Cryptocurrency valuation requires assessing market volatility, blockchain technology, and token utility, differing significantly from traditional financial instrument classification that emphasizes regulatory frameworks and standardized accounting principles. Accurate valuation impacts financial reporting, tax compliance, and investment decisions, necessitating specialized expertise in both digital assets and conventional accounting standards. Explore deeper insights on navigating the complexities of cryptocurrency in accounting practices.

Why it is important

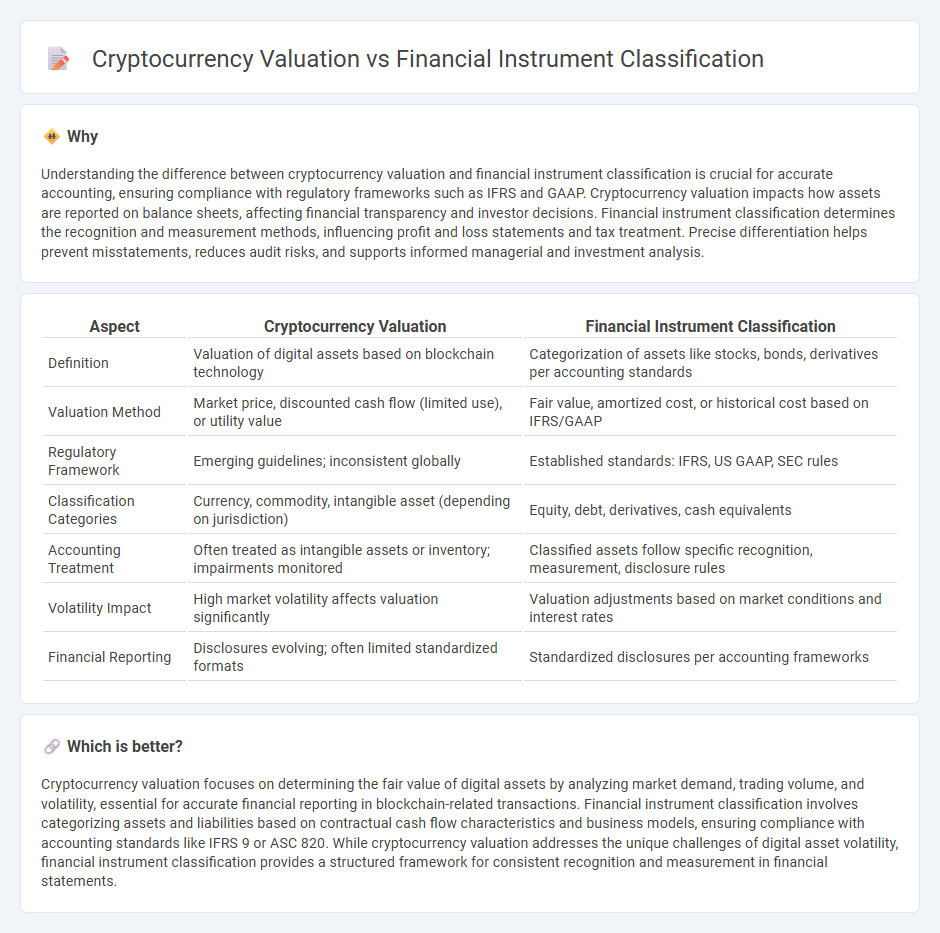

Understanding the difference between cryptocurrency valuation and financial instrument classification is crucial for accurate accounting, ensuring compliance with regulatory frameworks such as IFRS and GAAP. Cryptocurrency valuation impacts how assets are reported on balance sheets, affecting financial transparency and investor decisions. Financial instrument classification determines the recognition and measurement methods, influencing profit and loss statements and tax treatment. Precise differentiation helps prevent misstatements, reduces audit risks, and supports informed managerial and investment analysis.

Comparison Table

| Aspect | Cryptocurrency Valuation | Financial Instrument Classification |

|---|---|---|

| Definition | Valuation of digital assets based on blockchain technology | Categorization of assets like stocks, bonds, derivatives per accounting standards |

| Valuation Method | Market price, discounted cash flow (limited use), or utility value | Fair value, amortized cost, or historical cost based on IFRS/GAAP |

| Regulatory Framework | Emerging guidelines; inconsistent globally | Established standards: IFRS, US GAAP, SEC rules |

| Classification Categories | Currency, commodity, intangible asset (depending on jurisdiction) | Equity, debt, derivatives, cash equivalents |

| Accounting Treatment | Often treated as intangible assets or inventory; impairments monitored | Classified assets follow specific recognition, measurement, disclosure rules |

| Volatility Impact | High market volatility affects valuation significantly | Valuation adjustments based on market conditions and interest rates |

| Financial Reporting | Disclosures evolving; often limited standardized formats | Standardized disclosures per accounting frameworks |

Which is better?

Cryptocurrency valuation focuses on determining the fair value of digital assets by analyzing market demand, trading volume, and volatility, essential for accurate financial reporting in blockchain-related transactions. Financial instrument classification involves categorizing assets and liabilities based on contractual cash flow characteristics and business models, ensuring compliance with accounting standards like IFRS 9 or ASC 820. While cryptocurrency valuation addresses the unique challenges of digital asset volatility, financial instrument classification provides a structured framework for consistent recognition and measurement in financial statements.

Connection

Cryptocurrency valuation directly impacts the classification of these digital assets as financial instruments under accounting standards such as IFRS and GAAP. Accurate valuation methods, including fair value measurement and cost basis approaches, determine whether cryptocurrencies qualify as intangible assets, inventory, or financial instruments. This classification influences financial reporting, tax treatment, and risk assessment in accounting practices.

Key Terms

Fair Value

Financial instrument classification under IFRS 9 emphasizes fair value measurement through observable market inputs and active markets, providing a standardized framework for valuation. Cryptocurrency valuation faces challenges due to market volatility, limited liquidity, and lack of regulatory clarity, complicating fair value assessment. Explore comprehensive approaches to reconcile these differences and enhance valuation accuracy in digital assets.

Amortized Cost

Amortized cost classification for financial instruments involves measuring assets based on initial recognition minus principal repayments and adjusted for amortization of any premium or discount, commonly applied to debt securities held to maturity. In cryptocurrency valuation, however, the volatile nature and lack of consistent income streams challenge the use of amortized cost, often leading to preference for fair value measurement or mark-to-market approaches. Explore further to understand how amortized cost impacts regulatory compliance and investment strategies in both traditional finance and digital assets.

Market Volatility

Market volatility significantly impacts the classification of financial instruments and the valuation of cryptocurrencies, as fluctuating prices and rapid market changes challenge traditional assessment models. Financial instruments are categorized based on risk, liquidity, and regulatory frameworks, while cryptocurrency valuation requires consideration of factors like market sentiment, technological adoption, and tokenomics. Explore in-depth analyses and strategies by learning more about the intersection of financial instrument classification and cryptocurrency valuation under volatile market conditions.

Source and External Links

Classification of Financial Instruments (CFI Code): ISO 10962 - Financial instruments are classified under ISO 10962 into 6 main categories: equities, debt instruments, entitlements (rights), options, futures, and others, with a six-character CFI code that describes the instrument's type and attributes in detail.

ISO 10962 - The Classification of Financial Instruments (CFI) code is a standardized six-letter code used internationally to identify and describe financial instruments by category and specific characteristics, assigned when instruments are issued and linked to their ISINs.

Classification of financial instruments under IFRS 9 - Under IFRS 9, financial instruments are classified based on their contractual cash flow characteristics and business models into amortised cost, fair value through other comprehensive income (FVOCI), or fair value through profit or loss (FVTPL).

dowidth.com

dowidth.com