Environmental Social Governance (ESG) accounting evaluates corporate performance based on sustainability, social responsibility, and ethical management, incorporating metrics beyond financial statements. Climate accounting specifically focuses on measuring and reporting greenhouse gas emissions, carbon footprint, and climate-related financial risks to support climate action and regulatory compliance. Explore more to understand how these frameworks shape strategic decision-making and investor relations.

Why it is important

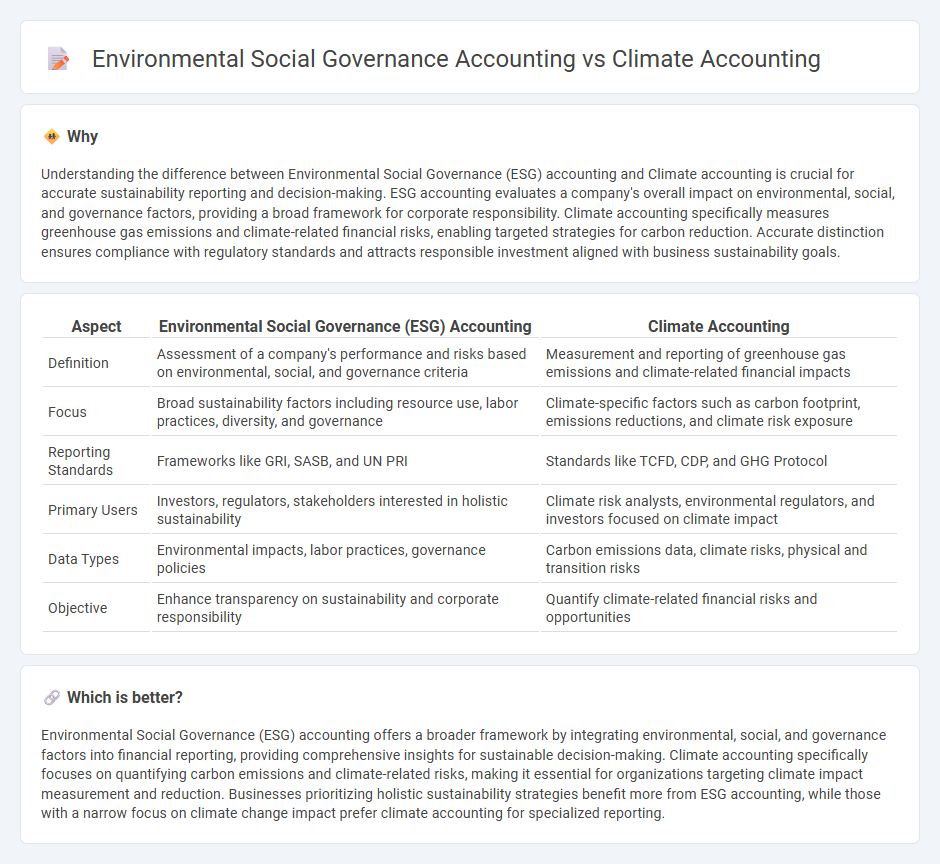

Understanding the difference between Environmental Social Governance (ESG) accounting and Climate accounting is crucial for accurate sustainability reporting and decision-making. ESG accounting evaluates a company's overall impact on environmental, social, and governance factors, providing a broad framework for corporate responsibility. Climate accounting specifically measures greenhouse gas emissions and climate-related financial risks, enabling targeted strategies for carbon reduction. Accurate distinction ensures compliance with regulatory standards and attracts responsible investment aligned with business sustainability goals.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Accounting | Climate Accounting |

|---|---|---|

| Definition | Assessment of a company's performance and risks based on environmental, social, and governance criteria | Measurement and reporting of greenhouse gas emissions and climate-related financial impacts |

| Focus | Broad sustainability factors including resource use, labor practices, diversity, and governance | Climate-specific factors such as carbon footprint, emissions reductions, and climate risk exposure |

| Reporting Standards | Frameworks like GRI, SASB, and UN PRI | Standards like TCFD, CDP, and GHG Protocol |

| Primary Users | Investors, regulators, stakeholders interested in holistic sustainability | Climate risk analysts, environmental regulators, and investors focused on climate impact |

| Data Types | Environmental impacts, labor practices, governance policies | Carbon emissions data, climate risks, physical and transition risks |

| Objective | Enhance transparency on sustainability and corporate responsibility | Quantify climate-related financial risks and opportunities |

Which is better?

Environmental Social Governance (ESG) accounting offers a broader framework by integrating environmental, social, and governance factors into financial reporting, providing comprehensive insights for sustainable decision-making. Climate accounting specifically focuses on quantifying carbon emissions and climate-related risks, making it essential for organizations targeting climate impact measurement and reduction. Businesses prioritizing holistic sustainability strategies benefit more from ESG accounting, while those with a narrow focus on climate change impact prefer climate accounting for specialized reporting.

Connection

Environmental, Social, and Governance (ESG) accounting integrates non-financial metrics related to sustainability, social responsibility, and ethical management into traditional accounting frameworks. Climate accounting focuses specifically on quantifying greenhouse gas emissions and assessing financial risks tied to climate change within organizational reporting. Both approaches align to enhance transparency, support compliance with regulatory standards, and guide sustainable investment by embedding environmental impact data into corporate financial disclosures.

Key Terms

Carbon Footprint

Climate accounting quantifies greenhouse gas emissions, primarily focusing on accurately measuring an organization's carbon footprint through scopes 1, 2, and 3 emissions. Environmental Social Governance (ESG) accounting integrates broader sustainability criteria, including carbon footprint metrics within environmental performance assessments, but also covers social and governance factors for holistic corporate responsibility reporting. Explore detailed methodologies to understand how each framework strategically manages and reports carbon emissions.

ESG Metrics

Climate accounting measures greenhouse gas emissions and carbon footprints to track a company's environmental impact, primarily focusing on climate-related risks and opportunities. Environmental, Social, and Governance (ESG) accounting evaluates broader factors including social responsibility, corporate governance, and sustainability practices alongside environmental metrics like energy use, waste management, and biodiversity. Explore more about how ESG metrics provide a comprehensive view of sustainable business performance.

Emissions Reporting

Climate accounting centers on quantifying greenhouse gas emissions and carbon footprints, enabling organizations to measure their impact on climate change with precision. Environmental, Social, and Governance (ESG) accounting incorporates emissions reporting as part of a broader framework assessing sustainability performance, risk management, and governance practices. Explore deeper insights into how these accounting methods drive corporate transparency and environmental responsibility.

Source and External Links

Climate accounting | What is it? - Emisoft - Climate accounting is a tool that provides an overview of organizations' climate impact through direct and indirect emissions, helping companies set emission targets and prioritize reductions to meet goals like the Paris Agreement and CSRD requirements.

Carbon accounting, explained - Normative.io - Carbon accounting quantifies greenhouse gas emissions of an organization to track climate impact, enabling businesses to understand their carbon footprint, reduce emissions, report progress, and achieve net zero targets.

Climate accounting your stakeholders want to see - KPMG - KPMG introduces a blockchain-based Climate Accounting Infrastructure to help organizations accurately measure, verify, and report greenhouse gas emissions for transparent climate risk assessment and compliance with sustainability regulations.

dowidth.com

dowidth.com