Zero trust accounting emphasizes stringent data verification and security protocols to protect financial information from unauthorized access or fraud. Environmental accounting focuses on integrating ecological costs and impacts into financial reporting to promote sustainable business practices. Discover how these distinct accounting approaches shape transparent and responsible financial management.

Why it is important

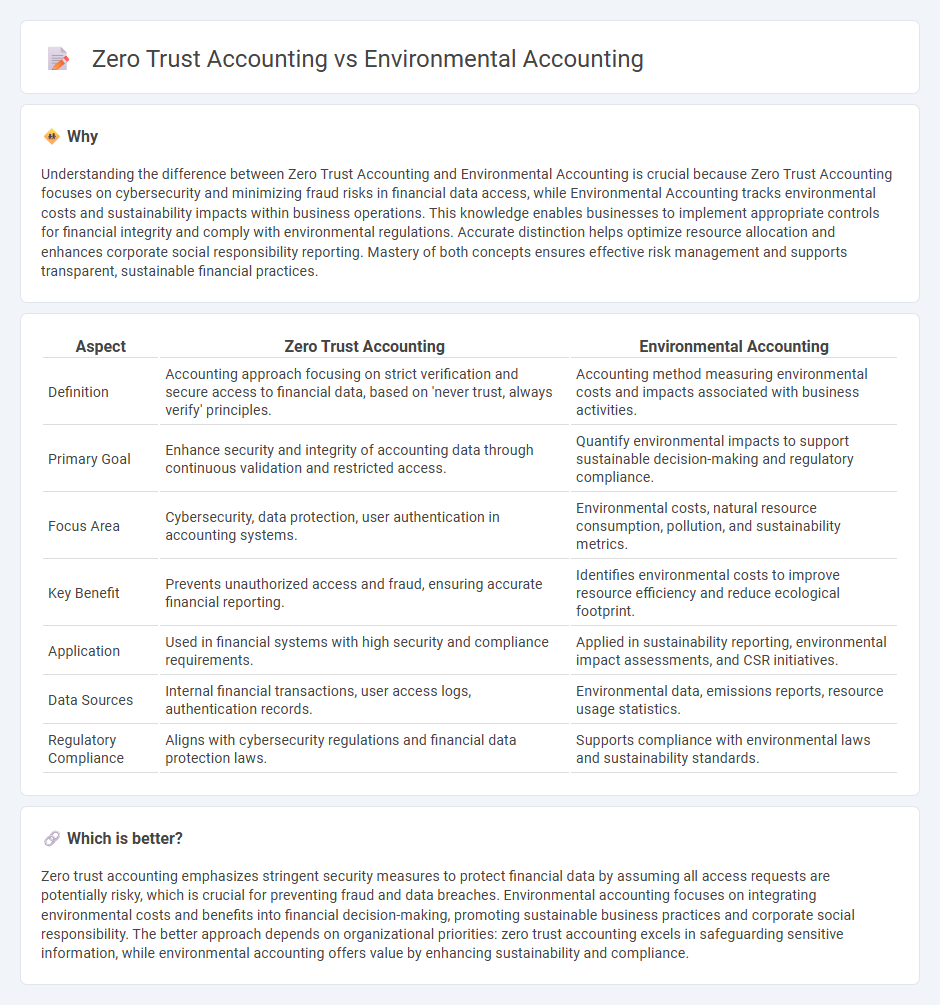

Understanding the difference between Zero Trust Accounting and Environmental Accounting is crucial because Zero Trust Accounting focuses on cybersecurity and minimizing fraud risks in financial data access, while Environmental Accounting tracks environmental costs and sustainability impacts within business operations. This knowledge enables businesses to implement appropriate controls for financial integrity and comply with environmental regulations. Accurate distinction helps optimize resource allocation and enhances corporate social responsibility reporting. Mastery of both concepts ensures effective risk management and supports transparent, sustainable financial practices.

Comparison Table

| Aspect | Zero Trust Accounting | Environmental Accounting |

|---|---|---|

| Definition | Accounting approach focusing on strict verification and secure access to financial data, based on 'never trust, always verify' principles. | Accounting method measuring environmental costs and impacts associated with business activities. |

| Primary Goal | Enhance security and integrity of accounting data through continuous validation and restricted access. | Quantify environmental impacts to support sustainable decision-making and regulatory compliance. |

| Focus Area | Cybersecurity, data protection, user authentication in accounting systems. | Environmental costs, natural resource consumption, pollution, and sustainability metrics. |

| Key Benefit | Prevents unauthorized access and fraud, ensuring accurate financial reporting. | Identifies environmental costs to improve resource efficiency and reduce ecological footprint. |

| Application | Used in financial systems with high security and compliance requirements. | Applied in sustainability reporting, environmental impact assessments, and CSR initiatives. |

| Data Sources | Internal financial transactions, user access logs, authentication records. | Environmental data, emissions reports, resource usage statistics. |

| Regulatory Compliance | Aligns with cybersecurity regulations and financial data protection laws. | Supports compliance with environmental laws and sustainability standards. |

Which is better?

Zero trust accounting emphasizes stringent security measures to protect financial data by assuming all access requests are potentially risky, which is crucial for preventing fraud and data breaches. Environmental accounting focuses on integrating environmental costs and benefits into financial decision-making, promoting sustainable business practices and corporate social responsibility. The better approach depends on organizational priorities: zero trust accounting excels in safeguarding sensitive information, while environmental accounting offers value by enhancing sustainability and compliance.

Connection

Zero trust accounting enhances financial transparency by rigorously verifying transactions, which supports environmental accounting's goal of accurately tracking sustainability-related costs and impacts. By integrating zero trust principles, organizations can ensure the integrity of environmental data, reducing risks of fraud and misreporting in carbon accounting and resource usage. This connection drives more reliable sustainability reporting and compliance with environmental regulations.

Key Terms

**Environmental accounting:**

Environmental accounting quantifies the economic impact of environmental costs and benefits, integrating ecological data into financial decision-making to promote sustainable business practices. This approach includes tracking resource consumption, waste generation, and pollution costs, enabling organizations to minimize their environmental footprint while optimizing operational efficiency. Discover more about how environmental accounting drives corporate sustainability and regulatory compliance.

Carbon footprint

Environmental accounting quantifies an organization's carbon footprint by tracking emissions across operations to support sustainability goals and regulatory compliance. Zero trust accounting integrates strict verification processes to ensure data integrity and transparency in carbon footprint reporting, reducing the risk of misrepresentation. Explore deeper insights into how these accounting approaches reshape carbon management strategies.

Sustainability reporting

Environmental accounting integrates financial data with ecological impact metrics to provide transparent sustainability reporting, highlighting resource consumption, waste management, and carbon footprint. Zero trust accounting applies strict verification protocols to financial transactions, enhancing data security and integrity without directly addressing environmental metrics. Explore how combining robust security measures with detailed sustainability disclosures can elevate corporate responsibility reporting.

Source and External Links

Environmental accounting - Wikipedia - Environmental accounting identifies resource use, measures and communicates the costs of a company's or national economic impact on the environment.

Environmental accounting | EBSCO Research Starters - Environmental accounting is a method of evaluating and analyzing the costs organizations incur due to their environmental impact, encompassing both financial and societal costs.

How to Become an Environmental Accountant - Environmental accountants calculate the environmental costs of business activities, helping organizations manage their environmental impact and implement sustainable practices.

dowidth.com

dowidth.com