Cryptofinance reconciliation focuses on verifying and matching cryptocurrency transactions across digital wallets and blockchain records to ensure accuracy and prevent fraud. Credit card reconciliation involves comparing credit card statements with internal financial records to identify discrepancies and confirm payment accuracy. Explore the distinct processes and benefits of each reconciliation method to enhance your financial management strategy.

Why it is important

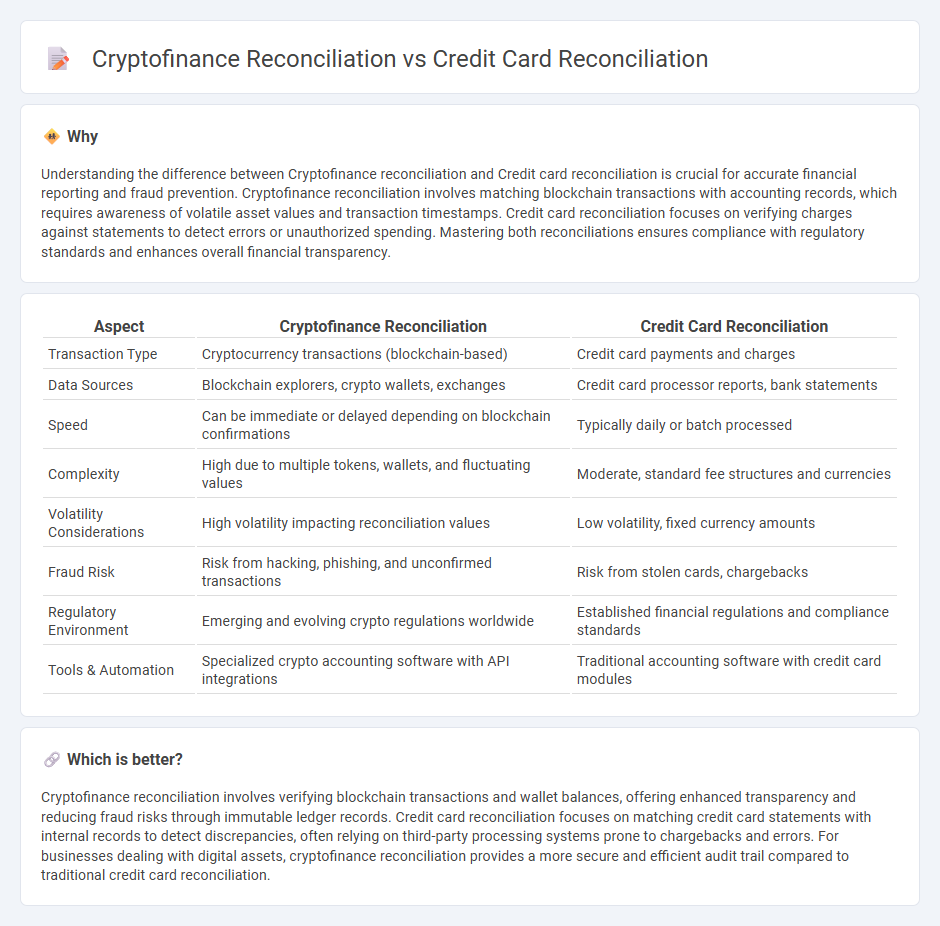

Understanding the difference between Cryptofinance reconciliation and Credit card reconciliation is crucial for accurate financial reporting and fraud prevention. Cryptofinance reconciliation involves matching blockchain transactions with accounting records, which requires awareness of volatile asset values and transaction timestamps. Credit card reconciliation focuses on verifying charges against statements to detect errors or unauthorized spending. Mastering both reconciliations ensures compliance with regulatory standards and enhances overall financial transparency.

Comparison Table

| Aspect | Cryptofinance Reconciliation | Credit Card Reconciliation |

|---|---|---|

| Transaction Type | Cryptocurrency transactions (blockchain-based) | Credit card payments and charges |

| Data Sources | Blockchain explorers, crypto wallets, exchanges | Credit card processor reports, bank statements |

| Speed | Can be immediate or delayed depending on blockchain confirmations | Typically daily or batch processed |

| Complexity | High due to multiple tokens, wallets, and fluctuating values | Moderate, standard fee structures and currencies |

| Volatility Considerations | High volatility impacting reconciliation values | Low volatility, fixed currency amounts |

| Fraud Risk | Risk from hacking, phishing, and unconfirmed transactions | Risk from stolen cards, chargebacks |

| Regulatory Environment | Emerging and evolving crypto regulations worldwide | Established financial regulations and compliance standards |

| Tools & Automation | Specialized crypto accounting software with API integrations | Traditional accounting software with credit card modules |

Which is better?

Cryptofinance reconciliation involves verifying blockchain transactions and wallet balances, offering enhanced transparency and reducing fraud risks through immutable ledger records. Credit card reconciliation focuses on matching credit card statements with internal records to detect discrepancies, often relying on third-party processing systems prone to chargebacks and errors. For businesses dealing with digital assets, cryptofinance reconciliation provides a more secure and efficient audit trail compared to traditional credit card reconciliation.

Connection

Cryptofinance reconciliation and credit card reconciliation both involve verifying transaction data to ensure accuracy and prevent discrepancies in financial records. Cryptofinance reconciliation focuses on aligning blockchain transactions with accounting ledgers, while credit card reconciliation matches credit card statements against internal records. Integrating these processes enhances financial transparency and reduces errors across digital and traditional payment systems.

Key Terms

Transaction Matching

Credit card reconciliation involves matching transaction records from credit card statements with internal accounting data to ensure accuracy and detect discrepancies. Cryptofinance reconciliation emphasizes matching on-chain blockchain transaction data with off-chain financial records, accounting for unique challenges like transaction hashes, wallet addresses, and varying confirmation times. Explore our detailed guide to master effective transaction matching strategies in both credit card and cryptofinance reconciliation.

Statement Verification

Credit card reconciliation centers on matching transaction statements from credit card issuers with internal records to ensure accurate expense tracking and fraud detection. Cryptofinance reconciliation involves verifying blockchain transaction statements and wallet balances, requiring real-time statement verification due to the decentralized and rapidly changing nature of crypto assets. Explore more to understand the nuances and tools enhancing statement verification in both reconciliation processes.

Ledger Integration

Credit card reconciliation involves matching transactions from credit card statements with ledger entries to ensure accurate financial records, typically requiring integration with accounting software like QuickBooks or Xero for real-time updates. Cryptofinance reconciliation, on the other hand, integrates blockchain ledger data with traditional accounting systems to validate and track digital asset transactions, often utilizing APIs for automated syncing between crypto wallets and enterprise ledgers. Explore how advanced ledger integration can streamline both credit card and cryptofinance reconciliation processes to enhance accuracy and financial transparency.

Source and External Links

How to Do a Credit Card Reconciliation - This resource provides an 8-step guide to credit card reconciliation, including gathering statements and receipts, checking balances, comparing transactions for discrepancies or fraudulent charges, and recording adjustments to internal records.

Complete Guide to Credit Card Reconciliation - This guide outlines the credit card reconciliation process with steps like collecting documents, organizing data, cross-checking transactions with the ledger, identifying errors, and reconciling outstanding items for businesses.

Complete Guide to Credit Card Reconciliation in 2025 - This article explains how to streamline corporate credit card reconciliation by setting up tracking systems, obtaining documentation for all charges, and reconciling discrepancies efficiently, often using automated expense management tools.

dowidth.com

dowidth.com