Environmental Social Governance (ESG) integration involves embedding a company's environmental, social, and governance factors into financial analysis to assess long-term value and risk management, whereas Carbon Accounting specifically quantifies greenhouse gas emissions to measure and reduce carbon footprints. ESG integration provides a broad framework encompassing diverse sustainability metrics, while Carbon Accounting focuses narrowly on emissions data critical for regulatory compliance and climate impact strategies. Explore further to understand how combining these approaches can enhance comprehensive sustainability reporting and accountability.

Why it is important

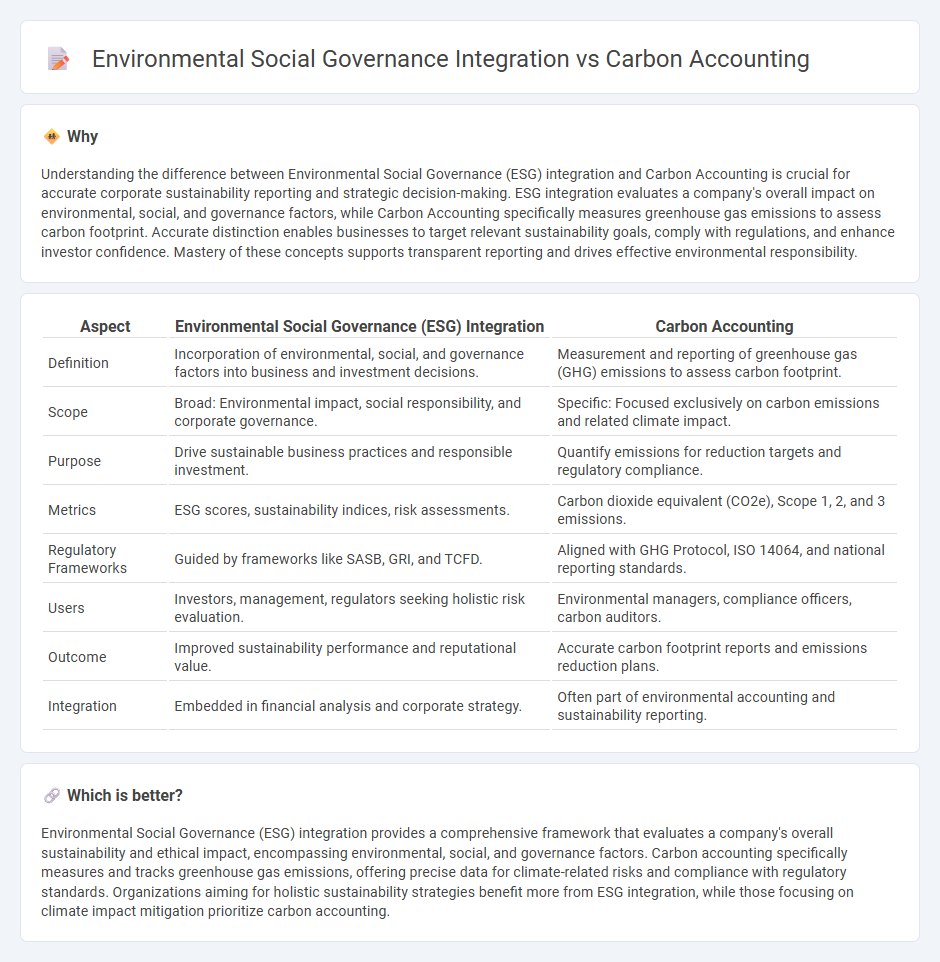

Understanding the difference between Environmental Social Governance (ESG) integration and Carbon Accounting is crucial for accurate corporate sustainability reporting and strategic decision-making. ESG integration evaluates a company's overall impact on environmental, social, and governance factors, while Carbon Accounting specifically measures greenhouse gas emissions to assess carbon footprint. Accurate distinction enables businesses to target relevant sustainability goals, comply with regulations, and enhance investor confidence. Mastery of these concepts supports transparent reporting and drives effective environmental responsibility.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Integration | Carbon Accounting |

|---|---|---|

| Definition | Incorporation of environmental, social, and governance factors into business and investment decisions. | Measurement and reporting of greenhouse gas (GHG) emissions to assess carbon footprint. |

| Scope | Broad: Environmental impact, social responsibility, and corporate governance. | Specific: Focused exclusively on carbon emissions and related climate impact. |

| Purpose | Drive sustainable business practices and responsible investment. | Quantify emissions for reduction targets and regulatory compliance. |

| Metrics | ESG scores, sustainability indices, risk assessments. | Carbon dioxide equivalent (CO2e), Scope 1, 2, and 3 emissions. |

| Regulatory Frameworks | Guided by frameworks like SASB, GRI, and TCFD. | Aligned with GHG Protocol, ISO 14064, and national reporting standards. |

| Users | Investors, management, regulators seeking holistic risk evaluation. | Environmental managers, compliance officers, carbon auditors. |

| Outcome | Improved sustainability performance and reputational value. | Accurate carbon footprint reports and emissions reduction plans. |

| Integration | Embedded in financial analysis and corporate strategy. | Often part of environmental accounting and sustainability reporting. |

Which is better?

Environmental Social Governance (ESG) integration provides a comprehensive framework that evaluates a company's overall sustainability and ethical impact, encompassing environmental, social, and governance factors. Carbon accounting specifically measures and tracks greenhouse gas emissions, offering precise data for climate-related risks and compliance with regulatory standards. Organizations aiming for holistic sustainability strategies benefit more from ESG integration, while those focusing on climate impact mitigation prioritize carbon accounting.

Connection

Environmental Social Governance (ESG) integration in accounting incorporates carbon accounting to measure and report a company's greenhouse gas emissions, reflecting its environmental impact. Carbon accounting quantifies carbon footprints, enabling organizations to align financial disclosures with sustainability goals and regulatory requirements. This connection supports transparent ESG reporting, influencing investment decisions and driving corporate responsibility towards climate change mitigation.

Key Terms

Greenhouse Gas (GHG) Emissions Reporting

Carbon accounting provides precise measurement and tracking of Greenhouse Gas (GHG) emissions, essential for organizations aiming to quantify their environmental impact. Environmental Social Governance (ESG) integration incorporates carbon accounting within a broader framework, emphasizing sustainable practices and stakeholder accountability across social and governance dimensions. Explore our detailed analysis to understand how effective GHG emissions reporting drives ESG success.

Double Materiality

Carbon accounting quantifies greenhouse gas emissions to assess organizational climate impact, serving as a crucial metric within environmental social governance (ESG) frameworks for sustainable business practices. ESG integration incorporates double materiality by evaluating how environmental and social factors affect both company performance and external stakeholders, ensuring comprehensive risk and opportunity analysis. Explore deeper insights into how carbon accounting complements ESG strategies through the lens of double materiality for holistic sustainability management.

ESG (Environmental, Social, Governance) Metrics

Carbon accounting quantifies greenhouse gas emissions to assess an organization's environmental impact, forming a crucial component of ESG metrics used in sustainability reporting. ESG integration evaluates broader factors beyond carbon emissions, including social responsibility, corporate governance, and ethical practices, to drive long-term value and risk management. Explore more about how carbon accounting enhances comprehensive ESG strategies for businesses aiming to improve sustainability performance.

Source and External Links

What Is Carbon Accounting? | IBM - Carbon accounting is the process of quantifying greenhouse gas emissions from an organization's activities, allowing it to understand its climate impact and set reduction goals using standards like the Greenhouse Gas Protocol.

Carbon accounting, explained - Normative.io - Carbon accounting enables organizations to calculate their carbon footprint, identify emission sources, reduce their impact, comply with reporting laws, and communicate progress to stakeholders.

Carbon Accounting | CarbonNeutral - Carbon accounting involves measuring and tracking greenhouse gas emissions to help businesses, governments, and individuals manage and mitigate their carbon footprint, often as part of a broader carbon reduction strategy that is becoming legally required in many countries.

dowidth.com

dowidth.com