Embedded finance compliance ensures that financial services integrated within non-financial platforms adhere to regulatory standards and prevent legal risks. Payment reconciliation tracks and verifies transactions to maintain accurate financial records and prevent discrepancies. Explore the critical differences between embedded finance compliance and payment reconciliation to optimize your accounting processes.

Why it is important

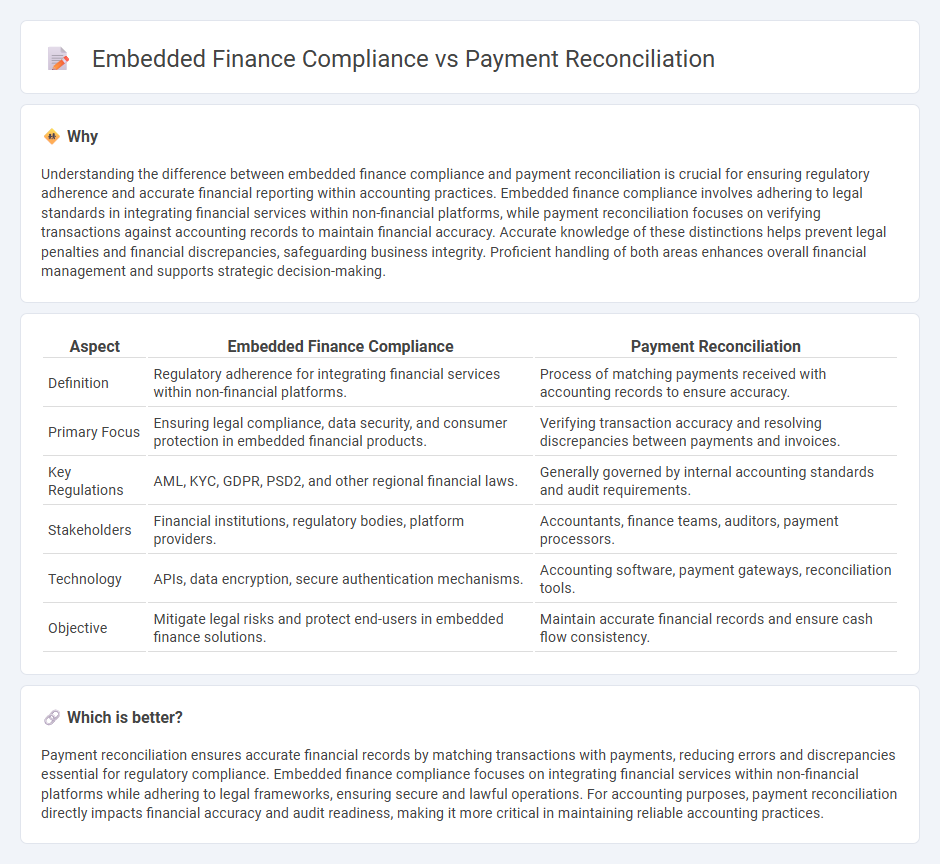

Understanding the difference between embedded finance compliance and payment reconciliation is crucial for ensuring regulatory adherence and accurate financial reporting within accounting practices. Embedded finance compliance involves adhering to legal standards in integrating financial services within non-financial platforms, while payment reconciliation focuses on verifying transactions against accounting records to maintain financial accuracy. Accurate knowledge of these distinctions helps prevent legal penalties and financial discrepancies, safeguarding business integrity. Proficient handling of both areas enhances overall financial management and supports strategic decision-making.

Comparison Table

| Aspect | Embedded Finance Compliance | Payment Reconciliation |

|---|---|---|

| Definition | Regulatory adherence for integrating financial services within non-financial platforms. | Process of matching payments received with accounting records to ensure accuracy. |

| Primary Focus | Ensuring legal compliance, data security, and consumer protection in embedded financial products. | Verifying transaction accuracy and resolving discrepancies between payments and invoices. |

| Key Regulations | AML, KYC, GDPR, PSD2, and other regional financial laws. | Generally governed by internal accounting standards and audit requirements. |

| Stakeholders | Financial institutions, regulatory bodies, platform providers. | Accountants, finance teams, auditors, payment processors. |

| Technology | APIs, data encryption, secure authentication mechanisms. | Accounting software, payment gateways, reconciliation tools. |

| Objective | Mitigate legal risks and protect end-users in embedded finance solutions. | Maintain accurate financial records and ensure cash flow consistency. |

Which is better?

Payment reconciliation ensures accurate financial records by matching transactions with payments, reducing errors and discrepancies essential for regulatory compliance. Embedded finance compliance focuses on integrating financial services within non-financial platforms while adhering to legal frameworks, ensuring secure and lawful operations. For accounting purposes, payment reconciliation directly impacts financial accuracy and audit readiness, making it more critical in maintaining reliable accounting practices.

Connection

Embedded finance compliance ensures that integrated financial services adhere to regulatory standards, minimizing risks related to fraud and data security during payment processes. Payment reconciliation relies on accurate transaction data, which is maintained and validated through compliance protocols embedded within financial systems. This synergy enhances transparency, reduces errors, and streamlines audit trails in accounting operations.

Key Terms

**Payment reconciliation:**

Payment reconciliation involves systematically matching and verifying transactions between payment records and bank statements to ensure accuracy and prevent discrepancies. It requires adherence to financial regulations such as PCI DSS and AML laws to maintain secure and lawful handling of transaction data. Explore more insights on optimizing payment reconciliation processes and ensuring compliance in financial operations.

Bank statement matching

Payment reconciliation streamlines financial operations by accurately matching transactions against bank statements, reducing errors and improving audit efficiency. Embedded finance compliance requires robust bank statement matching to ensure transparency, regulatory adherence, and fraud prevention within integrated financial services. Explore more to understand how effective bank statement matching enhances both payment reconciliation and embedded finance compliance.

Outstanding payments

Payment reconciliation ensures accurate matching of transactions to outstanding payments, reducing errors and financial discrepancies in accounts receivable. Embedded finance compliance involves adhering to regulatory standards while managing and processing outstanding payments within integrated financial services platforms. Explore how combining effective payment reconciliation with embedded finance compliance can enhance financial accuracy and regulatory adherence.

Source and External Links

What is Payment Reconciliation & How Does it Work? - Payment reconciliation involves comparing internal financial records with external payment records to ensure accuracy and consistency in financial transactions.

Payment reconciliation: What it is and how it's done - Payment reconciliation is a process that matches transaction records to verify the accuracy of payments made or received, involving steps like gathering data and resolving discrepancies.

What is Payment Reconciliation? - Payment reconciliation is an accounting process used to verify that all payments are properly recorded in the accounting system, with types including bank, cash, credit card, and digital wallet reconciliation.

dowidth.com

dowidth.com