Predictive close in accounting uses data analytics and machine learning to forecast financial outcomes before the official period-end close, improving accuracy and decision-making speed. Interim close involves preparing financial statements at regular intervals within the fiscal period to monitor ongoing performance and compliance. Explore the differences and benefits of predictive close versus interim close to enhance your financial reporting processes.

Why it is important

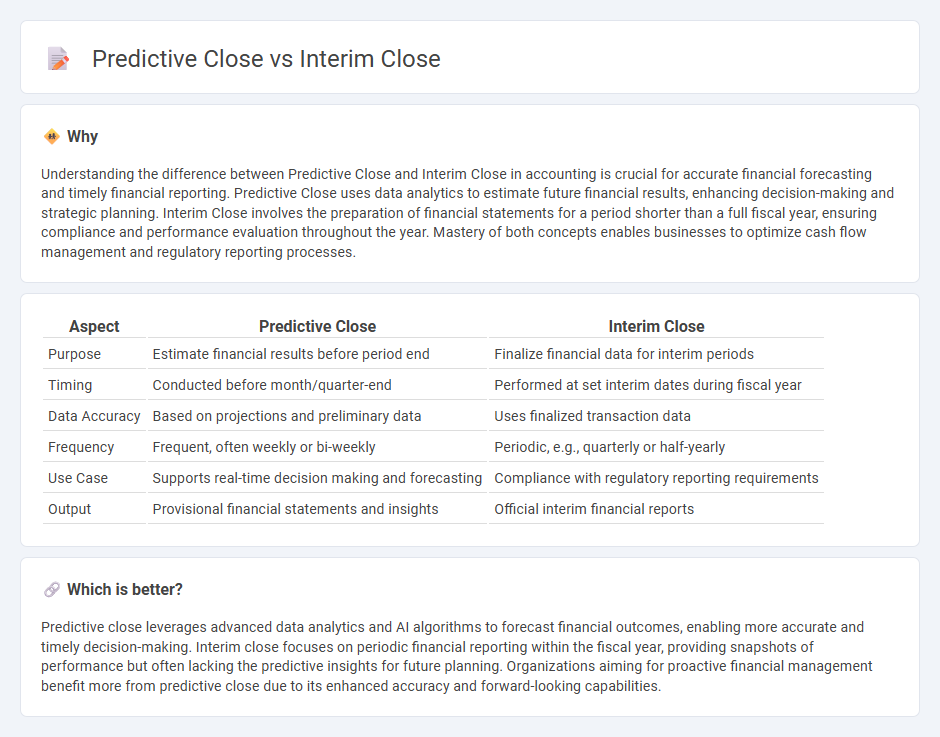

Understanding the difference between Predictive Close and Interim Close in accounting is crucial for accurate financial forecasting and timely financial reporting. Predictive Close uses data analytics to estimate future financial results, enhancing decision-making and strategic planning. Interim Close involves the preparation of financial statements for a period shorter than a full fiscal year, ensuring compliance and performance evaluation throughout the year. Mastery of both concepts enables businesses to optimize cash flow management and regulatory reporting processes.

Comparison Table

| Aspect | Predictive Close | Interim Close |

|---|---|---|

| Purpose | Estimate financial results before period end | Finalize financial data for interim periods |

| Timing | Conducted before month/quarter-end | Performed at set interim dates during fiscal year |

| Data Accuracy | Based on projections and preliminary data | Uses finalized transaction data |

| Frequency | Frequent, often weekly or bi-weekly | Periodic, e.g., quarterly or half-yearly |

| Use Case | Supports real-time decision making and forecasting | Compliance with regulatory reporting requirements |

| Output | Provisional financial statements and insights | Official interim financial reports |

Which is better?

Predictive close leverages advanced data analytics and AI algorithms to forecast financial outcomes, enabling more accurate and timely decision-making. Interim close focuses on periodic financial reporting within the fiscal year, providing snapshots of performance but often lacking the predictive insights for future planning. Organizations aiming for proactive financial management benefit more from predictive close due to its enhanced accuracy and forward-looking capabilities.

Connection

Predictive close and interim close both enhance financial reporting accuracy by providing timely insights into a company's financial position before the official period-end close. Predictive close uses real-time data and analytics to forecast financial outcomes, while interim close consolidates financial information at predetermined points during the fiscal period. Integrating predictive close within the interim close process streamlines decision-making and improves cash flow management in accounting.

Key Terms

Financial Statements

The interim close involves preparing financial statements for a specific period, typically monthly or quarterly, enabling timely insights into company performance and facilitating compliance with regulatory requirements. Predictive close leverages historical data and forecasting models to estimate future financial outcomes, guiding strategic decision-making and resource allocation for upcoming periods. Explore the differences and benefits of interim and predictive closes to enhance your financial reporting accuracy and foresight.

Accruals

Interim close processes provide a snapshot of financial performance by recording accruals based on estimated revenues and expenses, ensuring timely financial reporting before the final close. Predictive close uses advanced analytics and historical data to forecast accruals with greater accuracy, enhancing the precision of financial statements and reducing adjustment efforts during the final close. Explore how leveraging predictive close can optimize your accrual management for improved financial accuracy and efficiency.

Forecasting

Interim close provides a snapshot of sales performance during an ongoing period, enabling real-time adjustments and improved forecasting accuracy. Predictive close leverages historical data and market trends to estimate final sales outcomes more precisely, enhancing strategic decision-making. Explore the differences between interim and predictive closes to optimize your sales forecasting approach.

Source and External Links

Interim Closing - Definition, Meaning, and Examples - Interim closing is a temporary stage in new construction purchases where the buyer takes possession before full legal ownership is transferred.

Interim Closing Clause Examples - The interim closing clause allows for a temporary transfer of assets or obligations before a final transaction is completed.

Managing Interim and Year End Closing - Interim closing involves closing selected profit and loss accounts to retained earnings by creating journal entries.

dowidth.com

dowidth.com