Dark data auditing uncovers hidden or unused information within an organization's data reserves, revealing risks often overlooked in conventional accounting processes. Risk assessment systematically evaluates potential financial, operational, and compliance threats, essential for effective internal controls and fraud prevention. Explore how integrating dark data auditing enhances risk assessment accuracy in accounting.

Why it is important

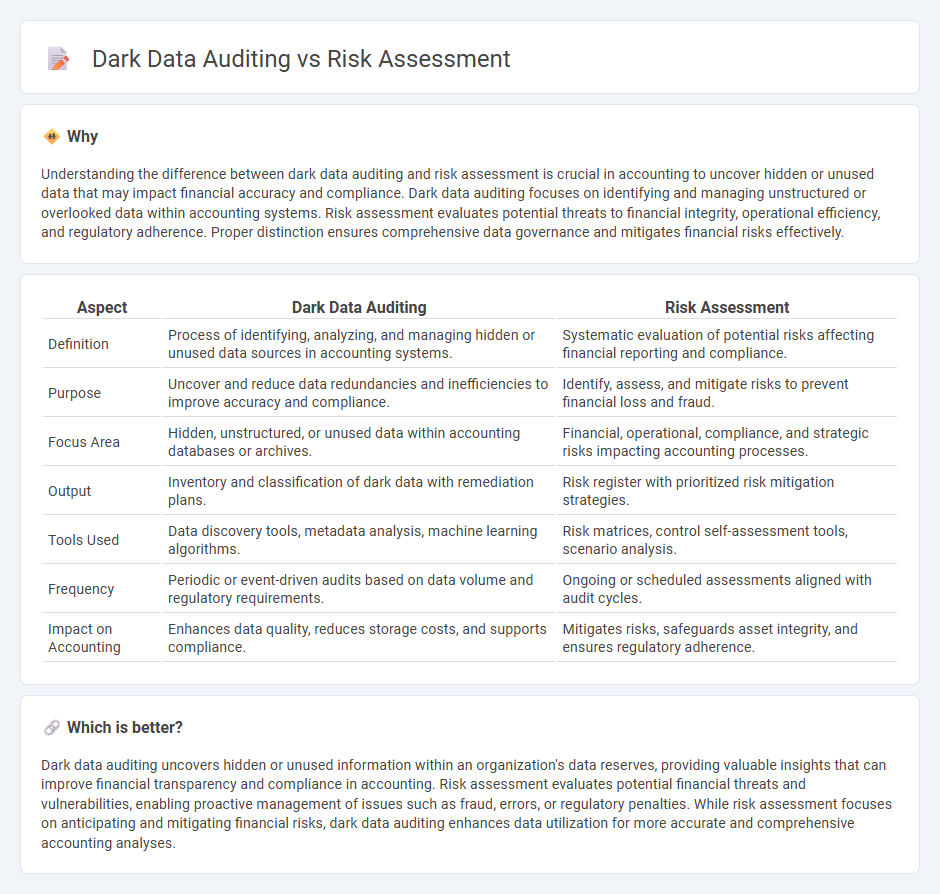

Understanding the difference between dark data auditing and risk assessment is crucial in accounting to uncover hidden or unused data that may impact financial accuracy and compliance. Dark data auditing focuses on identifying and managing unstructured or overlooked data within accounting systems. Risk assessment evaluates potential threats to financial integrity, operational efficiency, and regulatory adherence. Proper distinction ensures comprehensive data governance and mitigates financial risks effectively.

Comparison Table

| Aspect | Dark Data Auditing | Risk Assessment |

|---|---|---|

| Definition | Process of identifying, analyzing, and managing hidden or unused data sources in accounting systems. | Systematic evaluation of potential risks affecting financial reporting and compliance. |

| Purpose | Uncover and reduce data redundancies and inefficiencies to improve accuracy and compliance. | Identify, assess, and mitigate risks to prevent financial loss and fraud. |

| Focus Area | Hidden, unstructured, or unused data within accounting databases or archives. | Financial, operational, compliance, and strategic risks impacting accounting processes. |

| Output | Inventory and classification of dark data with remediation plans. | Risk register with prioritized risk mitigation strategies. |

| Tools Used | Data discovery tools, metadata analysis, machine learning algorithms. | Risk matrices, control self-assessment tools, scenario analysis. |

| Frequency | Periodic or event-driven audits based on data volume and regulatory requirements. | Ongoing or scheduled assessments aligned with audit cycles. |

| Impact on Accounting | Enhances data quality, reduces storage costs, and supports compliance. | Mitigates risks, safeguards asset integrity, and ensures regulatory adherence. |

Which is better?

Dark data auditing uncovers hidden or unused information within an organization's data reserves, providing valuable insights that can improve financial transparency and compliance in accounting. Risk assessment evaluates potential financial threats and vulnerabilities, enabling proactive management of issues such as fraud, errors, or regulatory penalties. While risk assessment focuses on anticipating and mitigating financial risks, dark data auditing enhances data utilization for more accurate and comprehensive accounting analyses.

Connection

Dark data auditing involves identifying and analyzing unstructured or hidden data within an organization to uncover potential risks and compliance issues. Risk assessment leverages insights from dark data audits to evaluate financial misstatements, fraud, and operational vulnerabilities more accurately. Integrating dark data auditing into accounting processes enhances the precision of risk management and regulatory compliance strategies.

Key Terms

**Risk assessment:**

Risk assessment involves identifying, analyzing, and prioritizing potential threats to an organization's assets, focusing on minimizing vulnerabilities and mitigating financial, operational, or reputational damages. It uses quantitative and qualitative methods to evaluate the likelihood and impact of risks, enabling informed decision-making and strategic risk management. Explore more to understand how comprehensive risk assessments can safeguard your business from emerging threats.

Internal Controls

Risk assessment evaluates potential threats to internal controls by identifying vulnerabilities and estimating the impact on organizational objectives. Dark data auditing uncovers unstructured, unused data that may pose compliance and security risks within internal control frameworks. Explore how integrating both approaches enhances the robustness of internal controls and mitigates hidden risks effectively.

Inherent Risk

Inherent risk in risk assessment refers to the natural level of risk present before any controls or mitigations are applied, often linked to business processes and environmental factors. Dark data auditing focuses on identifying and classifying hidden or unused data within an organization, which inherently carries risks such as compliance violations and security breaches. Explore more to understand how managing inherent risk through dark data auditing can strengthen enterprise risk frameworks.

Source and External Links

Risk assessment - Wikipedia - Risk assessment is the process of identifying hazards, evaluating the likelihood and consequences of negative events affecting people, assets, or the environment, and determining actions to mitigate these effects as part of broader risk management.

Risk Assessment: Process, Tools, & Techniques | SafetyCulture - A risk assessment systematically identifies hazards and evaluates their potential impact to prioritize measures for controlling or eliminating risks, crucial for workplace health and safety and compliance with OSHA regulations.

Risk assessment: An overview - Thomson Reuters Legal Solutions - Risk assessment involves identifying, analyzing, and evaluating risks linked to activities or projects, using methods like risk matrices and quantitative analysis to prioritize and mitigate risks effectively.

dowidth.com

dowidth.com