Decentralized ledger accounting utilizes blockchain technology to record transactions securely and transparently across multiple nodes, eliminating the risks of data tampering and centralized control inherent in paper-based ledgers. Paper-based ledger accounting relies on manual entries in physical books, which are susceptible to human error, loss, and lack of real-time updates. Discover how decentralized ledger systems are revolutionizing financial record-keeping compared to traditional methods.

Why it is important

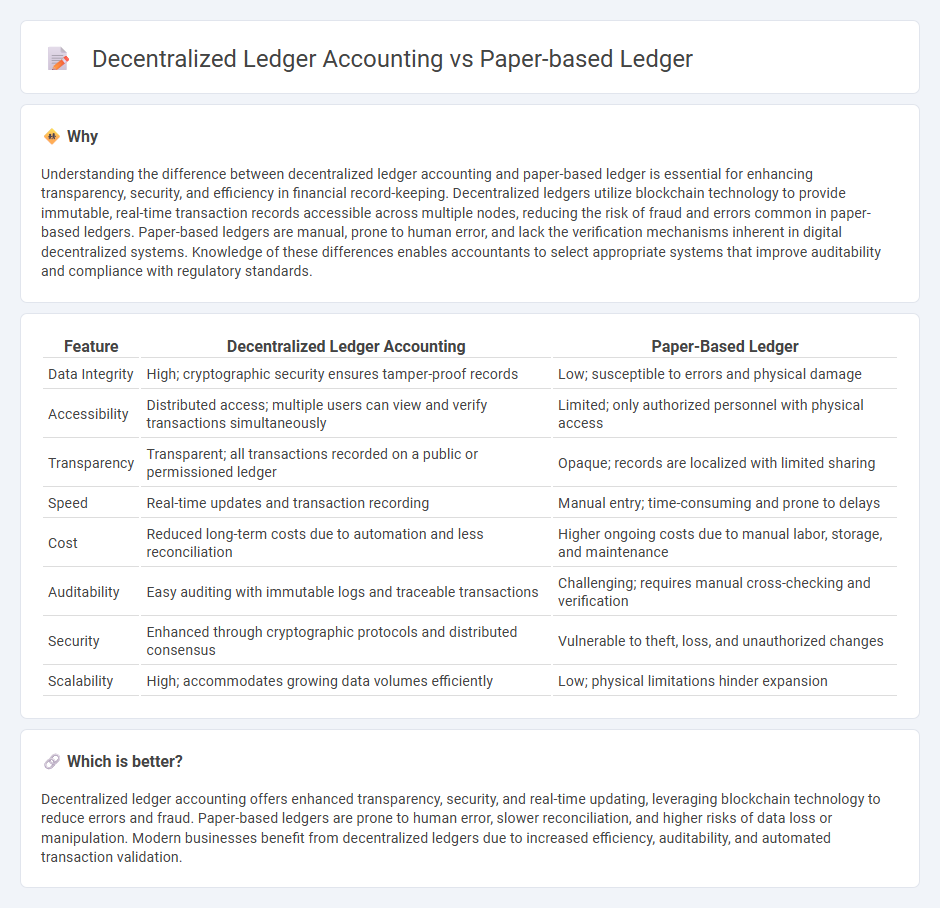

Understanding the difference between decentralized ledger accounting and paper-based ledger is essential for enhancing transparency, security, and efficiency in financial record-keeping. Decentralized ledgers utilize blockchain technology to provide immutable, real-time transaction records accessible across multiple nodes, reducing the risk of fraud and errors common in paper-based ledgers. Paper-based ledgers are manual, prone to human error, and lack the verification mechanisms inherent in digital decentralized systems. Knowledge of these differences enables accountants to select appropriate systems that improve auditability and compliance with regulatory standards.

Comparison Table

| Feature | Decentralized Ledger Accounting | Paper-Based Ledger |

|---|---|---|

| Data Integrity | High; cryptographic security ensures tamper-proof records | Low; susceptible to errors and physical damage |

| Accessibility | Distributed access; multiple users can view and verify transactions simultaneously | Limited; only authorized personnel with physical access |

| Transparency | Transparent; all transactions recorded on a public or permissioned ledger | Opaque; records are localized with limited sharing |

| Speed | Real-time updates and transaction recording | Manual entry; time-consuming and prone to delays |

| Cost | Reduced long-term costs due to automation and less reconciliation | Higher ongoing costs due to manual labor, storage, and maintenance |

| Auditability | Easy auditing with immutable logs and traceable transactions | Challenging; requires manual cross-checking and verification |

| Security | Enhanced through cryptographic protocols and distributed consensus | Vulnerable to theft, loss, and unauthorized changes |

| Scalability | High; accommodates growing data volumes efficiently | Low; physical limitations hinder expansion |

Which is better?

Decentralized ledger accounting offers enhanced transparency, security, and real-time updating, leveraging blockchain technology to reduce errors and fraud. Paper-based ledgers are prone to human error, slower reconciliation, and higher risks of data loss or manipulation. Modern businesses benefit from decentralized ledgers due to increased efficiency, auditability, and automated transaction validation.

Connection

Decentralized ledger accounting and paper-based ledger share the fundamental purpose of recording financial transactions accurately and securely. While paper-based ledgers rely on manual entries in physical books, decentralized ledger accounting utilizes blockchain technology to create immutable, transparent, and tamper-resistant digital records. Both systems ensure financial accountability, but decentralized ledgers enhance trust and efficiency by enabling real-time updates and distributed access among multiple participants.

Key Terms

Double-entry bookkeeping

Paper-based ledgers record financial transactions manually, relying heavily on physical documentation and human accuracy, often leading to delays and errors. Decentralized ledger accounting, powered by blockchain technology, enhances transparency, immutability, and real-time verification of double-entry bookkeeping by distributing transaction records across multiple nodes. Explore how decentralized ledgers revolutionize accuracy and trust in financial record-keeping.

Immutability

Paper-based ledgers offer limited immutability as physical records can be altered, damaged, or forged, undermining trustworthiness. Decentralized ledger accounting, such as blockchain technology, ensures immutability through cryptographic hashing and distributed consensus, making data tampering nearly impossible and enhancing transaction transparency. Explore how decentralized ledgers transform financial integrity and data security for deeper insights.

Reconciliation

Paper-based ledgers rely on manual entry and physical record-keeping, leading to increased risks of errors and time-consuming reconciliation processes. Decentralized ledger accounting uses blockchain technology to provide real-time, tamper-proof transaction records, which significantly streamline reconciliation by ensuring data consistency across multiple parties. Explore how decentralized ledgers can transform your reconciliation workflows and improve accounting accuracy.

Source and External Links

Big E-Z Bookkeeping Paper Ledger System - This paper-based ledger system helps track a year's worth of business income and expenses with forms for income, expenses, bank reconciliation, and profit & loss, supporting physical record-keeping and organization for tax purposes.

Digital vs. Paper: Which Bookkeeping Ledger Book is Right for You? - Paper ledgers provide tangible records without the need for technology skills, ideal for those preferring manual entry, though they can be time-consuming and prone to errors compared to digital alternatives.

Bulk Ledger Sheets & Paper - OnTimeSupplies.com - Accounting ledger sheets are available in bulk for accurate bookkeeping and can serve as valuable backups alongside digital records, offering various layouts and sizes to organize financial and meeting documentation effectively.

dowidth.com

dowidth.com