Deferred revenue recognition records income when payment is received before goods or services are delivered, ensuring liabilities reflect unearned revenue. Revenue realization principle recognizes revenue when it is earned and realizable, aligning income with the delivery of products or completion of services. Explore the distinctions between these accounting methods to enhance accurate financial reporting.

Why it is important

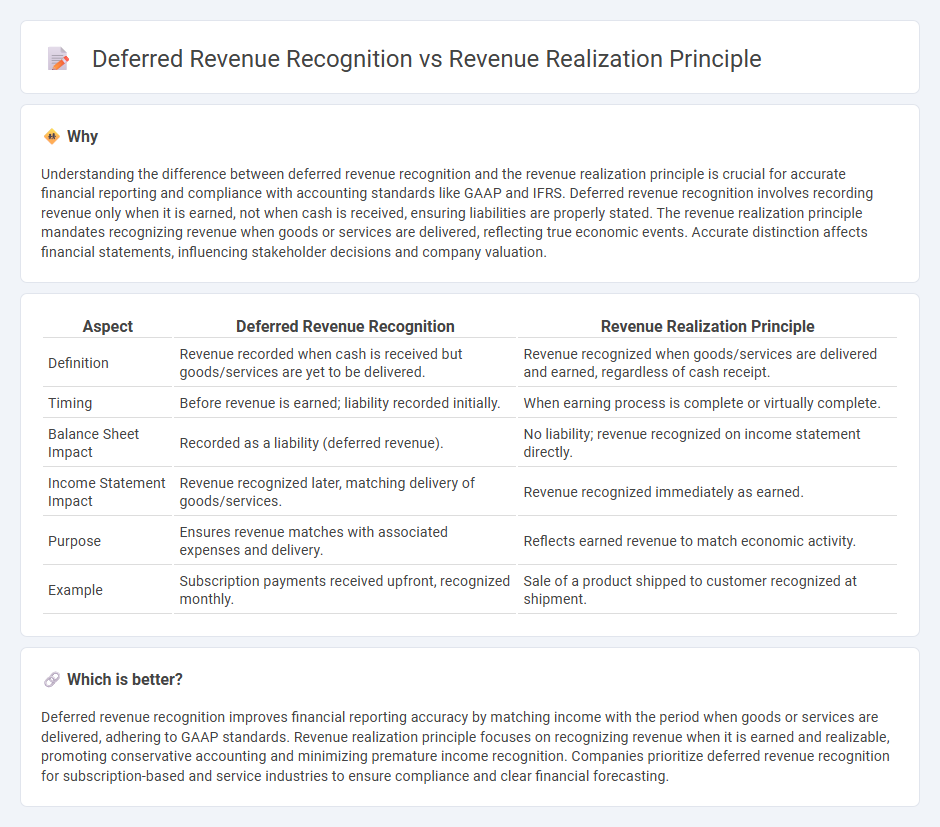

Understanding the difference between deferred revenue recognition and the revenue realization principle is crucial for accurate financial reporting and compliance with accounting standards like GAAP and IFRS. Deferred revenue recognition involves recording revenue only when it is earned, not when cash is received, ensuring liabilities are properly stated. The revenue realization principle mandates recognizing revenue when goods or services are delivered, reflecting true economic events. Accurate distinction affects financial statements, influencing stakeholder decisions and company valuation.

Comparison Table

| Aspect | Deferred Revenue Recognition | Revenue Realization Principle |

|---|---|---|

| Definition | Revenue recorded when cash is received but goods/services are yet to be delivered. | Revenue recognized when goods/services are delivered and earned, regardless of cash receipt. |

| Timing | Before revenue is earned; liability recorded initially. | When earning process is complete or virtually complete. |

| Balance Sheet Impact | Recorded as a liability (deferred revenue). | No liability; revenue recognized on income statement directly. |

| Income Statement Impact | Revenue recognized later, matching delivery of goods/services. | Revenue recognized immediately as earned. |

| Purpose | Ensures revenue matches with associated expenses and delivery. | Reflects earned revenue to match economic activity. |

| Example | Subscription payments received upfront, recognized monthly. | Sale of a product shipped to customer recognized at shipment. |

Which is better?

Deferred revenue recognition improves financial reporting accuracy by matching income with the period when goods or services are delivered, adhering to GAAP standards. Revenue realization principle focuses on recognizing revenue when it is earned and realizable, promoting conservative accounting and minimizing premature income recognition. Companies prioritize deferred revenue recognition for subscription-based and service industries to ensure compliance and clear financial forecasting.

Connection

Deferred revenue recognition and the revenue realization principle are intrinsically connected through the timing of recording income. Deferred revenue occurs when payment is received before delivering goods or services, ensuring compliance with the revenue realization principle which mandates revenue recognition only when it is earned and realizable. This alignment prevents premature revenue recognition, maintaining accurate financial statements and reflecting the true economic activity of a business.

Key Terms

Revenue Recognition

The revenue realization principle recognizes revenue when goods or services are delivered and payment is assured, aligning with the accrual accounting method. Deferred revenue recognition records cash received before the earning process is complete, treating it as a liability until obligations are fulfilled. Explore the key differences and accounting standards guiding revenue recognition for effective financial reporting.

Unearned Revenue

The revenue realization principle requires recognizing revenue when it is earned, which means goods or services have been delivered and the seller's performance obligation is fulfilled. Deferred revenue recognition, particularly in the context of unearned revenue, involves recording payments received before the delivery of goods or services as a liability until the earnings process is complete. Explore more to understand how unearned revenue impacts financial statements and compliance with accounting standards.

Performance Obligation

Revenue realization principle requires recognizing revenue when the performance obligation is satisfied by transferring control of goods or services to the customer, aligning income with actual delivery. Deferred revenue recognition involves recording payments received in advance as a liability until the related performance obligation is fulfilled, ensuring accurate matching of revenue with earned earnings. Explore more to understand how these accounting standards impact financial reporting and business decision-making.

Source and External Links

Realization Principle of Accounting - The realization principle states that revenue is recognized when the goods or services are transferred to the customer, whether or not payment has been received, meaning profit is realized at the point of sale or service completion.

What is Revenue Realization? | DealHub - Revenue realization occurs when revenue is earned and collected following accounting standards, focusing on cash flow and requiring criteria such as delivery and collectability to be met before revenue is recognized.

What is revenue realization vs. revenue recognition? - Revenue realization is part of the revenue recognition process and happens when a company has fulfilled its obligations and can reasonably expect payment, thereby recording revenue in the correct accounting period.

dowidth.com

dowidth.com