Smart contracts accounting leverages blockchain technology to execute and record financial transactions with immutable accuracy, ensuring transparency and reducing human error. Automated reconciliation uses software algorithms to match data from different financial records swiftly, minimizing discrepancies and accelerating the closing process. Explore the benefits and differences between these innovative accounting approaches to enhance your financial operations.

Why it is important

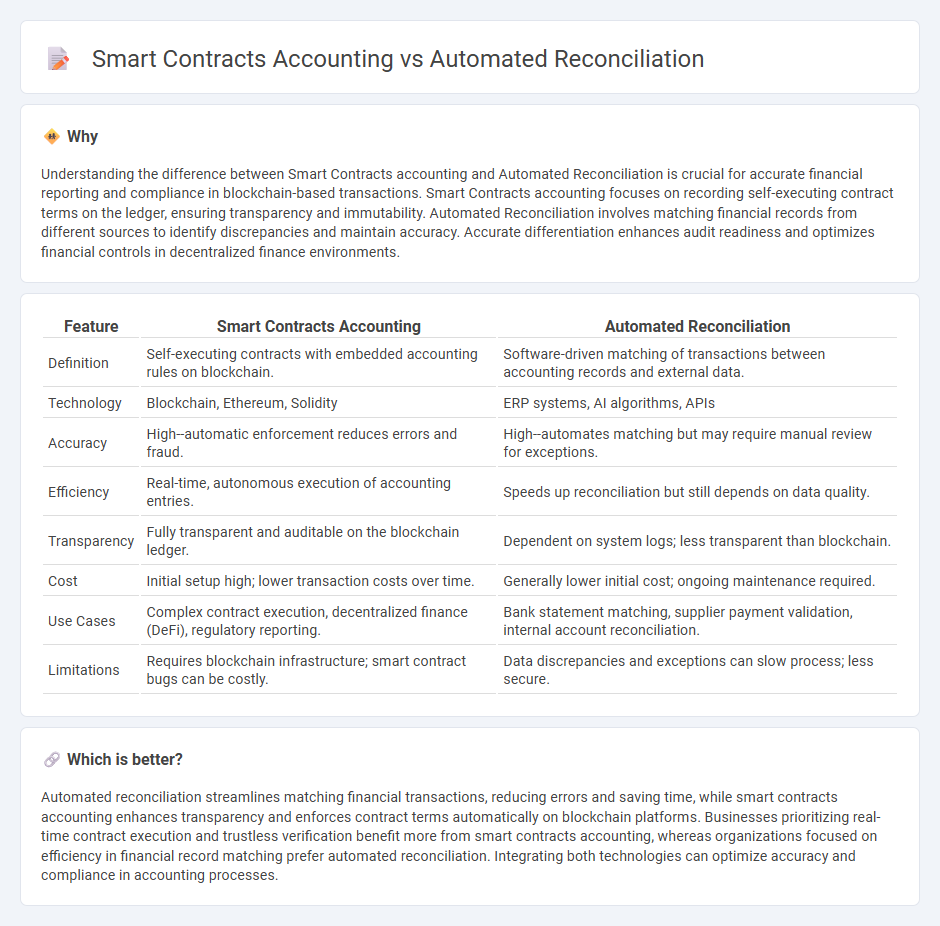

Understanding the difference between Smart Contracts accounting and Automated Reconciliation is crucial for accurate financial reporting and compliance in blockchain-based transactions. Smart Contracts accounting focuses on recording self-executing contract terms on the ledger, ensuring transparency and immutability. Automated Reconciliation involves matching financial records from different sources to identify discrepancies and maintain accuracy. Accurate differentiation enhances audit readiness and optimizes financial controls in decentralized finance environments.

Comparison Table

| Feature | Smart Contracts Accounting | Automated Reconciliation |

|---|---|---|

| Definition | Self-executing contracts with embedded accounting rules on blockchain. | Software-driven matching of transactions between accounting records and external data. |

| Technology | Blockchain, Ethereum, Solidity | ERP systems, AI algorithms, APIs |

| Accuracy | High--automatic enforcement reduces errors and fraud. | High--automates matching but may require manual review for exceptions. |

| Efficiency | Real-time, autonomous execution of accounting entries. | Speeds up reconciliation but still depends on data quality. |

| Transparency | Fully transparent and auditable on the blockchain ledger. | Dependent on system logs; less transparent than blockchain. |

| Cost | Initial setup high; lower transaction costs over time. | Generally lower initial cost; ongoing maintenance required. |

| Use Cases | Complex contract execution, decentralized finance (DeFi), regulatory reporting. | Bank statement matching, supplier payment validation, internal account reconciliation. |

| Limitations | Requires blockchain infrastructure; smart contract bugs can be costly. | Data discrepancies and exceptions can slow process; less secure. |

Which is better?

Automated reconciliation streamlines matching financial transactions, reducing errors and saving time, while smart contracts accounting enhances transparency and enforces contract terms automatically on blockchain platforms. Businesses prioritizing real-time contract execution and trustless verification benefit more from smart contracts accounting, whereas organizations focused on efficiency in financial record matching prefer automated reconciliation. Integrating both technologies can optimize accuracy and compliance in accounting processes.

Connection

Smart contract accounting leverages blockchain technology to ensure transparent, real-time recording of financial transactions, enhancing accuracy and auditability. Automated reconciliation integrates with smart contracts by systematically matching transactions across ledgers, reducing manual errors and accelerating financial close processes. Together, they streamline accounting operations, improve compliance, and enable seamless verification of contract terms through immutable records.

Key Terms

Data Matching Algorithms

Automated reconciliation utilizes advanced data matching algorithms to identify discrepancies in financial records quickly, enhancing accuracy and reducing manual errors in accounting processes. Smart contracts accounting leverages blockchain technology to enforce transaction rules automatically, ensuring data integrity and real-time reconciliation without human intervention. Explore how these innovative approaches transform financial operations and improve audit trails.

Blockchain Ledger

Automated reconciliation leverages blockchain ledger technology to streamline transaction matching by ensuring immutable and transparent record-keeping, reducing errors and manual intervention. Smart contracts accounting enhances this process through self-executing contracts that automatically enforce terms and update financial records in real-time on the blockchain, improving accuracy and efficiency. Explore the latest advancements in blockchain ledger solutions to optimize automated reconciliation and smart contract accounting.

Real-time Settlement

Automated reconciliation enhances financial accuracy by instantly matching transactions, reducing errors and manual effort, while smart contracts enable real-time settlement through programmable agreements that self-execute when conditions are met. Real-time settlement powered by smart contracts eliminates counterparty risk and accelerates fund transfers within decentralized networks. Explore how integrating automated reconciliation with smart contract solutions can revolutionize finance operations.

Source and External Links

Ultimate Guide to Automated Reconciliation - SolveXia - Automated reconciliation uses software to streamline the matching of internal records with external financial statements, drastically reducing manual effort and time while increasing accuracy by monitoring transactions and flagging exceptions only for human review.

What is Automated Reconciliation? - Kolleno - Automated reconciliation software automatically matches transactions, integrates with ERP and accounting systems, and uses algorithms to detect and resolve discrepancies in real-time, improving accuracy and reducing manual errors and delays.

Manual vs. Automated Reconciliation: Why Automation Wins - Nominal - Automation leverages rules and AI to perform real-time matching across systems, flagging exceptions for review, enhancing speed, visibility, and control, while enabling finance teams to focus on exceptions rather than repetitive tasks.

dowidth.com

dowidth.com