspect | Microtransaction Accounting | Amortization |

|---|---|---|

| Definition | Recognizing revenue and expenses immediately per small transaction | Gradual expense recognition of an intangible asset over its useful life |

| Application | Used in digital sales, gaming, online platforms | Applied to intangible assets like patents, licenses, software |

| Revenue Recognition | Instant recognition upon transaction completion | Not applicable; focuses on expense spreading |

| Expense Recognition | Immediate cost recording per transaction | Systematic allocation over asset's useful life |

| Financial Impact | Fluctuates with transaction volume | Smoothens expenses across periods |

| Accounting Standards | IFRS 15 / ASC 606 - revenue from contracts with customers | IAS 38 / ASC 350 - intangible assets amortization |

| Balance Sheet Effect | Minimal; transactions recognized immediately | Reduces asset value over time through amortization |

Which is better?

Microtransaction accounting provides real-time revenue recognition by recording each transaction individually, enhancing cash flow accuracy and financial transparency. Amortization, on the other hand, spreads out the cost of an asset over its useful life, aligning expenses with revenue generation for long-term financial planning. The choice depends on the business model: microtransaction accounting suits high-frequency sales environments, while amortization is ideal for capital-intensive assets and long-term investments.

Connection

Microtransaction accounting involves recording numerous small financial transactions, requiring precise tracking to ensure accurate revenue recognition. Amortization systematically allocates the cost of intangible assets or prepaid expenses over their useful life, matching expenses with periods benefited. Both processes emphasize detailed financial recording and timing of expense recognition to maintain accurate and compliant financial statements.

Key Terms

Intangible Assets

Amortization systematically allocates the cost of intangible assets such as patents, trademarks, and software over their useful life, aligning expenses with revenue generation periods to accurately reflect asset value on financial statements. Microtransaction accounting records revenue from small, incremental sales typical in digital goods or services, requiring careful recognition to match revenue with associated costs while complying with IFRS 15 or ASC 606 standards. Explore detailed strategies for managing intangible asset amortization and microtransaction revenue recognition to enhance your accounting practices.

Revenue Recognition

Amortization allocates the cost of an asset over its useful life, impacting revenue recognition by matching expenses with generated revenue, while microtransaction accounting records immediate income from small, individual sales often in digital platforms or games. Revenue recognition principles differ, as amortization spreads income over time whereas microtransactions result in instant turnover recognition. Explore detailed accounting practices to optimize financial reporting accuracy for your business.

Expense Matching

Amortization allocates the cost of intangible assets over their useful life to match expenses with revenues, ensuring accurate financial reporting. Microtransaction accounting records revenue from small, individual transactions as they occur, which can create timing differences in expense matching. Explore the detailed accounting implications of amortization and microtransactions to optimize your financial strategy.

Source and External Links

amortization | Wex | US Law | LII / Legal Information Institute - Amortization is the process of spreading loan payments into periodic installments that cover both principal and interest so the loan is paid off by a specific date; it also refers to expensing intangible assets over time for tax purposes.

Amortization - Wikipedia - Amortization involves reducing loan principal over time through scheduled payments or systematically writing off the cost of intangible assets over their useful life.

Amortization Calculator | Bankrate - Amortization is paying off a debt with equal installments where each payment partially covers interest and principal, with tools available to calculate how loan terms affect payoff and interest paid.

dowidth.com

dowidth.com