Outsourced bookkeeping services provide businesses with expert financial record management handled entirely by external professionals, ensuring accuracy and efficiency without increasing internal workload. Co-managed bookkeeping combines internal staff efforts with external specialists to enhance control and collaboration while leveraging expert insights. Discover how each approach can optimize your accounting processes and support your financial goals.

Why it is important

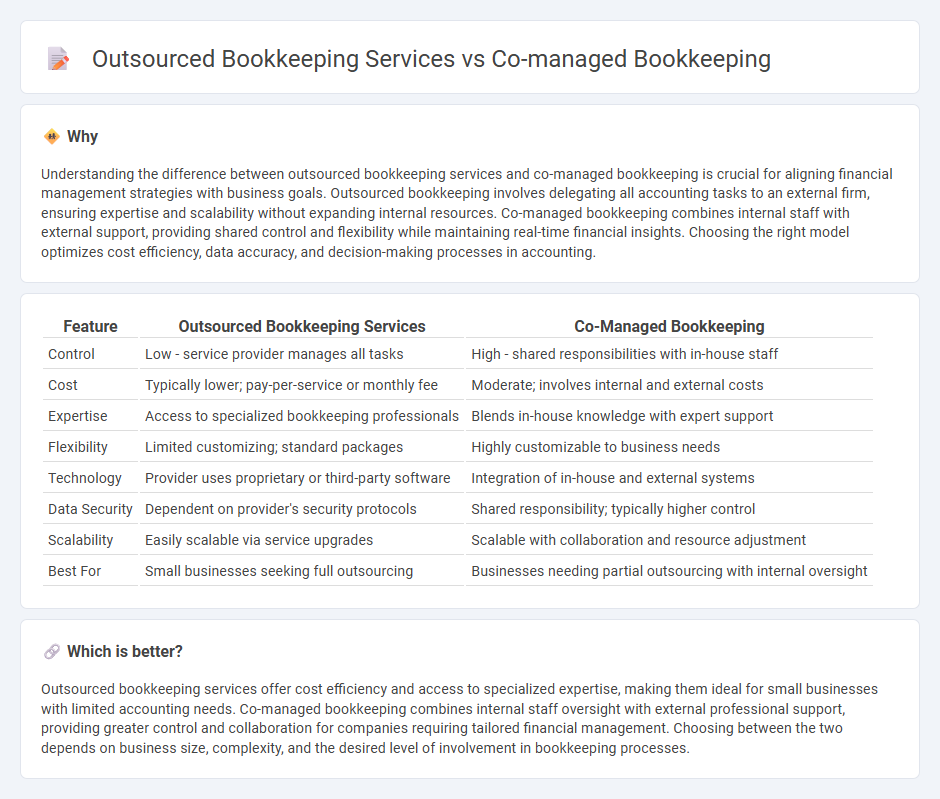

Understanding the difference between outsourced bookkeeping services and co-managed bookkeeping is crucial for aligning financial management strategies with business goals. Outsourced bookkeeping involves delegating all accounting tasks to an external firm, ensuring expertise and scalability without expanding internal resources. Co-managed bookkeeping combines internal staff with external support, providing shared control and flexibility while maintaining real-time financial insights. Choosing the right model optimizes cost efficiency, data accuracy, and decision-making processes in accounting.

Comparison Table

| Feature | Outsourced Bookkeeping Services | Co-Managed Bookkeeping |

|---|---|---|

| Control | Low - service provider manages all tasks | High - shared responsibilities with in-house staff |

| Cost | Typically lower; pay-per-service or monthly fee | Moderate; involves internal and external costs |

| Expertise | Access to specialized bookkeeping professionals | Blends in-house knowledge with expert support |

| Flexibility | Limited customizing; standard packages | Highly customizable to business needs |

| Technology | Provider uses proprietary or third-party software | Integration of in-house and external systems |

| Data Security | Dependent on provider's security protocols | Shared responsibility; typically higher control |

| Scalability | Easily scalable via service upgrades | Scalable with collaboration and resource adjustment |

| Best For | Small businesses seeking full outsourcing | Businesses needing partial outsourcing with internal oversight |

Which is better?

Outsourced bookkeeping services offer cost efficiency and access to specialized expertise, making them ideal for small businesses with limited accounting needs. Co-managed bookkeeping combines internal staff oversight with external professional support, providing greater control and collaboration for companies requiring tailored financial management. Choosing between the two depends on business size, complexity, and the desired level of involvement in bookkeeping processes.

Connection

Outsourced bookkeeping services and co-managed bookkeeping both leverage external expertise to enhance financial record accuracy and efficiency. While outsourced bookkeeping fully entrusts daily financial transactions to external professionals, co-managed bookkeeping integrates internal staff with outsourced specialists, enabling shared control and real-time collaboration. This connection facilitates scalable financial management solutions tailored to diverse business needs, improving data accuracy and compliance.

Key Terms

Collaboration

Co-managed bookkeeping combines in-house expertise with external support to enhance accuracy and real-time financial insights, fostering a collaborative approach that leverages both parties' strengths. Outsourced bookkeeping services delegate all financial record-keeping to specialized providers, optimizing efficiency but limiting direct involvement and control. Explore how integrating collaboration in bookkeeping can improve your business's financial management and decision-making.

Control

Co-managed bookkeeping offers businesses greater control over financial processes by allowing collaboration between internal staff and external experts, ensuring tailored oversight and real-time adjustments. Outsourced bookkeeping services, while efficient and cost-effective, often limit direct control due to reliance on third-party management and standardized procedures. Discover how choosing between co-managed and outsourced bookkeeping impacts your financial accuracy and operational control.

Cost

Co-managed bookkeeping typically reduces costs by blending in-house oversight with external expertise, optimizing resource allocation and control over financial processes. Outsourced bookkeeping services streamline expenses through fixed fees and scalability, minimizing overhead related to personnel and technology. Explore detailed cost comparisons and benefits to determine the best approach for your business needs.

Source and External Links

Client Accounting Services - Outsourced Bookkeeping - Provides structured, outsourced bookkeeping that lets businesses collaborate with accounting experts, handle daily transactions, and keep records clean for easy decision-making and tax preparation.

Outsourced Accounting Services - Virtual CFOs - Offers co-managed bookkeeping solutions with flexible support, from daily transaction management to strategic financial guidance, allowing businesses to focus on growth while ensuring accurate finances.

Outsourced Bookkeeping Services | Virtual Accounting in USA - Delivers outsourced, certified bookkeepers for businesses and CPAs, enabling scalable, remote co-management of financial records and analytics for data-driven decisions.

dowidth.com

dowidth.com