Neobank reconciliation involves matching digital transactions and account balances within online-only banking platforms, focusing on seamless integration with financial apps and real-time data updates. Credit card reconciliation centers on verifying credit card statements against recorded expenses to detect discrepancies, fraudulent charges, and ensure accurate financial reporting. Explore further to understand the distinct processes and benefits of each reconciliation method in modern accounting.

Why it is important

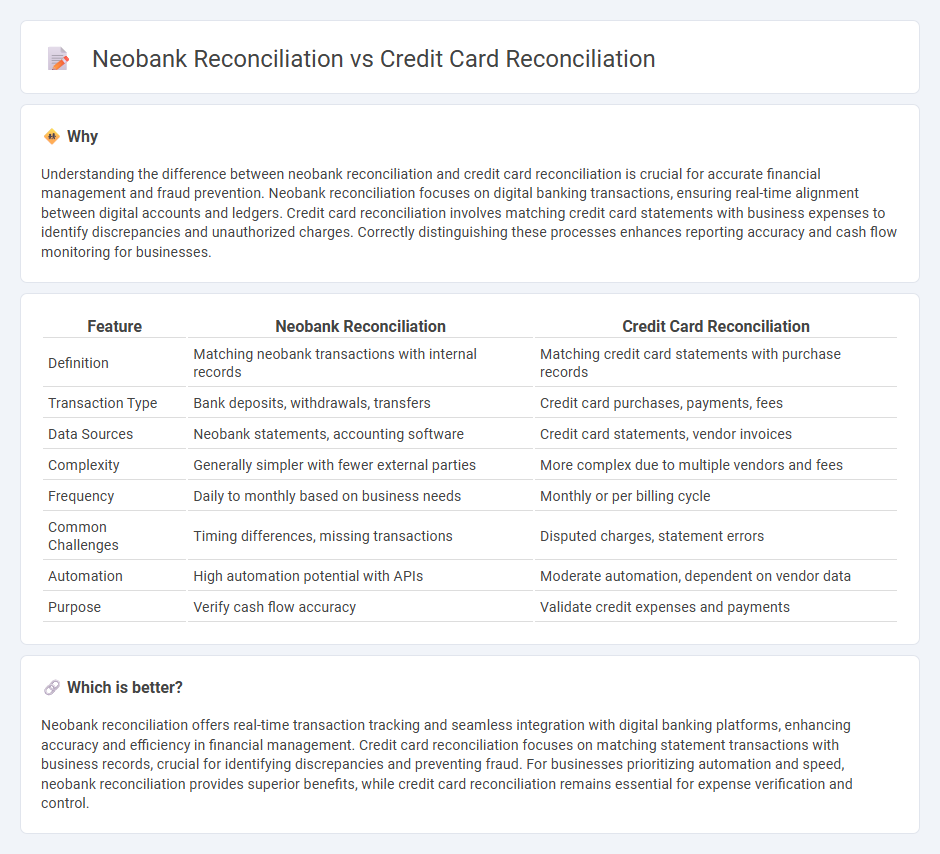

Understanding the difference between neobank reconciliation and credit card reconciliation is crucial for accurate financial management and fraud prevention. Neobank reconciliation focuses on digital banking transactions, ensuring real-time alignment between digital accounts and ledgers. Credit card reconciliation involves matching credit card statements with business expenses to identify discrepancies and unauthorized charges. Correctly distinguishing these processes enhances reporting accuracy and cash flow monitoring for businesses.

Comparison Table

| Feature | Neobank Reconciliation | Credit Card Reconciliation |

|---|---|---|

| Definition | Matching neobank transactions with internal records | Matching credit card statements with purchase records |

| Transaction Type | Bank deposits, withdrawals, transfers | Credit card purchases, payments, fees |

| Data Sources | Neobank statements, accounting software | Credit card statements, vendor invoices |

| Complexity | Generally simpler with fewer external parties | More complex due to multiple vendors and fees |

| Frequency | Daily to monthly based on business needs | Monthly or per billing cycle |

| Common Challenges | Timing differences, missing transactions | Disputed charges, statement errors |

| Automation | High automation potential with APIs | Moderate automation, dependent on vendor data |

| Purpose | Verify cash flow accuracy | Validate credit expenses and payments |

Which is better?

Neobank reconciliation offers real-time transaction tracking and seamless integration with digital banking platforms, enhancing accuracy and efficiency in financial management. Credit card reconciliation focuses on matching statement transactions with business records, crucial for identifying discrepancies and preventing fraud. For businesses prioritizing automation and speed, neobank reconciliation provides superior benefits, while credit card reconciliation remains essential for expense verification and control.

Connection

Neobank reconciliation and credit card reconciliation are interconnected through their shared focus on ensuring accurate financial records by verifying transaction data against bank statements. Both processes involve matching payments, deposits, and fees to detect discrepancies, prevent fraud, and maintain precise cash flow management. Integrating neobank reconciliation with credit card reconciliation streamlines financial oversight, improving real-time accuracy and facilitating efficient expense tracking for businesses.

Key Terms

Transaction Matching

Credit card reconciliation involves verifying transactions against statements to detect discrepancies, often requiring manual review due to varied merchant descriptors and transaction timings. Neobank reconciliation leverages automated, real-time transaction matching through advanced APIs and AI, enhancing accuracy and speed by directly syncing with customer accounts and transaction feeds. Explore more to understand how these technological differences impact financial management efficiency.

Settlement Timing

Credit card reconciliation involves matching transactions after payment processing, with settlement timing typically ranging from one to three business days. Neobank reconciliation often benefits from faster settlement timing due to real-time or near-real-time transaction updates enabled by advanced banking APIs. Explore more to understand how settlement timing impacts cash flow and financial accuracy in both reconciliation processes.

Platform Integration

Credit card reconciliation integrates with multiple payment gateways and accounting software to streamline transaction verification, whereas neobank reconciliation emphasizes real-time API connectivity with core banking platforms for seamless fund tracking. Both systems leverage platform integration to enhance accuracy and reduce manual errors but differ in their connection ecosystems and data synchronization frequency. Explore in-depth comparisons to optimize your reconciliation process.

Source and External Links

How to Do a Credit Card Reconciliation - Capture Expense - Provides an 8-step guide on how to reconcile credit card statements, including gathering documents, checking opening balances, and matching transactions.

Complete Guide to Credit Card Reconciliation - Tipalti - Outlines the process of comparing transactions in credit card statements with company ledgers, including steps for collecting documents, organizing data, and identifying errors.

Complete Guide to Credit Card Reconciliation in 2025 - Ramp - Offers a step-by-step guide to reconciling corporate credit cards, focusing on setting up expense tracking systems and automating the reconciliation process.

dowidth.com

dowidth.com