Outsourced bookkeeping services offer businesses comprehensive financial management through a dedicated team, ensuring accuracy, compliance, and scalability. Freelance bookkeepers provide flexible, personalized support ideal for small businesses seeking cost-effective solutions without long-term commitments. Explore the benefits and differences to determine which bookkeeping option best suits your accounting needs.

Why it is important

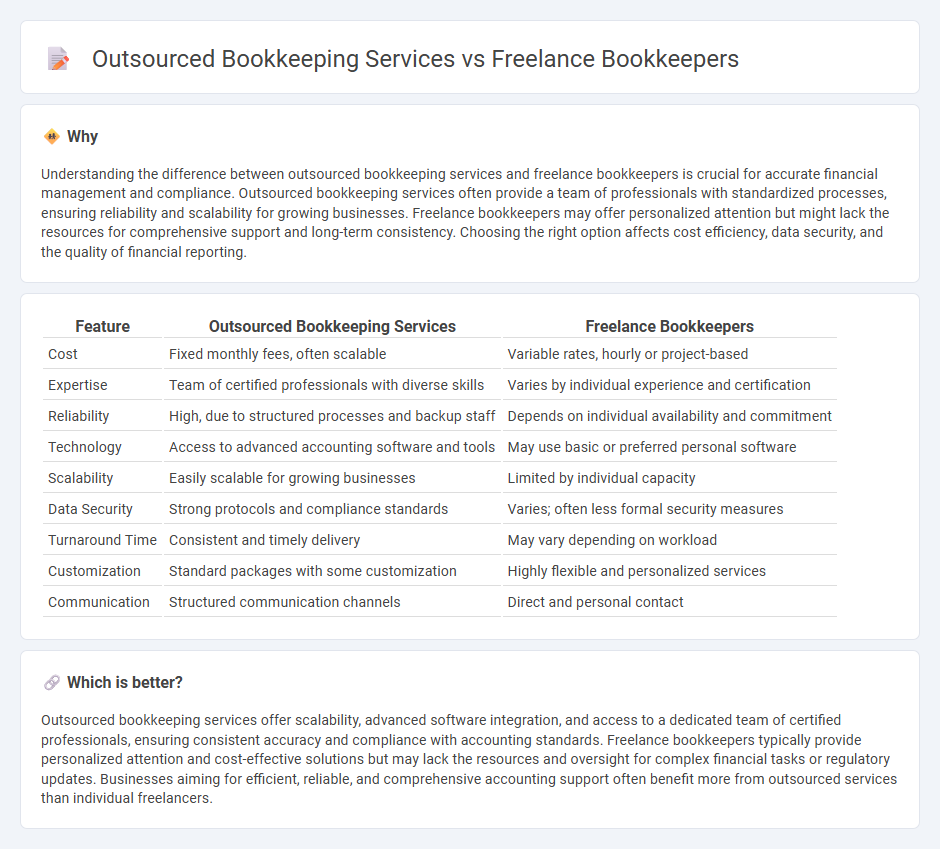

Understanding the difference between outsourced bookkeeping services and freelance bookkeepers is crucial for accurate financial management and compliance. Outsourced bookkeeping services often provide a team of professionals with standardized processes, ensuring reliability and scalability for growing businesses. Freelance bookkeepers may offer personalized attention but might lack the resources for comprehensive support and long-term consistency. Choosing the right option affects cost efficiency, data security, and the quality of financial reporting.

Comparison Table

| Feature | Outsourced Bookkeeping Services | Freelance Bookkeepers |

|---|---|---|

| Cost | Fixed monthly fees, often scalable | Variable rates, hourly or project-based |

| Expertise | Team of certified professionals with diverse skills | Varies by individual experience and certification |

| Reliability | High, due to structured processes and backup staff | Depends on individual availability and commitment |

| Technology | Access to advanced accounting software and tools | May use basic or preferred personal software |

| Scalability | Easily scalable for growing businesses | Limited by individual capacity |

| Data Security | Strong protocols and compliance standards | Varies; often less formal security measures |

| Turnaround Time | Consistent and timely delivery | May vary depending on workload |

| Customization | Standard packages with some customization | Highly flexible and personalized services |

| Communication | Structured communication channels | Direct and personal contact |

Which is better?

Outsourced bookkeeping services offer scalability, advanced software integration, and access to a dedicated team of certified professionals, ensuring consistent accuracy and compliance with accounting standards. Freelance bookkeepers typically provide personalized attention and cost-effective solutions but may lack the resources and oversight for complex financial tasks or regulatory updates. Businesses aiming for efficient, reliable, and comprehensive accounting support often benefit more from outsourced services than individual freelancers.

Connection

Outsourced bookkeeping services and freelance bookkeepers both provide essential financial record management, offering businesses flexible, cost-effective solutions compared to in-house accounting teams. Freelance bookkeepers often operate independently or through platforms that connect them with businesses needing tailored bookkeeping support, which aligns closely with outsourced bookkeeping firms that manage multiple clients remotely. Both options leverage technology such as cloud-based accounting software, enhancing accuracy, accessibility, and real-time financial reporting for small to medium-sized enterprises.

Key Terms

Independence

Freelance bookkeepers operate independently, offering personalized services directly to clients with flexible schedules and tailored solutions. Outsourced bookkeeping services provide a structured team approach, leveraging standardized processes and advanced technology for scalability and consistency. Explore the differences in autonomy and service delivery models to determine the best fit for your business needs.

Scalability

Freelance bookkeepers offer personalized services that can limit scalability due to single-resource dependency and availability constraints. Outsourced bookkeeping services provide scalable solutions with access to specialized teams and advanced technology, ensuring consistent support as business needs grow. Explore how choosing between freelance and outsourced bookkeeping impacts your company's financial scalability and efficiency.

Cost structure

Freelance bookkeepers typically charge hourly rates ranging from $20 to $50, providing flexibility but potential variability in monthly expenses, while outsourced bookkeeping services often offer fixed monthly fees between $300 and $1,000, ensuring predictable costs with scalable financial reporting solutions. Freelancers may lack access to advanced software and compliance resources included in professional services, impacting overall cost efficiency and accuracy. Explore our detailed comparison to determine the most cost-effective bookkeeping option for your business needs.

Source and External Links

Employed vs Freelance Bookkeepers: What's the Difference? - Freelance bookkeepers provide bookkeeping services on a contract basis, often working remotely for multiple clients, handling tasks like tracking income and expenses, preparing financial statements, and assisting with tax preparation.

How to become a freelance bookkeeper (steps and skills) - To become a freelance bookkeeper, individuals need to understand bookkeeping duties, acquire relevant certifications, and develop skills in areas such as budgeting, report preparation, and client communication to build a successful self-employed career.

Freelance Bookkeeping Guide 2024 - Freelance bookkeepers offer businesses cost-effective, flexible access to specialized financial skills, requiring proficiency in accounting software, strong financial understanding, and essential soft skills like communication and time management to effectively serve multiple clients.

dowidth.com

dowidth.com