Environmental Social Governance (ESG) accounting focuses on measuring a company's sustainability performance and social responsibility alongside traditional financial metrics, emphasizing long-term impact on the environment and society. Fund accounting, primarily used by non-profits and government entities, tracks the allocation and usage of funds to ensure compliance with specific regulatory and donor requirements. Explore the key differences and applications of these accounting approaches to better understand their role in modern financial management.

Why it is important

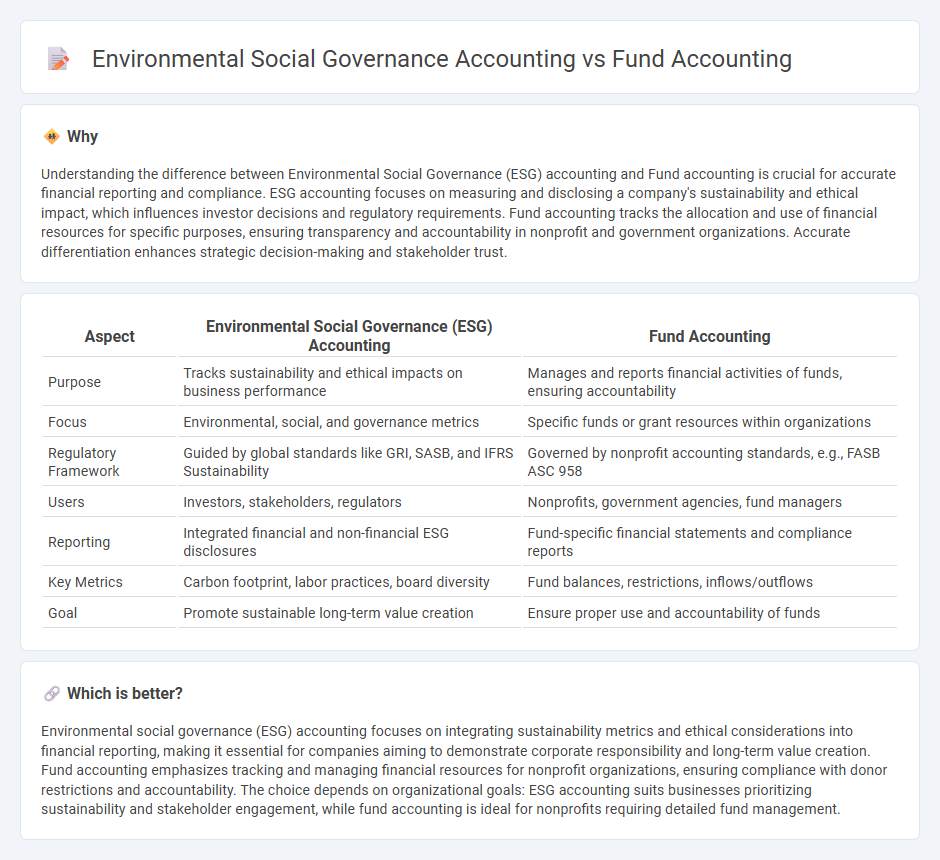

Understanding the difference between Environmental Social Governance (ESG) accounting and Fund accounting is crucial for accurate financial reporting and compliance. ESG accounting focuses on measuring and disclosing a company's sustainability and ethical impact, which influences investor decisions and regulatory requirements. Fund accounting tracks the allocation and use of financial resources for specific purposes, ensuring transparency and accountability in nonprofit and government organizations. Accurate differentiation enhances strategic decision-making and stakeholder trust.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Accounting | Fund Accounting |

|---|---|---|

| Purpose | Tracks sustainability and ethical impacts on business performance | Manages and reports financial activities of funds, ensuring accountability |

| Focus | Environmental, social, and governance metrics | Specific funds or grant resources within organizations |

| Regulatory Framework | Guided by global standards like GRI, SASB, and IFRS Sustainability | Governed by nonprofit accounting standards, e.g., FASB ASC 958 |

| Users | Investors, stakeholders, regulators | Nonprofits, government agencies, fund managers |

| Reporting | Integrated financial and non-financial ESG disclosures | Fund-specific financial statements and compliance reports |

| Key Metrics | Carbon footprint, labor practices, board diversity | Fund balances, restrictions, inflows/outflows |

| Goal | Promote sustainable long-term value creation | Ensure proper use and accountability of funds |

Which is better?

Environmental social governance (ESG) accounting focuses on integrating sustainability metrics and ethical considerations into financial reporting, making it essential for companies aiming to demonstrate corporate responsibility and long-term value creation. Fund accounting emphasizes tracking and managing financial resources for nonprofit organizations, ensuring compliance with donor restrictions and accountability. The choice depends on organizational goals: ESG accounting suits businesses prioritizing sustainability and stakeholder engagement, while fund accounting is ideal for nonprofits requiring detailed fund management.

Connection

Environmental, Social, and Governance (ESG) accounting integrates non-financial metrics focused on sustainability and ethical impact into traditional accounting frameworks, often analyzed through fund accounting structures that manage resources according to specific environmental or social mandates. Fund accounting supports ESG goals by enabling organizations to track and report financial activities separately for funds dedicated to sustainability projects, ensuring transparency and compliance with ESG criteria. The intersection of ESG and fund accounting enhances accountability and informs stakeholders about the efficient allocation of resources toward socially responsible investments and environmental stewardship.

Key Terms

**Fund accounting:**

Fund accounting is a financial reporting system primarily used by non-profit organizations and government entities to track resources allocated for specific purposes, ensuring compliance with donor restrictions and regulatory requirements. It emphasizes accountability by segregating funds into separate accounts to monitor inflows, outflows, and balances distinctly for each fund. Explore the key differences and benefits of fund accounting to optimize financial management within mission-driven organizations.

Funds

Fund accounting emphasizes tracking and managing financial resources tied to specific purposes or restrictions, ensuring compliance with donor requirements and regulatory standards. Environmental Social Governance (ESG) accounting integrates sustainability metrics, assessing how funds align with ethical, environmental, and social criteria to promote responsible investment. Explore detailed comparisons and implications of fund management within ESG frameworks to enhance fund allocation strategies.

Restricted vs. Unrestricted Net Assets

Fund accounting distinguishes restricted net assets as resources limited by external donors for specific purposes, while unrestricted net assets can be used at the organization's discretion. Environmental, Social, and Governance (ESG) accounting integrates these classifications by aligning restricted funds with sustainability projects and unrestricted funds supporting general ESG initiatives. Explore further how these accounting approaches impact nonprofit financial transparency and sustainability reporting.

Source and External Links

What Is Fund Accounting? | Xero US - Fund accounting is an accounting practice used mainly by nonprofit organizations to ensure money is used for its intended purpose by tracking funds separately with accrual accounting, focusing on accountability rather than profit.

Fund accounting - Wikipedia - Fund accounting is a system recording resources whose use is limited by donors or legislation, emphasizing accountability over profitability, typically used by nonprofits and governments, with each fund being a self-balancing set of accounts.

Fund Accounting 101 : Office of Budgeting & Financial Analysis - Fund accounting classifies financial resources into funds with specific use limitations, each fund having its own assets, liabilities, revenues, and expenditures, with fund balances representing the net assets available after liabilities and reserves.

dowidth.com

dowidth.com