Zero-knowledge proofs enable verification of financial data without revealing the underlying details, offering enhanced privacy compared to traditional GAAP (Generally Accepted Accounting Principles) methods. Unlike GAAP, which mandates full disclosure and standardized reporting, zero-knowledge protocols support secure transactions and compliance while preserving confidentiality. Explore how zero-knowledge proofs are transforming accounting standards and financial transparency.

Why it is important

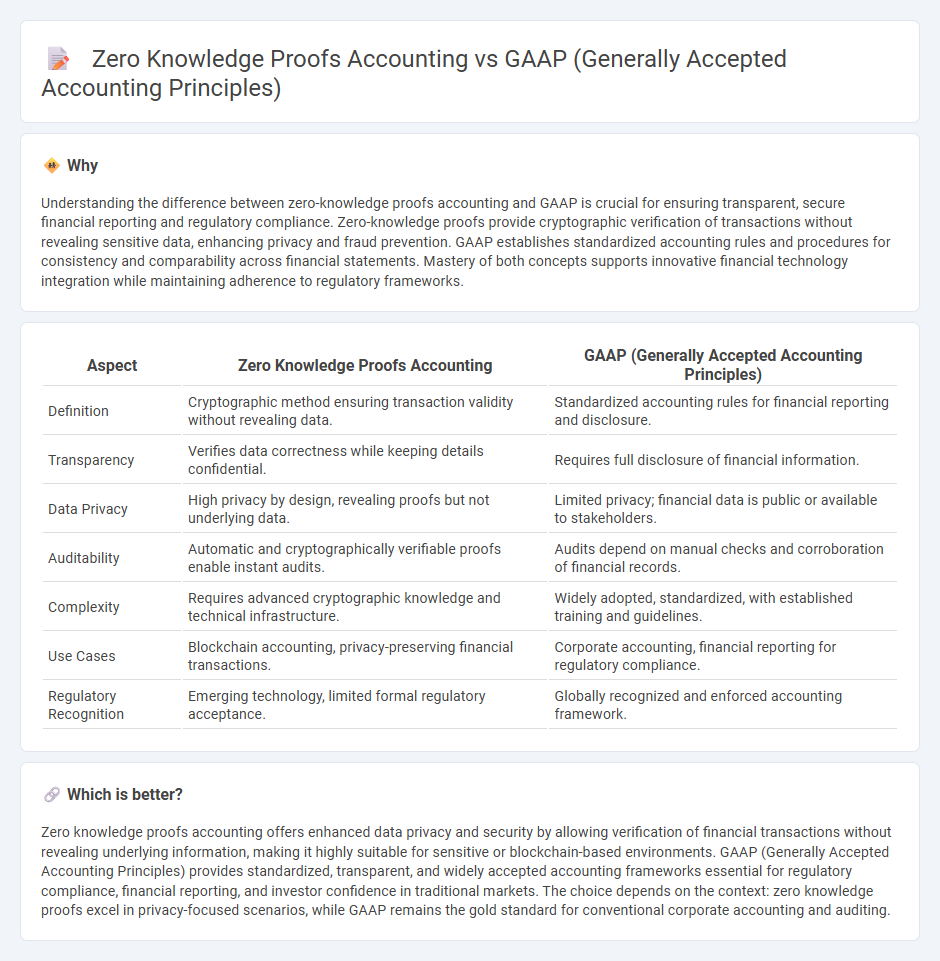

Understanding the difference between zero-knowledge proofs accounting and GAAP is crucial for ensuring transparent, secure financial reporting and regulatory compliance. Zero-knowledge proofs provide cryptographic verification of transactions without revealing sensitive data, enhancing privacy and fraud prevention. GAAP establishes standardized accounting rules and procedures for consistency and comparability across financial statements. Mastery of both concepts supports innovative financial technology integration while maintaining adherence to regulatory frameworks.

Comparison Table

| Aspect | Zero Knowledge Proofs Accounting | GAAP (Generally Accepted Accounting Principles) |

|---|---|---|

| Definition | Cryptographic method ensuring transaction validity without revealing data. | Standardized accounting rules for financial reporting and disclosure. |

| Transparency | Verifies data correctness while keeping details confidential. | Requires full disclosure of financial information. |

| Data Privacy | High privacy by design, revealing proofs but not underlying data. | Limited privacy; financial data is public or available to stakeholders. |

| Auditability | Automatic and cryptographically verifiable proofs enable instant audits. | Audits depend on manual checks and corroboration of financial records. |

| Complexity | Requires advanced cryptographic knowledge and technical infrastructure. | Widely adopted, standardized, with established training and guidelines. |

| Use Cases | Blockchain accounting, privacy-preserving financial transactions. | Corporate accounting, financial reporting for regulatory compliance. |

| Regulatory Recognition | Emerging technology, limited formal regulatory acceptance. | Globally recognized and enforced accounting framework. |

Which is better?

Zero knowledge proofs accounting offers enhanced data privacy and security by allowing verification of financial transactions without revealing underlying information, making it highly suitable for sensitive or blockchain-based environments. GAAP (Generally Accepted Accounting Principles) provides standardized, transparent, and widely accepted accounting frameworks essential for regulatory compliance, financial reporting, and investor confidence in traditional markets. The choice depends on the context: zero knowledge proofs excel in privacy-focused scenarios, while GAAP remains the gold standard for conventional corporate accounting and auditing.

Connection

Zero knowledge proofs enhance accounting integrity by enabling verification of financial data without exposing sensitive details, aligning with GAAP's emphasis on transparency and accuracy. These cryptographic protocols support compliance by ensuring transactions meet GAAP standards while maintaining confidentiality. Integrating zero knowledge proofs into accounting systems strengthens audit processes and fosters trust in financial reporting.

Key Terms

Standardization

GAAP provides a standardized framework for financial reporting, ensuring consistency, transparency, and comparability across organizations. Zero Knowledge Proofs (ZKP) accounting introduces privacy-preserving methods that validate transactions without revealing sensitive data, but lacks a universally accepted standard akin to GAAP. Explore how integrating ZKP into standardized accounting can transform financial verification.

Transparency

GAAP emphasizes standardized financial reporting with clear disclosure requirements to ensure transparency and comparability across organizations. Zero-knowledge proofs accounting allows validation of transactions without revealing sensitive details, offering privacy while maintaining trust through cryptographic guarantees. Explore how combining GAAP's clarity with zero-knowledge proofs' privacy improves transparent yet secure financial reporting.

Privacy

GAAP enforces standardized financial reporting to ensure transparency and compliance, often requiring disclosure of sensitive information, which can limit privacy. Zero knowledge proofs accounting leverages cryptographic techniques to validate transaction accuracy and compliance without revealing underlying data, significantly enhancing privacy protection. Explore how zero knowledge proofs can revolutionize privacy in accounting frameworks.

Source and External Links

What Is GAAP in Accounting? - GAAP (Generally Accepted Accounting Principles) is a standardized set of accounting rules and principles ensuring consistent, accurate financial reporting such as regularity, consistency, conservatism, matching, and materiality.

Generally Accepted Accounting Principles (GAAP) - GAAP rules, created and maintained by FASB, standardize US public companies' financial statements and disclosures, improving consistency and comparability in financial reporting.

Generally Accepted Accounting Principles (United States) - GAAP includes core assumptions such as business entity, going concern, monetary unit, and time-period principles that guide how financial data is recorded and reported.

dowidth.com

dowidth.com