Fractional CFO services provide strategic financial leadership on a part-time basis, focusing on high-level decision-making, cash flow optimization, and long-term financial planning. Management accounting, by contrast, centers on detailed internal financial analysis, budgeting, and performance measurement to support daily operational decisions. Explore how integrating both approaches can enhance your business's financial health and growth potential.

Why it is important

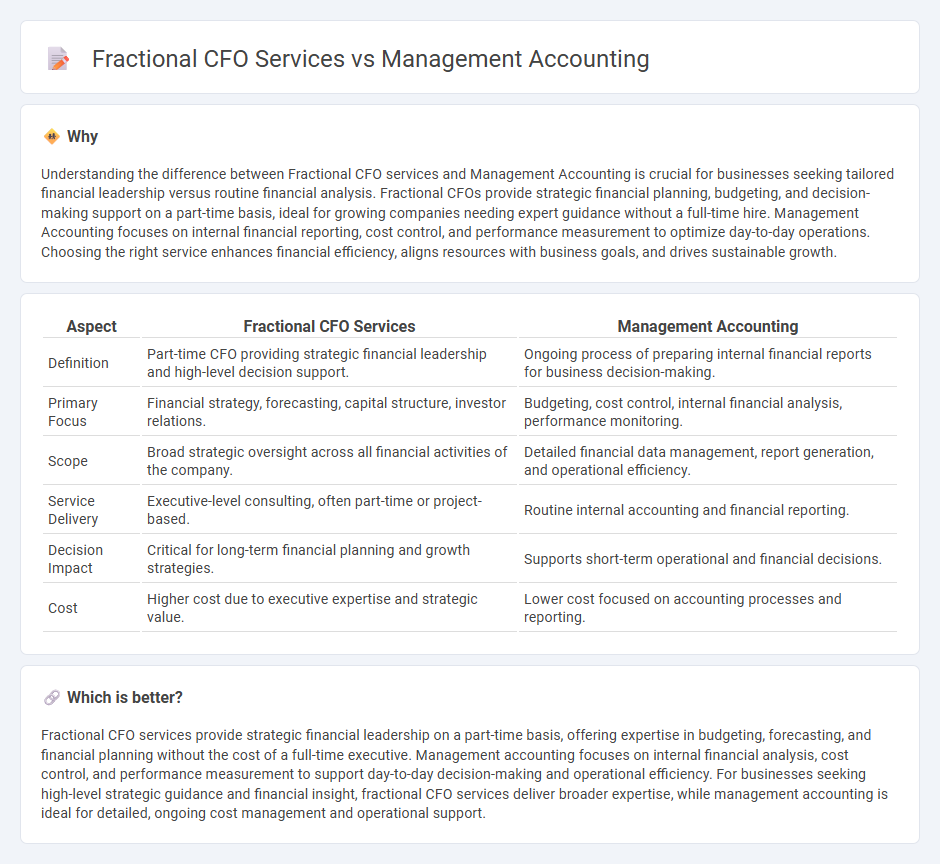

Understanding the difference between Fractional CFO services and Management Accounting is crucial for businesses seeking tailored financial leadership versus routine financial analysis. Fractional CFOs provide strategic financial planning, budgeting, and decision-making support on a part-time basis, ideal for growing companies needing expert guidance without a full-time hire. Management Accounting focuses on internal financial reporting, cost control, and performance measurement to optimize day-to-day operations. Choosing the right service enhances financial efficiency, aligns resources with business goals, and drives sustainable growth.

Comparison Table

| Aspect | Fractional CFO Services | Management Accounting |

|---|---|---|

| Definition | Part-time CFO providing strategic financial leadership and high-level decision support. | Ongoing process of preparing internal financial reports for business decision-making. |

| Primary Focus | Financial strategy, forecasting, capital structure, investor relations. | Budgeting, cost control, internal financial analysis, performance monitoring. |

| Scope | Broad strategic oversight across all financial activities of the company. | Detailed financial data management, report generation, and operational efficiency. |

| Service Delivery | Executive-level consulting, often part-time or project-based. | Routine internal accounting and financial reporting. |

| Decision Impact | Critical for long-term financial planning and growth strategies. | Supports short-term operational and financial decisions. |

| Cost | Higher cost due to executive expertise and strategic value. | Lower cost focused on accounting processes and reporting. |

Which is better?

Fractional CFO services provide strategic financial leadership on a part-time basis, offering expertise in budgeting, forecasting, and financial planning without the cost of a full-time executive. Management accounting focuses on internal financial analysis, cost control, and performance measurement to support day-to-day decision-making and operational efficiency. For businesses seeking high-level strategic guidance and financial insight, fractional CFO services deliver broader expertise, while management accounting is ideal for detailed, ongoing cost management and operational support.

Connection

Fractional CFO services provide businesses with expert financial leadership on a part-time basis, complementing management accounting by delivering strategic insights and real-time financial analysis. Management accounting focuses on internal financial data to optimize operational decision-making, which fractional CFOs leverage to guide budgeting, forecasting, and performance evaluation. This connection ensures smaller companies gain high-level financial expertise, improving cash flow management and profitability through data-driven strategies.

Key Terms

Budgeting

Management accounting centers on detailed budgeting processes that track expenses, forecast revenues, and analyze variances to support operational decisions. Fractional CFO services leverage advanced budgeting techniques combined with strategic financial planning to optimize cash flow, align budgets with long-term goals, and provide executive-level insights. Explore how each approach enhances financial management by visiting our in-depth guide on budgeting strategies.

Financial Analysis

Financial analysis in management accounting centers on internal budgeting, cost control, and performance measurement to improve operational efficiency. Fractional CFO services provide strategic financial analysis, including cash flow forecasting, risk assessment, and capital structure optimization to support long-term business growth. Explore detailed comparisons to understand which approach best suits your company's financial goals.

Strategic Planning

Management accounting provides detailed financial analysis and performance metrics to support strategic planning by identifying cost-saving opportunities and forecasting future financial trends. Fractional CFO services deliver high-level financial leadership, focusing on aligning strategic goals with financial planning, risk management, and capital allocation for scalable growth. Explore how integrating these approaches can optimize your business strategy and financial outcomes.

Source and External Links

What Is Management Accounting? - FreshBooks - This webpage provides an overview of management accounting, discussing its functions in forecasting, make-or-buy decisions, and analyzing performance variances.

Managerial Accounting - Definition, Objectives & Techniques - Zoho - This guide explains managerial accounting, its objectives, and techniques, focusing on its role in planning, analyzing data, and aiding decision-making.

Management accounting - Wikipedia - This Wikipedia page details the role of management accounting within corporations, highlighting its involvement in forecasting, cost management, and decision-making processes.

dowidth.com

dowidth.com