Fractional CFOs provide specialized financial leadership on a part-time or project basis, offering cost-effective expertise for businesses needing strategic guidance without the full-time expense. Full-time CFOs deliver comprehensive oversight, managing all financial operations with continuous involvement, ideal for larger organizations requiring constant executive presence. Explore the distinct advantages of fractional versus full-time CFO roles to determine the best fit for your company's financial needs.

Why it is important

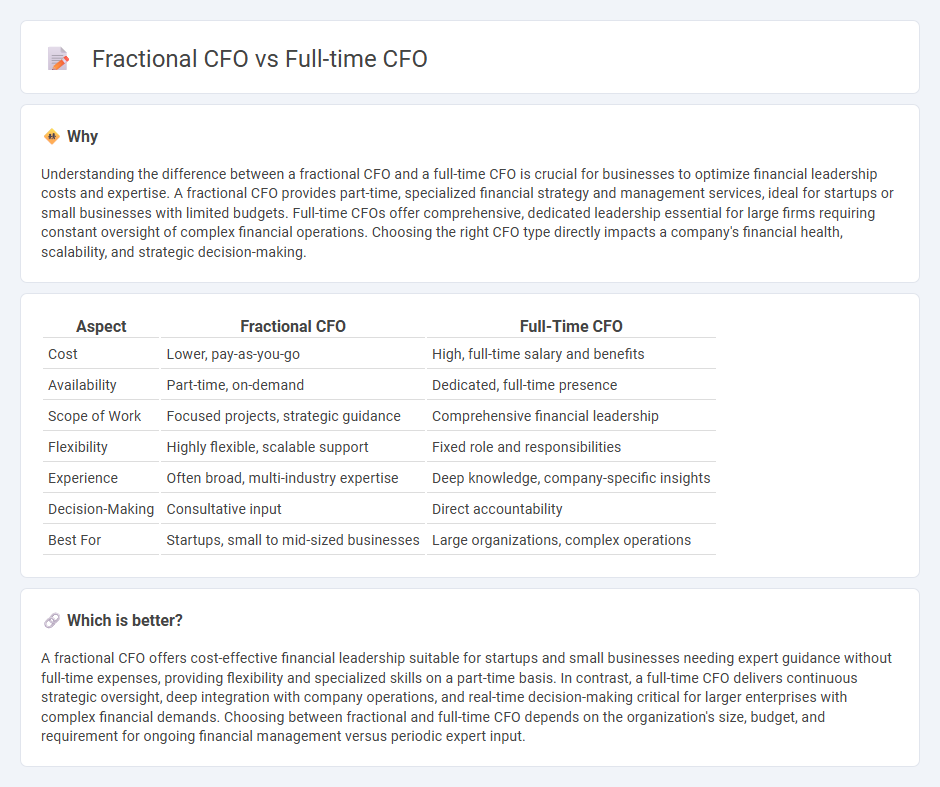

Understanding the difference between a fractional CFO and a full-time CFO is crucial for businesses to optimize financial leadership costs and expertise. A fractional CFO provides part-time, specialized financial strategy and management services, ideal for startups or small businesses with limited budgets. Full-time CFOs offer comprehensive, dedicated leadership essential for large firms requiring constant oversight of complex financial operations. Choosing the right CFO type directly impacts a company's financial health, scalability, and strategic decision-making.

Comparison Table

| Aspect | Fractional CFO | Full-Time CFO |

|---|---|---|

| Cost | Lower, pay-as-you-go | High, full-time salary and benefits |

| Availability | Part-time, on-demand | Dedicated, full-time presence |

| Scope of Work | Focused projects, strategic guidance | Comprehensive financial leadership |

| Flexibility | Highly flexible, scalable support | Fixed role and responsibilities |

| Experience | Often broad, multi-industry expertise | Deep knowledge, company-specific insights |

| Decision-Making | Consultative input | Direct accountability |

| Best For | Startups, small to mid-sized businesses | Large organizations, complex operations |

Which is better?

A fractional CFO offers cost-effective financial leadership suitable for startups and small businesses needing expert guidance without full-time expenses, providing flexibility and specialized skills on a part-time basis. In contrast, a full-time CFO delivers continuous strategic oversight, deep integration with company operations, and real-time decision-making critical for larger enterprises with complex financial demands. Choosing between fractional and full-time CFO depends on the organization's size, budget, and requirement for ongoing financial management versus periodic expert input.

Connection

Fractional CFOs provide specialized financial strategy and expertise on a part-time basis, complementing the continuous, comprehensive oversight offered by full-time CFOs. Both roles focus on improving financial performance, risk management, and strategic planning, with fractional CFOs often supporting growing businesses or those with fluctuating financial demands. Collaboration between fractional and full-time CFOs ensures seamless financial leadership and scalable solutions tailored to an organization's evolving needs.

Key Terms

Employment Status

A full-time CFO is an in-house executive employed on a permanent basis, typically receiving a fixed salary and benefits package, ensuring constant availability and deep integration within the company's leadership. In contrast, a fractional CFO operates as an outsourced or part-time financial expert, hired on a contractual basis to provide specialized financial guidance without the full-time commitment and overhead costs. Explore further to understand which CFO model best aligns with your company's strategic goals and operational needs.

Compensation Structure

Full-time CFOs typically receive a fixed annual salary ranging from $150,000 to $400,000, supplemented by bonuses and stock options, reflecting their full commitment and strategic involvement in the company. Fractional CFOs offer flexible, project-based or monthly retainer fees, often costing between $5,000 and $15,000 per month, providing cost-efficiency for startups and growing businesses needing expert financial leadership without a full-time salary burden. Explore detailed comparisons and tailored compensation plans to optimize financial leadership for your company.

Scope of Involvement

A full-time CFO provides comprehensive financial leadership, overseeing all aspects of a company's financial strategy, reporting, compliance, and risk management on a daily basis. In contrast, a fractional CFO offers targeted expertise for specific projects or periods, focusing on key areas like budgeting, forecasting, and financial analysis without full-time commitment. Discover more about choosing the right CFO model tailored to your business needs.

Source and External Links

Do You Need a Part-time, Full-time, or Fractional CFO? - A full-time CFO is a traditional executive who works exclusively for one company, overseeing all financial operations, strategic planning, fundraising, compliance, and team leadership, typically found in larger corporations or well-funded startups with complex needs.

Fractional vs. Full-Time CFOs: Which Is Right for Your Business? - A full-time CFO is a dedicated member of the organization, responsible for comprehensive financial oversight, strategic planning, risk management, and team leadership, working closely with the executive team and becoming deeply embedded in the company's culture and long-term goals.

Fractional CFO Vs Full-Time CFO - A full-time CFO is usually involved in every aspect of the business's financial strategy, from daily operations to long-term planning, but comes with high salary and benefit costs and less flexibility to scale down if business needs change.

dowidth.com

dowidth.com