Neobank reconciliation focuses on verifying digital transaction records with bank statements to ensure accuracy in cash flow management. Fixed assets reconciliation involves matching physical asset records with financial data to maintain accurate valuation and depreciation schedules. Explore detailed processes and benefits of each reconciliation type for effective financial control.

Why it is important

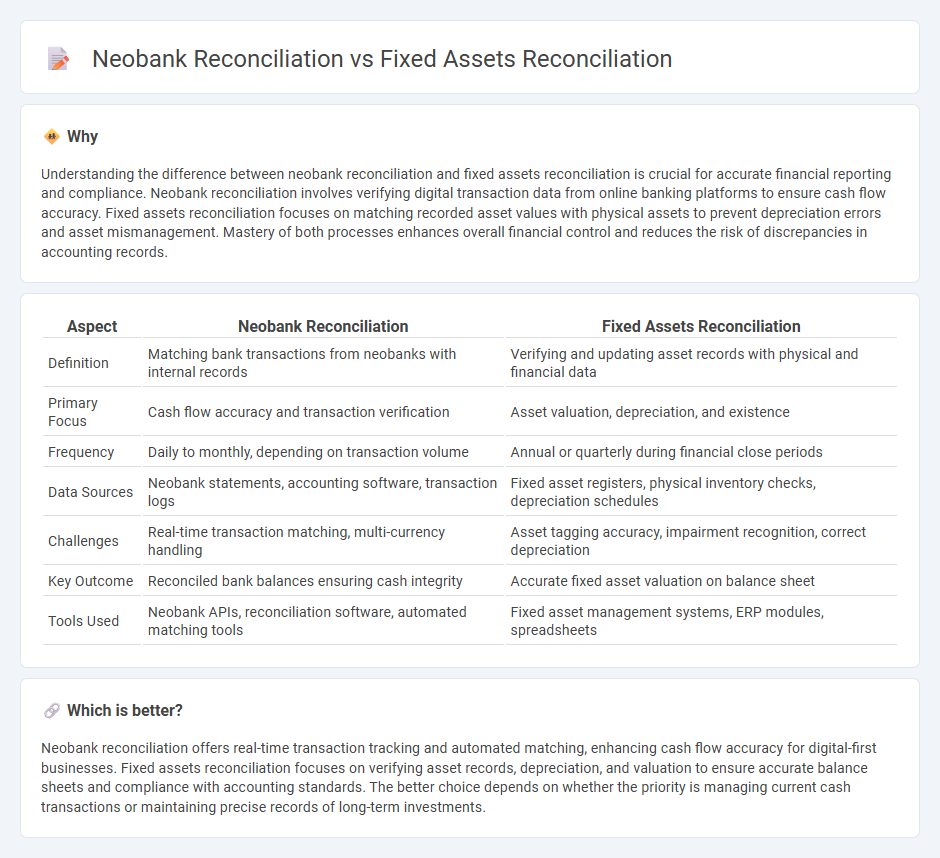

Understanding the difference between neobank reconciliation and fixed assets reconciliation is crucial for accurate financial reporting and compliance. Neobank reconciliation involves verifying digital transaction data from online banking platforms to ensure cash flow accuracy. Fixed assets reconciliation focuses on matching recorded asset values with physical assets to prevent depreciation errors and asset mismanagement. Mastery of both processes enhances overall financial control and reduces the risk of discrepancies in accounting records.

Comparison Table

| Aspect | Neobank Reconciliation | Fixed Assets Reconciliation |

|---|---|---|

| Definition | Matching bank transactions from neobanks with internal records | Verifying and updating asset records with physical and financial data |

| Primary Focus | Cash flow accuracy and transaction verification | Asset valuation, depreciation, and existence |

| Frequency | Daily to monthly, depending on transaction volume | Annual or quarterly during financial close periods |

| Data Sources | Neobank statements, accounting software, transaction logs | Fixed asset registers, physical inventory checks, depreciation schedules |

| Challenges | Real-time transaction matching, multi-currency handling | Asset tagging accuracy, impairment recognition, correct depreciation |

| Key Outcome | Reconciled bank balances ensuring cash integrity | Accurate fixed asset valuation on balance sheet |

| Tools Used | Neobank APIs, reconciliation software, automated matching tools | Fixed asset management systems, ERP modules, spreadsheets |

Which is better?

Neobank reconciliation offers real-time transaction tracking and automated matching, enhancing cash flow accuracy for digital-first businesses. Fixed assets reconciliation focuses on verifying asset records, depreciation, and valuation to ensure accurate balance sheets and compliance with accounting standards. The better choice depends on whether the priority is managing current cash transactions or maintaining precise records of long-term investments.

Connection

Neobank reconciliation streamlines the verification of digital transactions, ensuring real-time accuracy in financial records that directly affect fixed assets accounting. Accurate neobank data updates enable precise fixed assets reconciliation by reflecting current asset acquisitions, disposals, and depreciation schedules. Integrating these reconciliations enhances financial control, reduces errors, and supports compliance with accounting standards such as IFRS and GAAP.

Key Terms

**Fixed assets reconciliation:**

Fixed assets reconciliation involves comparing fixed asset records with general ledger accounts to ensure accuracy and consistency in financial reporting, often including asset additions, disposals, and depreciation adjustments. The process requires detailed verification of asset tags, acquisition costs, and accumulated depreciation to prevent discrepancies that impact balance sheet integrity. Explore more about fixed assets reconciliation to enhance your company's asset management and accounting precision.

Depreciation

Fixed assets reconciliation ensures accurate tracking of asset values and accumulated depreciation, reflecting true book value over time, while neobank reconciliation primarily focuses on matching transactional data and cash flows without detailed asset tracking. Depreciation in fixed assets reconciliation involves systematic allocation of costs to expense accounts to comply with accounting standards, which is typically absent in neobank reconciliation processes. Explore more about how these reconciliations impact financial reporting and decision-making.

Asset register

Fixed assets reconciliation involves verifying the accuracy of the asset register by matching physical assets with accounting records, ensuring depreciation schedules and asset valuations are correctly recorded. Neobank reconciliation focuses on aligning transaction data from the digital banking platform with internal financial statements, emphasizing cash flow and payment accuracy rather than fixed assets. Explore detailed methodologies and tools to optimize asset register integrity and streamline reconciliations.

Source and External Links

What is Fixed Asset Reconciliation? - Explains the process of verifying the accuracy and completeness of a company's fixed asset records by comparing general ledger balances with the fixed asset register.

How to Reconcile Fixed Assets - Provides practical steps for reconciling fixed assets, emphasizing the importance of comparing general ledger balances with the fixed asset subsidiary ledger.

Fixed Asset Reconciliation: The Complete Guide - Offers a detailed guide on reconciling fixed asset accounts, including compiling necessary documents and cross-referencing trial balances.

dowidth.com

dowidth.com