Payroll crypto taxation involves navigating complex regulations for reporting and withholding taxes on cryptocurrency payments, requiring specialized accounting expertise to ensure compliance with IRS guidelines and varying state laws. Payroll outsourcing transfers these responsibilities to professional firms that handle tax calculations, reporting, and employee compensation management, reducing internal administrative burden and minimizing risk of errors. Explore detailed comparisons to determine the optimal approach for your business's payroll and tax compliance needs.

Why it is important

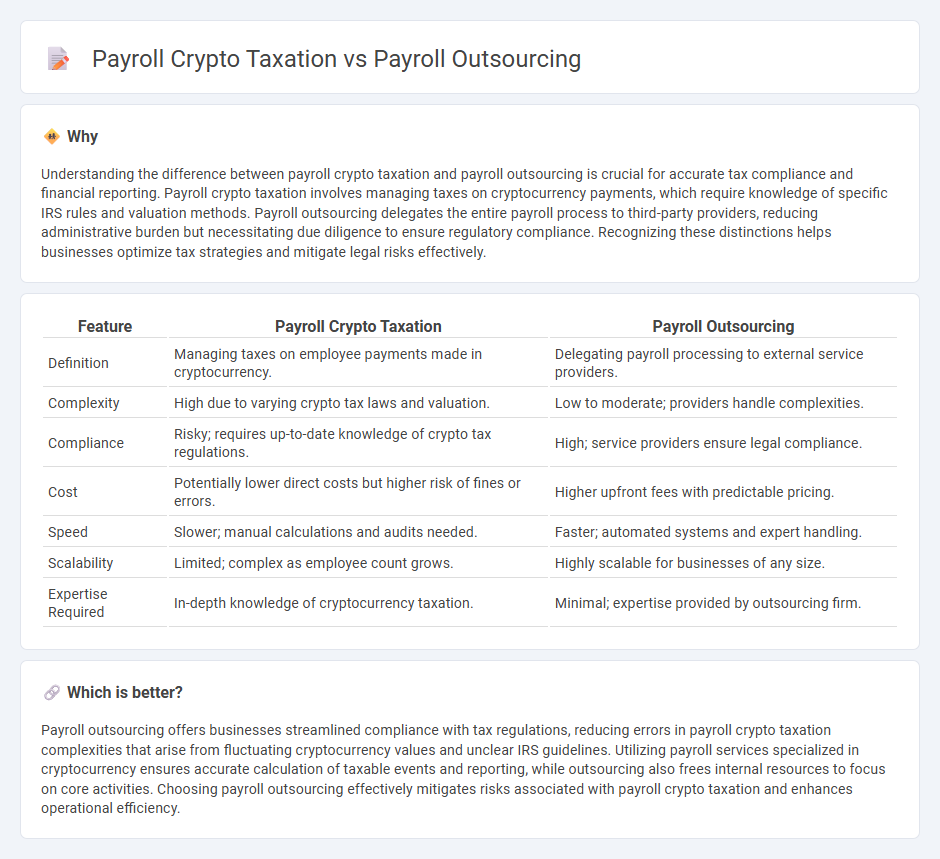

Understanding the difference between payroll crypto taxation and payroll outsourcing is crucial for accurate tax compliance and financial reporting. Payroll crypto taxation involves managing taxes on cryptocurrency payments, which require knowledge of specific IRS rules and valuation methods. Payroll outsourcing delegates the entire payroll process to third-party providers, reducing administrative burden but necessitating due diligence to ensure regulatory compliance. Recognizing these distinctions helps businesses optimize tax strategies and mitigate legal risks effectively.

Comparison Table

| Feature | Payroll Crypto Taxation | Payroll Outsourcing |

|---|---|---|

| Definition | Managing taxes on employee payments made in cryptocurrency. | Delegating payroll processing to external service providers. |

| Complexity | High due to varying crypto tax laws and valuation. | Low to moderate; providers handle complexities. |

| Compliance | Risky; requires up-to-date knowledge of crypto tax regulations. | High; service providers ensure legal compliance. |

| Cost | Potentially lower direct costs but higher risk of fines or errors. | Higher upfront fees with predictable pricing. |

| Speed | Slower; manual calculations and audits needed. | Faster; automated systems and expert handling. |

| Scalability | Limited; complex as employee count grows. | Highly scalable for businesses of any size. |

| Expertise Required | In-depth knowledge of cryptocurrency taxation. | Minimal; expertise provided by outsourcing firm. |

Which is better?

Payroll outsourcing offers businesses streamlined compliance with tax regulations, reducing errors in payroll crypto taxation complexities that arise from fluctuating cryptocurrency values and unclear IRS guidelines. Utilizing payroll services specialized in cryptocurrency ensures accurate calculation of taxable events and reporting, while outsourcing also frees internal resources to focus on core activities. Choosing payroll outsourcing effectively mitigates risks associated with payroll crypto taxation and enhances operational efficiency.

Connection

Payroll crypto taxation involves calculating and reporting employee compensation paid in cryptocurrencies, which requires specialized knowledge of tax regulations. Payroll outsourcing firms often integrate crypto payment solutions to manage these complexities, ensuring compliance with evolving tax laws. Combining payroll outsourcing with crypto taxation expertise helps businesses streamline payroll processing while adhering to legal requirements.

Key Terms

Compliance

Payroll outsourcing ensures compliance with local labor laws, tax regulations, and reporting requirements by leveraging expert knowledge and automated systems, reducing the risk of costly errors. Payroll crypto taxation demands precise tracking of cryptocurrency transactions, adherence to evolving tax guidelines, and accurate reporting of taxable events to meet regulatory standards. Explore our detailed analysis to understand how both approaches maintain regulatory compliance effectively.

Remittance

Payroll outsourcing streamlines salary management by delegating payment processing, tax filing, and compliance to specialized firms, reducing errors and saving time for businesses. Payroll crypto taxation involves tracking and reporting cryptocurrency payments within payroll, demanding precise remittance calculations to adhere to evolving tax regulations. Explore detailed strategies to optimize remittance processes in both traditional payroll outsourcing and crypto payroll tax compliance.

Reporting

Payroll outsourcing streamlines employee payment processes by delegating tax withholding, filing, and compliance responsibilities to specialized providers, ensuring accurate and timely reporting to tax authorities. In contrast, payroll crypto taxation demands meticulous tracking of digital asset transactions, often requiring integration with blockchain analysis tools to generate precise tax reports that comply with evolving regulations. Explore comprehensive solutions to optimize reporting accuracy and compliance in both payroll outsourcing and crypto payroll tax management.

Source and External Links

Outsourcing Payroll: How It Works, Benefits, Costs & More - This resource explains how outsourcing payroll can help businesses save time, reduce errors, and focus on core operations by delegating tasks to a third-party provider.

What is Payroll Outsourcing? - This glossary entry defines payroll outsourcing and discusses its benefits, such as saving time and reducing errors, by hiring an external company to manage payroll tasks.

Payroll outsourcing: pros, cons, and how to do it successfully - This article outlines the advantages and disadvantages of payroll outsourcing, including lower costs, time saved, and compliance across borders, while also providing strategies for successful implementation.

dowidth.com

dowidth.com