Cryptofinance reconciliation involves verifying and matching cryptocurrency transactions across blockchain records and accounting ledgers to ensure accuracy in digital asset management. Expense account reconciliation focuses on validating business expenditures by comparing expense reports with bank statements and internal records to prevent discrepancies. Explore detailed methods and tools to master both reconciliation processes effectively.

Why it is important

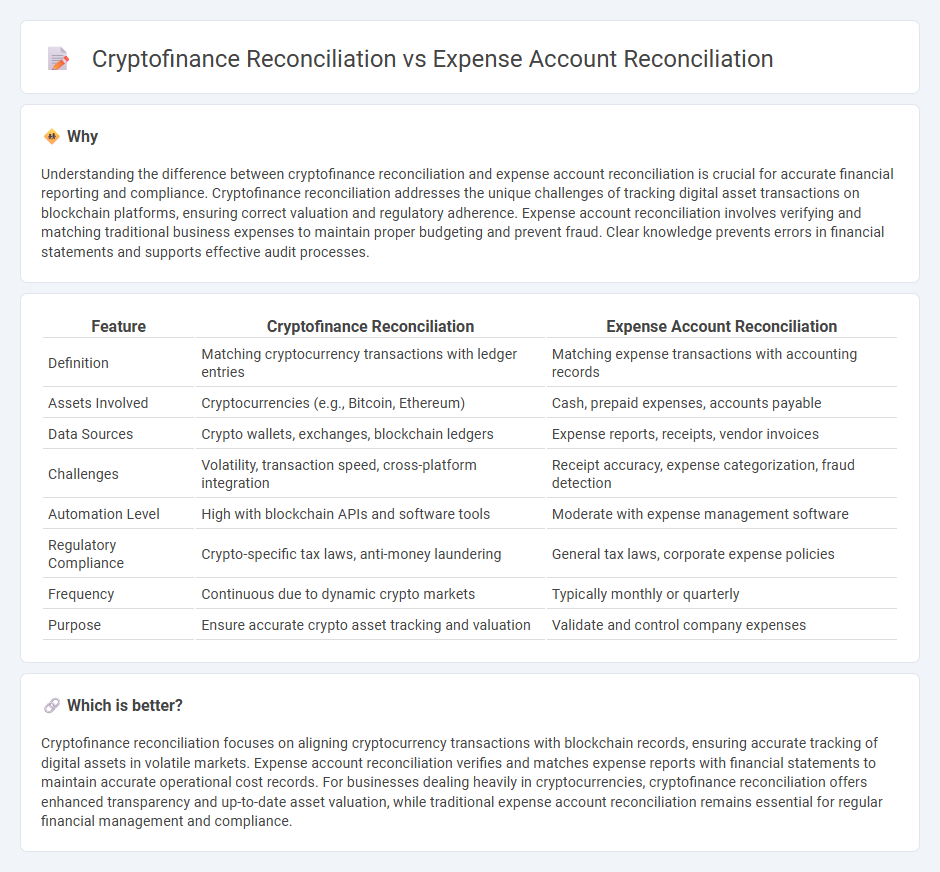

Understanding the difference between cryptofinance reconciliation and expense account reconciliation is crucial for accurate financial reporting and compliance. Cryptofinance reconciliation addresses the unique challenges of tracking digital asset transactions on blockchain platforms, ensuring correct valuation and regulatory adherence. Expense account reconciliation involves verifying and matching traditional business expenses to maintain proper budgeting and prevent fraud. Clear knowledge prevents errors in financial statements and supports effective audit processes.

Comparison Table

| Feature | Cryptofinance Reconciliation | Expense Account Reconciliation |

|---|---|---|

| Definition | Matching cryptocurrency transactions with ledger entries | Matching expense transactions with accounting records |

| Assets Involved | Cryptocurrencies (e.g., Bitcoin, Ethereum) | Cash, prepaid expenses, accounts payable |

| Data Sources | Crypto wallets, exchanges, blockchain ledgers | Expense reports, receipts, vendor invoices |

| Challenges | Volatility, transaction speed, cross-platform integration | Receipt accuracy, expense categorization, fraud detection |

| Automation Level | High with blockchain APIs and software tools | Moderate with expense management software |

| Regulatory Compliance | Crypto-specific tax laws, anti-money laundering | General tax laws, corporate expense policies |

| Frequency | Continuous due to dynamic crypto markets | Typically monthly or quarterly |

| Purpose | Ensure accurate crypto asset tracking and valuation | Validate and control company expenses |

Which is better?

Cryptofinance reconciliation focuses on aligning cryptocurrency transactions with blockchain records, ensuring accurate tracking of digital assets in volatile markets. Expense account reconciliation verifies and matches expense reports with financial statements to maintain accurate operational cost records. For businesses dealing heavily in cryptocurrencies, cryptofinance reconciliation offers enhanced transparency and up-to-date asset valuation, while traditional expense account reconciliation remains essential for regular financial management and compliance.

Connection

Cryptofinance reconciliation involves verifying cryptocurrency transaction records to ensure accuracy and alignment with blockchain data, which directly impacts the accuracy of Expense account reconciliation by matching these verified transactions with recorded business expenses. Both processes rely on precise ledger comparison to identify discrepancies, ensuring financial statements reflect true financial positions. Efficient integration of cryptofinance reconciliation enhances transparency in expense tracking, reducing errors and improving audit readiness.

Key Terms

Matching Principle

Expense account reconciliation ensures all business expenses are accurately recorded and matched to the period they were incurred, adhering to the Matching Principle by aligning expenses with corresponding revenues. Cryptofinance reconciliation applies this principle to digital asset transactions, matching cryptocurrency inflows and outflows within the proper accounting period for transparent financial reporting. Explore how mastering these reconciliations strengthens financial integrity and compliance.

Blockchain Ledger

Expense account reconciliation involves verifying transactions recorded in corporate accounting systems against bank statements and receipts to ensure accuracy and prevent fraud. Cryptofinance reconciliation, especially on blockchain ledgers, requires validating cryptocurrency transactions by cross-referencing on-chain data with exchange records and wallet histories to maintain integrity and traceability. Explore how blockchain technology enhances transparency and security in financial reconciliation processes.

Transaction Categorization

Expense account reconciliation primarily involves categorizing transactions based on business-related spends such as travel, meals, and office supplies to ensure accurate financial reporting and budgeting. Cryptofinance reconciliation focuses on categorizing blockchain transactions including transfers, staking rewards, and exchange orders, which requires specialized classification to address unique crypto asset types and transaction complexities. Explore deeper insights into effective transaction categorization strategies in both domains for improved accuracy and compliance.

Source and External Links

What is Expense Reconciliation? - Navan - Expense reconciliation is the process of verifying and matching business expenses with records like receipts and credit card statements to ensure accuracy, prevent fraud, and maintain financial reporting integrity.

Expense Reconciliation Guide: Implement a Winning Strategy - Tipalti - Expense reconciliation involves comparing actual expenses against budgets and general ledger entries to find errors, discrepancies, or unauthorized expenses as the last step in the expense management cycle.

Expense Reconciliation: How to Reconcile Expenses Faster - Ramp - Expense reconciliation can be done manually or automatically, involving collecting and matching receipts, invoices, and reports to financial records, with automated software helping to streamline and scale the process.

dowidth.com

dowidth.com