Forensic accounting software specializes in detecting fraud, analyzing financial discrepancies, and supporting legal investigations by providing detailed audit trails and transaction analysis. Budgeting software focuses on financial planning, expense tracking, and forecasting to help businesses allocate resources efficiently and maintain fiscal control. Explore their unique features and benefits to determine which software best meets your financial management needs.

Why it is important

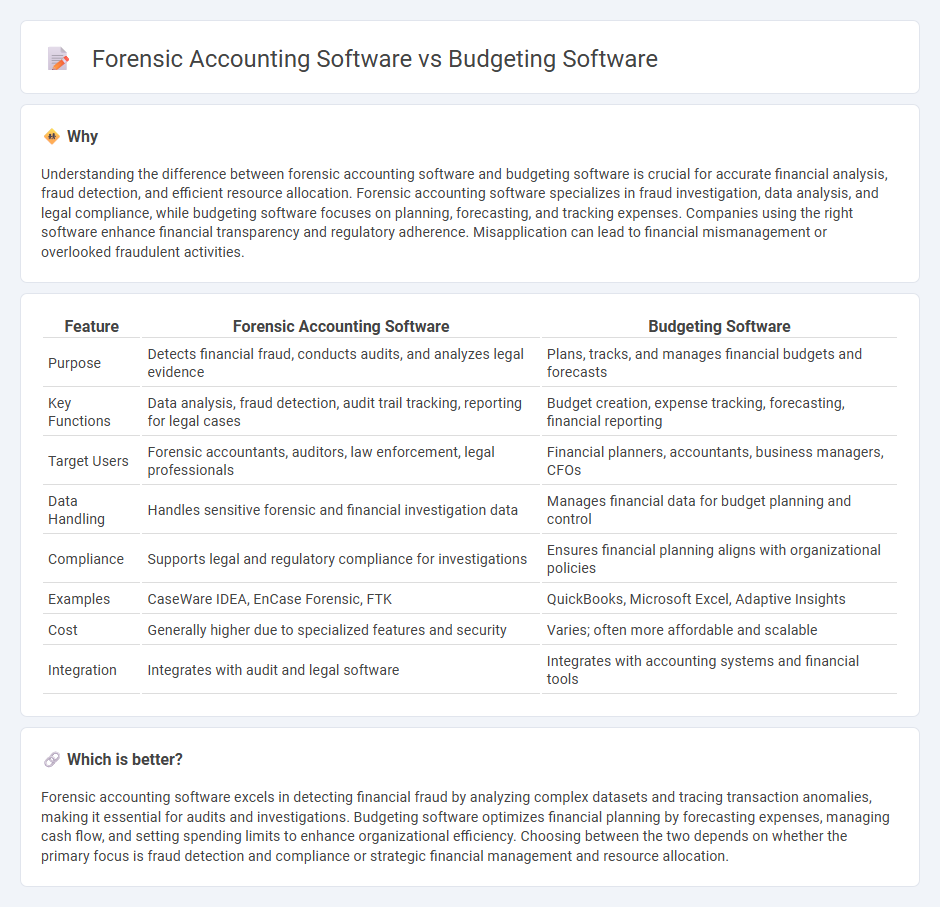

Understanding the difference between forensic accounting software and budgeting software is crucial for accurate financial analysis, fraud detection, and efficient resource allocation. Forensic accounting software specializes in fraud investigation, data analysis, and legal compliance, while budgeting software focuses on planning, forecasting, and tracking expenses. Companies using the right software enhance financial transparency and regulatory adherence. Misapplication can lead to financial mismanagement or overlooked fraudulent activities.

Comparison Table

| Feature | Forensic Accounting Software | Budgeting Software |

|---|---|---|

| Purpose | Detects financial fraud, conducts audits, and analyzes legal evidence | Plans, tracks, and manages financial budgets and forecasts |

| Key Functions | Data analysis, fraud detection, audit trail tracking, reporting for legal cases | Budget creation, expense tracking, forecasting, financial reporting |

| Target Users | Forensic accountants, auditors, law enforcement, legal professionals | Financial planners, accountants, business managers, CFOs |

| Data Handling | Handles sensitive forensic and financial investigation data | Manages financial data for budget planning and control |

| Compliance | Supports legal and regulatory compliance for investigations | Ensures financial planning aligns with organizational policies |

| Examples | CaseWare IDEA, EnCase Forensic, FTK | QuickBooks, Microsoft Excel, Adaptive Insights |

| Cost | Generally higher due to specialized features and security | Varies; often more affordable and scalable |

| Integration | Integrates with audit and legal software | Integrates with accounting systems and financial tools |

Which is better?

Forensic accounting software excels in detecting financial fraud by analyzing complex datasets and tracing transaction anomalies, making it essential for audits and investigations. Budgeting software optimizes financial planning by forecasting expenses, managing cash flow, and setting spending limits to enhance organizational efficiency. Choosing between the two depends on whether the primary focus is fraud detection and compliance or strategic financial management and resource allocation.

Connection

Forensic accounting software and budgeting software intersect by enhancing financial transparency and fraud detection during budget planning and analysis. Forensic accounting tools analyze financial records to uncover irregularities, while budgeting software manages and forecasts organizational finances, enabling early identification of discrepancies. Integrating both systems strengthens internal controls and improves accuracy in financial reporting.

Key Terms

Financial Planning

Budgeting software streamlines financial planning by enabling users to create detailed expense forecasts, monitor cash flow, and set savings goals tailored to personal or business needs. Forensic accounting software, while primarily designed for detecting fraud and analyzing financial discrepancies, also supports planning by providing in-depth transaction analysis and audit trails that ensure accuracy and compliance. Explore the distinctive features and benefits of both software types to enhance your financial planning strategy.

Fraud Detection

Budgeting software primarily facilitates financial planning and resource allocation, whereas forensic accounting software specializes in detecting and analyzing fraudulent activities through data mining, transaction analysis, and anomaly detection. Forensic accounting tools incorporate advanced features like artificial intelligence, pattern recognition, and audit trail examination to enhance fraud detection capabilities beyond basic financial monitoring. Discover how integrating forensic accounting software can significantly improve your organization's ability to identify and mitigate financial fraud risks.

Expense Tracking

Budgeting software specializes in comprehensive expense tracking by categorizing and monitoring daily spending to help users maintain financial goals and optimize cash flow. Forensic accounting software, designed for investigative purposes, tracks expenses with detailed audit trails to detect fraud, discrepancies, and financial anomalies. Explore deeper insights into how each software enhances expense tracking accuracy and financial management.

Source and External Links

Scoro Business Budgeting Software - Offers integrated tools for budget planning, financial reporting, and project management in a single system.

Quicken - Provides comprehensive financial management features, including budgeting, tracking spending, and customizable reports for personal and small business use.

Mint (now part of Credit Karma) - A free online budget tracker that helps monitor spending and track net worth by connecting to various financial accounts.

dowidth.com

dowidth.com