Carbon accounting quantifies greenhouse gas emissions to monitor environmental impact and support sustainability initiatives, using metrics like CO2 equivalent tons. Governmental accounting focuses on tracking public funds, ensuring compliance with regulations, and transparent financial reporting through frameworks such as GAAP or GASB standards. Explore how these distinct accounting methods address environmental and fiscal responsibilities.

Why it is important

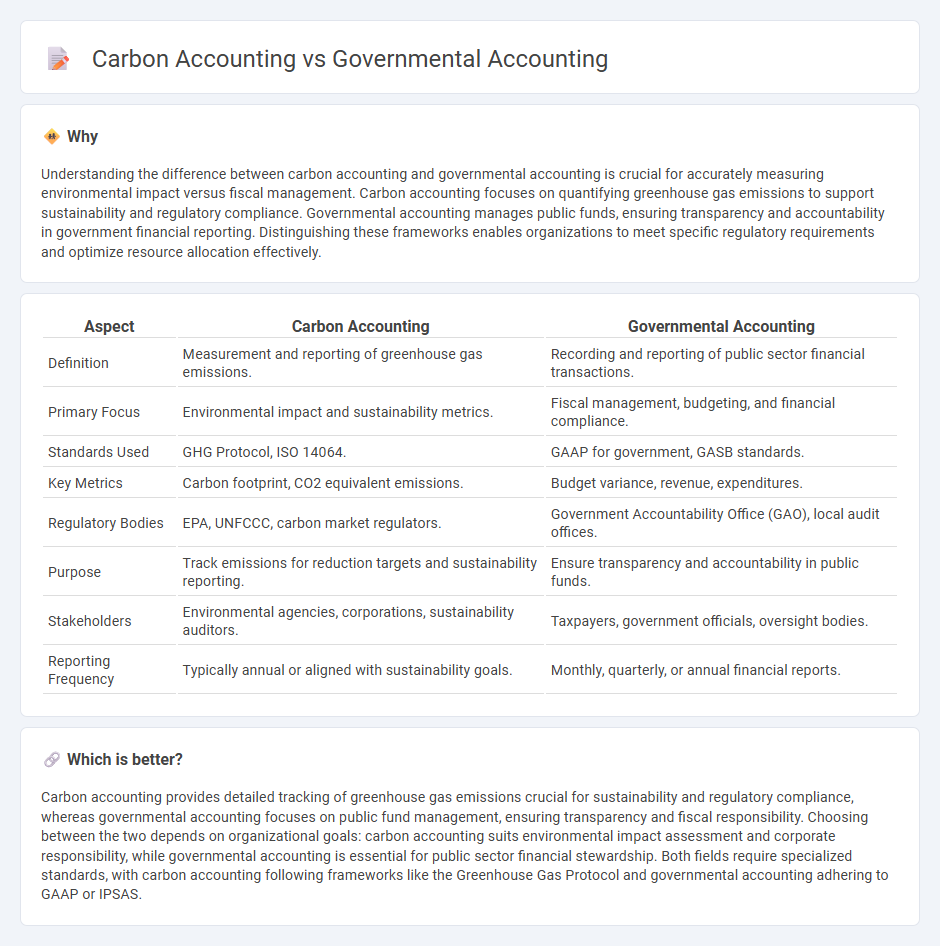

Understanding the difference between carbon accounting and governmental accounting is crucial for accurately measuring environmental impact versus fiscal management. Carbon accounting focuses on quantifying greenhouse gas emissions to support sustainability and regulatory compliance. Governmental accounting manages public funds, ensuring transparency and accountability in government financial reporting. Distinguishing these frameworks enables organizations to meet specific regulatory requirements and optimize resource allocation effectively.

Comparison Table

| Aspect | Carbon Accounting | Governmental Accounting |

|---|---|---|

| Definition | Measurement and reporting of greenhouse gas emissions. | Recording and reporting of public sector financial transactions. |

| Primary Focus | Environmental impact and sustainability metrics. | Fiscal management, budgeting, and financial compliance. |

| Standards Used | GHG Protocol, ISO 14064. | GAAP for government, GASB standards. |

| Key Metrics | Carbon footprint, CO2 equivalent emissions. | Budget variance, revenue, expenditures. |

| Regulatory Bodies | EPA, UNFCCC, carbon market regulators. | Government Accountability Office (GAO), local audit offices. |

| Purpose | Track emissions for reduction targets and sustainability reporting. | Ensure transparency and accountability in public funds. |

| Stakeholders | Environmental agencies, corporations, sustainability auditors. | Taxpayers, government officials, oversight bodies. |

| Reporting Frequency | Typically annual or aligned with sustainability goals. | Monthly, quarterly, or annual financial reports. |

Which is better?

Carbon accounting provides detailed tracking of greenhouse gas emissions crucial for sustainability and regulatory compliance, whereas governmental accounting focuses on public fund management, ensuring transparency and fiscal responsibility. Choosing between the two depends on organizational goals: carbon accounting suits environmental impact assessment and corporate responsibility, while governmental accounting is essential for public sector financial stewardship. Both fields require specialized standards, with carbon accounting following frameworks like the Greenhouse Gas Protocol and governmental accounting adhering to GAAP or IPSAS.

Connection

Carbon accounting quantifies greenhouse gas emissions to assess environmental impact, creating data essential for governmental accounting to integrate sustainability metrics into public financial reports. Governments utilize carbon accounting data to allocate budgets, enforce regulations, and develop policies aimed at reducing carbon footprints in accordance with environmental standards. This intersection ensures accountability and transparency in public sector financial management while promoting climate change mitigation goals.

Key Terms

**Governmental Accounting:**

Governmental accounting emphasizes recording and reporting financial transactions of public sector entities, ensuring transparency, compliance with regulations, and efficient allocation of public resources. It follows specific standards like the Governmental Accounting Standards Board (GASB) to produce financial statements that aid stakeholders in decision-making. Explore more to understand how governmental accounting enhances public sector accountability and fiscal management.

Fund Accounting

Governmental accounting centers on fund accounting, emphasizing accountability and resource allocation across various governmental funds such as general, special revenue, and capital project funds to ensure compliance with legal and budgetary constraints. Carbon accounting, in contrast, quantifies greenhouse gas emissions to track environmental impact and support sustainability initiatives but does not utilize fund accounting principles. To explore the distinctions and applications of fund accounting in governmental contexts versus environmental reporting, learn more about their specific methodologies and frameworks.

Budgetary Control

Governmental accounting emphasizes budgetary control by tracking appropriations, expenditures, and ensuring compliance with legal and fiscal regulations to maintain public fund accountability. Carbon accounting focuses on quantifying greenhouse gas emissions to monitor environmental impact and support sustainable decision-making. Explore more to understand how budgetary control mechanisms differ between these accounting practices.

Source and External Links

Governmental Accounting - Governmental accounting involves recording and managing financial transactions for government entities, focusing on financial resources rather than economic ones.

Governmental Accounting Standards Board (GASB) - GASB is an independent organization that develops standards for US state and local government accounting, ensuring transparency and fiscal responsibility.

What Is Government Accounting? - Government accountants track public finances to ensure proper use, transparency, and compliance with legal standards, unlike private sector accounting's profit focus.

dowidth.com

dowidth.com