ESG assurance evaluates the accuracy and reliability of environmental, social, and governance disclosures, ensuring companies meet sustainability standards and stakeholder expectations. Financial audits focus on verifying the correctness of financial statements to comply with accounting principles and regulatory requirements. Explore how integrating ESG assurance enhances corporate transparency and risk management.

Why it is important

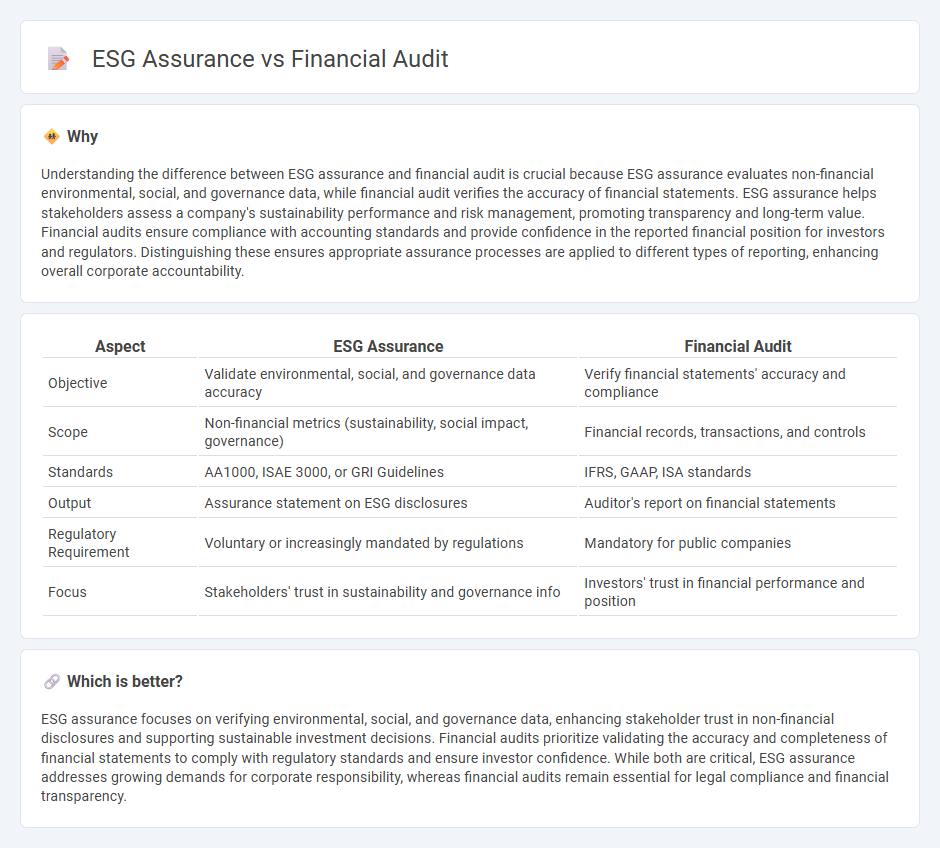

Understanding the difference between ESG assurance and financial audit is crucial because ESG assurance evaluates non-financial environmental, social, and governance data, while financial audit verifies the accuracy of financial statements. ESG assurance helps stakeholders assess a company's sustainability performance and risk management, promoting transparency and long-term value. Financial audits ensure compliance with accounting standards and provide confidence in the reported financial position for investors and regulators. Distinguishing these ensures appropriate assurance processes are applied to different types of reporting, enhancing overall corporate accountability.

Comparison Table

| Aspect | ESG Assurance | Financial Audit |

|---|---|---|

| Objective | Validate environmental, social, and governance data accuracy | Verify financial statements' accuracy and compliance |

| Scope | Non-financial metrics (sustainability, social impact, governance) | Financial records, transactions, and controls |

| Standards | AA1000, ISAE 3000, or GRI Guidelines | IFRS, GAAP, ISA standards |

| Output | Assurance statement on ESG disclosures | Auditor's report on financial statements |

| Regulatory Requirement | Voluntary or increasingly mandated by regulations | Mandatory for public companies |

| Focus | Stakeholders' trust in sustainability and governance info | Investors' trust in financial performance and position |

Which is better?

ESG assurance focuses on verifying environmental, social, and governance data, enhancing stakeholder trust in non-financial disclosures and supporting sustainable investment decisions. Financial audits prioritize validating the accuracy and completeness of financial statements to comply with regulatory standards and ensure investor confidence. While both are critical, ESG assurance addresses growing demands for corporate responsibility, whereas financial audits remain essential for legal compliance and financial transparency.

Connection

ESG assurance and financial audit intersect through their shared goal of validating the accuracy and reliability of corporate disclosures to stakeholders. Both processes involve evaluating internal controls, risk management systems, and compliance frameworks to ensure transparency in financial and non-financial reporting. Integrating ESG assurance with financial audits enhances overall audit quality by providing a comprehensive assessment of a company's sustainability impact alongside its financial health.

Key Terms

**Financial audit:**

Financial audit rigorously examines a company's financial statements to ensure accuracy, compliance with accounting standards, and reliable representation of financial health. It involves detailed assessment of transactions, balances, and internal controls to detect errors or fraud and provide assurance to stakeholders. Explore more to understand the distinct methodologies and objectives separating financial audits from ESG assurance.

Materiality

Financial audit concentrates on materiality defined by quantitative thresholds impacting financial statements, ensuring accuracy and compliance with accounting standards. ESG assurance prioritizes materiality based on environmental, social, and governance factors relevant to stakeholders, often incorporating qualitative impacts and future risks. Discover how aligning materiality frameworks enhances comprehensive assurance across financial and ESG domains.

Internal controls

Financial audit primarily evaluates the accuracy and completeness of financial statements by examining internal controls that safeguard assets and ensure reliable financial reporting. ESG assurance focuses on the effectiveness of internal controls related to environmental, social, and governance data, confirming the integrity and transparency of non-financial disclosures. Discover how strengthening internal controls enhances both financial and ESG assurance processes.

Source and External Links

Financial Audit: Overview, and Best Practices - AuditBoard - A financial audit is a detailed examination of a company's financial statements including balance sheet, income statement, statement of cash flows, and changes in equity to ensure accuracy and fairness, following a process of preparation, team designation, execution, audit opinion formation, and action planning.

Financial audit - Wikipedia - A financial audit provides an independent opinion on whether financial statements give a true and fair view, involving phases like analytical procedures, tests of detail, and ending with an audit report based on professional judgment.

What is a financial audit? | UE Blog - Universidad Europea - Financial audit is a systematic and comprehensive examination of financial statements by qualified auditors to verify their accuracy, compliance with laws, and transparency, often required by regulatory or statutory reasons.

dowidth.com

dowidth.com