Fractional CFOs provide part-time financial leadership tailored to specific business needs, offering expertise in strategic planning, cash flow management, and financial reporting without the cost of a full-time executive. Virtual CFOs deliver the same high-level financial guidance remotely, leveraging technology to manage accounting, budgeting, and financial analysis for businesses of all sizes. Explore more about how fractional and virtual CFOs can optimize your company's financial strategy and operational efficiency.

Why it is important

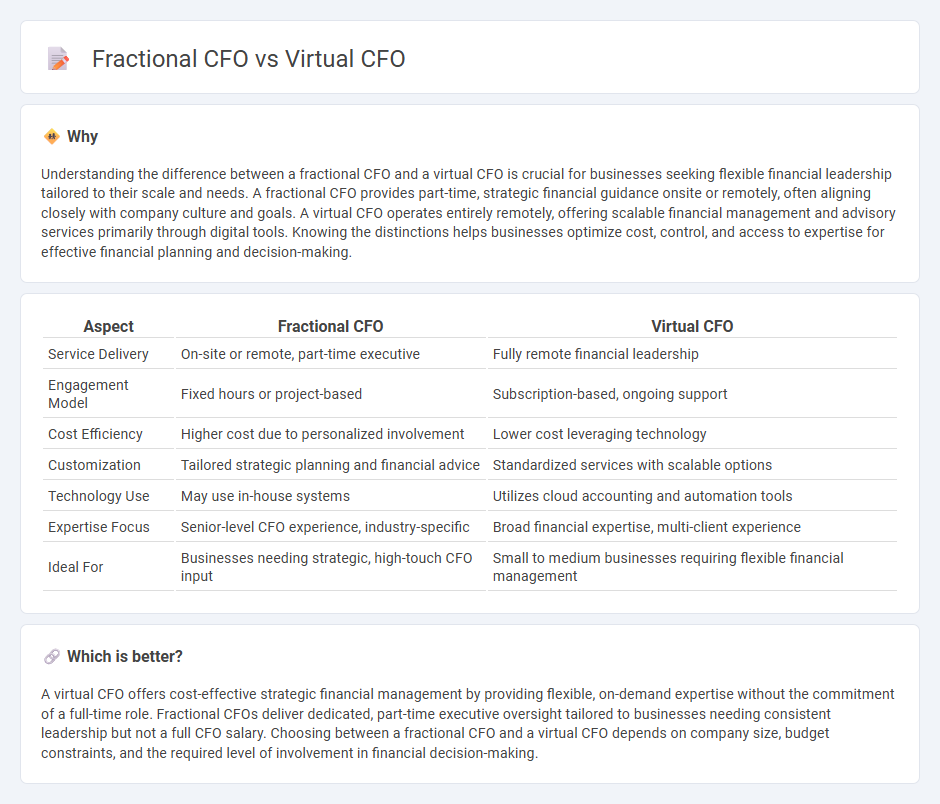

Understanding the difference between a fractional CFO and a virtual CFO is crucial for businesses seeking flexible financial leadership tailored to their scale and needs. A fractional CFO provides part-time, strategic financial guidance onsite or remotely, often aligning closely with company culture and goals. A virtual CFO operates entirely remotely, offering scalable financial management and advisory services primarily through digital tools. Knowing the distinctions helps businesses optimize cost, control, and access to expertise for effective financial planning and decision-making.

Comparison Table

| Aspect | Fractional CFO | Virtual CFO |

|---|---|---|

| Service Delivery | On-site or remote, part-time executive | Fully remote financial leadership |

| Engagement Model | Fixed hours or project-based | Subscription-based, ongoing support |

| Cost Efficiency | Higher cost due to personalized involvement | Lower cost leveraging technology |

| Customization | Tailored strategic planning and financial advice | Standardized services with scalable options |

| Technology Use | May use in-house systems | Utilizes cloud accounting and automation tools |

| Expertise Focus | Senior-level CFO experience, industry-specific | Broad financial expertise, multi-client experience |

| Ideal For | Businesses needing strategic, high-touch CFO input | Small to medium businesses requiring flexible financial management |

Which is better?

A virtual CFO offers cost-effective strategic financial management by providing flexible, on-demand expertise without the commitment of a full-time role. Fractional CFOs deliver dedicated, part-time executive oversight tailored to businesses needing consistent leadership but not a full CFO salary. Choosing between a fractional CFO and a virtual CFO depends on company size, budget constraints, and the required level of involvement in financial decision-making.

Connection

Fractional CFOs and virtual CFOs both provide strategic financial leadership on a flexible, part-time basis, enabling businesses to benefit from expert accounting insights without the cost of a full-time executive. Fractional CFOs typically work onsite with multiple clients, offering tailored financial management, while virtual CFOs deliver services remotely using digital tools to oversee accounting and financial planning. Both roles focus on enhancing cash flow management, budgeting, and financial reporting to drive business growth and operational efficiency.

Key Terms

Outsourced services

Virtual CFOs provide outsourced financial leadership through cloud-based tools, delivering scalable services tailored for startups and small businesses. Fractional CFOs offer part-time, in-depth financial strategy and management, often integrating on-site presence for mid-sized companies seeking experienced executive oversight. Explore the key differences and benefits of outsourced CFO services to determine the best fit for your business.

Strategic financial management

Virtual CFOs leverage cloud-based tools to provide strategic financial management remotely, offering scalable solutions tailored to startups and small businesses. Fractional CFOs, often seasoned executives, work part-time on-site or remotely, integrating deeply with company leadership for long-term strategic financial planning. Explore how each model can optimize your company's financial strategy and growth potential.

Cost efficiency

A virtual CFO offers cost efficiency by providing on-demand financial expertise without the expenses of a full-time salary, making it ideal for startups and small businesses. Fractional CFOs deliver specialized financial leadership part-time, balancing expert insight with lower costs compared to a full-time CFO, often working several days a week. Explore the differences between virtual CFOs and fractional CFOs to find the best fit for optimizing your financial management expenses.

dowidth.com

dowidth.com