Carbon footprint accounting quantifies greenhouse gas emissions associated with business activities, providing measurable data for sustainability strategies. Non-financial reporting encompasses a broader range of environmental, social, and governance (ESG) metrics, offering qualitative and quantitative insights beyond financial performance. Explore the distinctions and integration of these approaches to enhance corporate transparency and environmental responsibility.

Why it is important

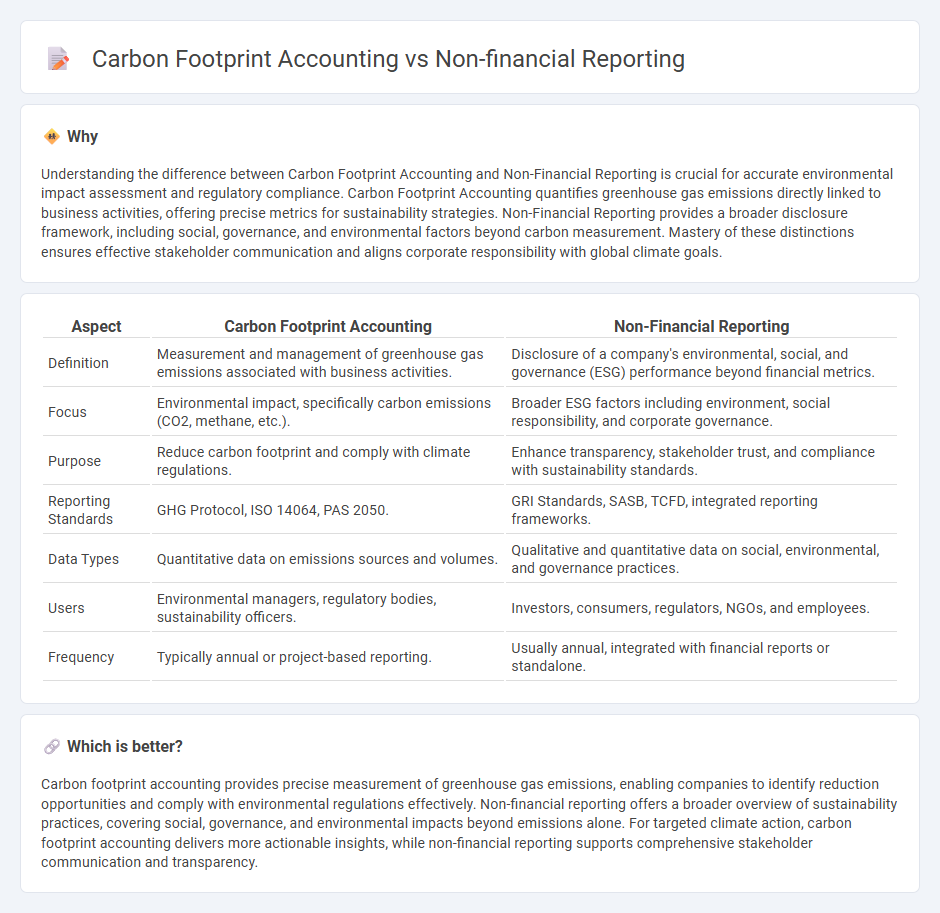

Understanding the difference between Carbon Footprint Accounting and Non-Financial Reporting is crucial for accurate environmental impact assessment and regulatory compliance. Carbon Footprint Accounting quantifies greenhouse gas emissions directly linked to business activities, offering precise metrics for sustainability strategies. Non-Financial Reporting provides a broader disclosure framework, including social, governance, and environmental factors beyond carbon measurement. Mastery of these distinctions ensures effective stakeholder communication and aligns corporate responsibility with global climate goals.

Comparison Table

| Aspect | Carbon Footprint Accounting | Non-Financial Reporting |

|---|---|---|

| Definition | Measurement and management of greenhouse gas emissions associated with business activities. | Disclosure of a company's environmental, social, and governance (ESG) performance beyond financial metrics. |

| Focus | Environmental impact, specifically carbon emissions (CO2, methane, etc.). | Broader ESG factors including environment, social responsibility, and corporate governance. |

| Purpose | Reduce carbon footprint and comply with climate regulations. | Enhance transparency, stakeholder trust, and compliance with sustainability standards. |

| Reporting Standards | GHG Protocol, ISO 14064, PAS 2050. | GRI Standards, SASB, TCFD, integrated reporting frameworks. |

| Data Types | Quantitative data on emissions sources and volumes. | Qualitative and quantitative data on social, environmental, and governance practices. |

| Users | Environmental managers, regulatory bodies, sustainability officers. | Investors, consumers, regulators, NGOs, and employees. |

| Frequency | Typically annual or project-based reporting. | Usually annual, integrated with financial reports or standalone. |

Which is better?

Carbon footprint accounting provides precise measurement of greenhouse gas emissions, enabling companies to identify reduction opportunities and comply with environmental regulations effectively. Non-financial reporting offers a broader overview of sustainability practices, covering social, governance, and environmental impacts beyond emissions alone. For targeted climate action, carbon footprint accounting delivers more actionable insights, while non-financial reporting supports comprehensive stakeholder communication and transparency.

Connection

Carbon footprint accounting quantifies greenhouse gas emissions associated with business activities, providing essential data for comprehensive non-financial reporting. Non-financial reporting frameworks, such as the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB), integrate these carbon metrics to disclose environmental impact and sustainability performance to stakeholders. This connection enhances corporate transparency and supports compliance with evolving regulatory requirements on climate-related disclosures.

Key Terms

Sustainability Reporting

Non-financial reporting encompasses a broad range of sustainability metrics, including environmental, social, and governance (ESG) factors, providing a comprehensive view of a company's impact beyond financial performance. Carbon footprint accounting specifically measures the total greenhouse gas emissions caused directly or indirectly by an organization, offering precise data critical for climate action and compliance with international standards such as the GHG Protocol and ISO 14064. Explore deeper insights into how these reporting frameworks drive transparency and accountability in corporate sustainability efforts.

Greenhouse Gas (GHG) Emissions

Non-financial reporting encompasses a broad range of environmental, social, and governance (ESG) metrics, while carbon footprint accounting specifically quantifies greenhouse gas (GHG) emissions associated with organizational activities. Carbon footprint accounting uses standardized protocols such as the GHG Protocol to measure direct and indirect emissions, providing actionable data for emission reduction strategies. Explore detailed methodologies and benefits of integrating carbon footprint accounting within broader non-financial reporting frameworks to enhance sustainability transparency.

Environmental, Social, and Governance (ESG)

Non-financial reporting encompasses a broad spectrum of Environmental, Social, and Governance (ESG) disclosures that address corporate sustainability, social responsibility, and ethical governance practices beyond financial metrics. Carbon footprint accounting specifically quantifies greenhouse gas emissions, serving as a critical environmental metric within ESG frameworks to measure a company's direct and indirect impact on climate change. Explore how integrated ESG reporting and precise carbon accounting drive transparency and accountability in sustainable business strategies.

Source and External Links

Non-financial reporting: responsible, far-sighted management - PwC - Non-financial reporting involves disclosing information beyond financial data, focusing on key themes affecting organizations, such as environmental, social, and governance issues, which helps assure long-term value and corporate responsibility, particularly for large multinational companies.

Non-financial reporting - Globalnaps - It is a transparency practice where companies report on sustainability, human rights, environmental impact, and social aspects, with large entities often required by the EU Non-Financial Reporting Directive to disclose this information, though smaller companies may do so voluntarily.

A Comprehensive Guide to Non-Financial Reporting - This guide details the main non-financial reporting standards like CSRD, ISSB, CDP, and GRI, explaining how these frameworks facilitate transparency on sustainability and ESG impacts, with some being mandatory in regions like the EU and others voluntary but influential globally.

dowidth.com

dowidth.com