Embedded finance compliance involves adhering to regulations that govern the integration of financial services into non-financial platforms, focusing on data privacy, transaction security, and anti-money laundering measures. SOX compliance mandates stringent internal controls and financial reporting accuracy to prevent corporate fraud, as outlined by the Sarbanes-Oxley Act of 2002. Explore further to understand the distinct requirements and implications of both frameworks within accounting practices.

Why it is important

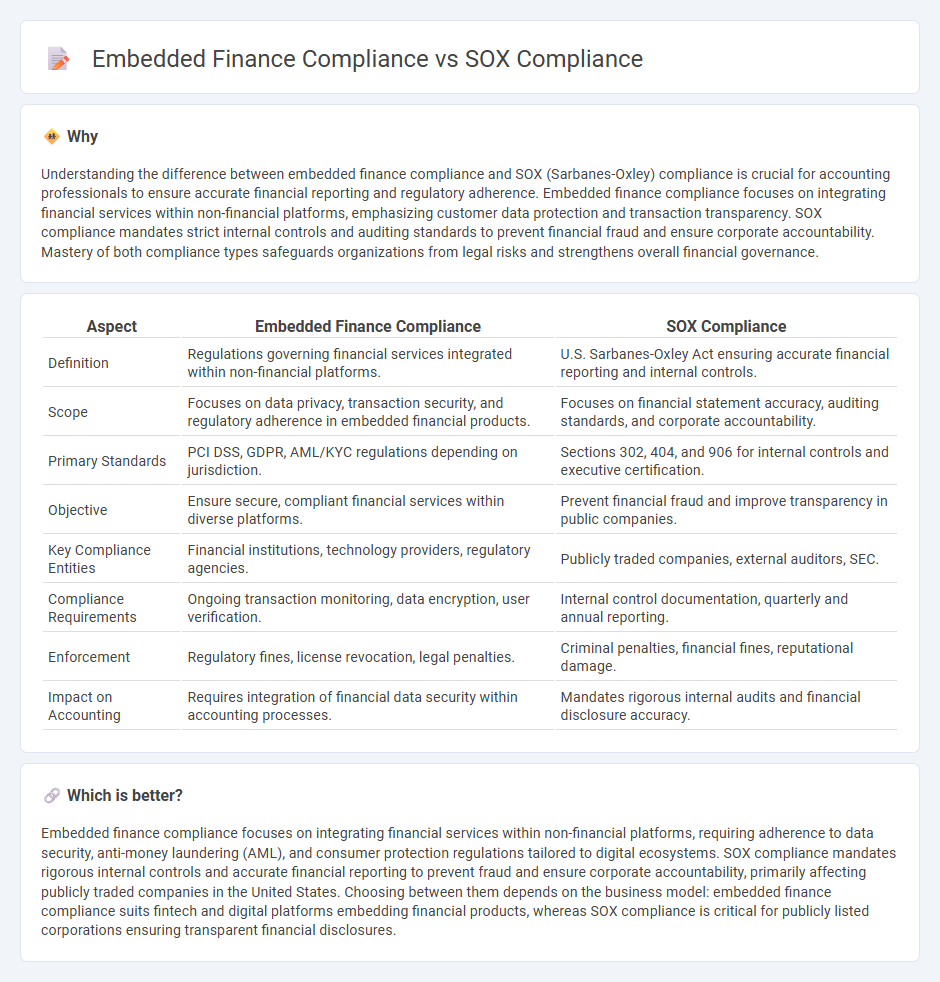

Understanding the difference between embedded finance compliance and SOX (Sarbanes-Oxley) compliance is crucial for accounting professionals to ensure accurate financial reporting and regulatory adherence. Embedded finance compliance focuses on integrating financial services within non-financial platforms, emphasizing customer data protection and transaction transparency. SOX compliance mandates strict internal controls and auditing standards to prevent financial fraud and ensure corporate accountability. Mastery of both compliance types safeguards organizations from legal risks and strengthens overall financial governance.

Comparison Table

| Aspect | Embedded Finance Compliance | SOX Compliance |

|---|---|---|

| Definition | Regulations governing financial services integrated within non-financial platforms. | U.S. Sarbanes-Oxley Act ensuring accurate financial reporting and internal controls. |

| Scope | Focuses on data privacy, transaction security, and regulatory adherence in embedded financial products. | Focuses on financial statement accuracy, auditing standards, and corporate accountability. |

| Primary Standards | PCI DSS, GDPR, AML/KYC regulations depending on jurisdiction. | Sections 302, 404, and 906 for internal controls and executive certification. |

| Objective | Ensure secure, compliant financial services within diverse platforms. | Prevent financial fraud and improve transparency in public companies. |

| Key Compliance Entities | Financial institutions, technology providers, regulatory agencies. | Publicly traded companies, external auditors, SEC. |

| Compliance Requirements | Ongoing transaction monitoring, data encryption, user verification. | Internal control documentation, quarterly and annual reporting. |

| Enforcement | Regulatory fines, license revocation, legal penalties. | Criminal penalties, financial fines, reputational damage. |

| Impact on Accounting | Requires integration of financial data security within accounting processes. | Mandates rigorous internal audits and financial disclosure accuracy. |

Which is better?

Embedded finance compliance focuses on integrating financial services within non-financial platforms, requiring adherence to data security, anti-money laundering (AML), and consumer protection regulations tailored to digital ecosystems. SOX compliance mandates rigorous internal controls and accurate financial reporting to prevent fraud and ensure corporate accountability, primarily affecting publicly traded companies in the United States. Choosing between them depends on the business model: embedded finance compliance suits fintech and digital platforms embedding financial products, whereas SOX compliance is critical for publicly listed corporations ensuring transparent financial disclosures.

Connection

Embedded finance compliance ensures that financial services integrated within non-financial platforms adhere to regulatory standards, while SOX compliance mandates rigorous internal controls and accurate financial reporting for publicly traded companies. Both frameworks intersect in maintaining transparency, accountability, and risk management within financial processes. Integrating embedded finance solutions requires organizations to align their systems with SOX controls to prevent fraud and enhance data integrity.

Key Terms

SOX compliance:

SOX compliance mandates stringent internal controls and accuracy in financial reporting to prevent fraud and ensure transparency for publicly traded companies. Embedded finance compliance, while related to fintech integration, primarily addresses regulatory adherence specific to financial service embedding, such as consumer protection and data privacy. Explore detailed differences and best practices to optimize your organization's regulatory strategy.

Internal Controls

SOX compliance mandates rigorous internal controls to ensure accurate financial reporting and prevent fraud, emphasizing audit trails, segregation of duties, and continuous monitoring. Embedded finance compliance requires adapting these controls to integrated financial services within non-financial platforms, focusing on real-time transaction monitoring, data privacy, and regulatory alignment with fintech standards. Explore detailed strategies to optimize internal controls across both compliance frameworks for robust financial governance.

Financial Reporting

SOX compliance mandates stringent controls and accurate documentation for financial reporting to prevent fraud and ensure transparency in public companies, with Section 404 emphasizing internal control assessments. Embedded finance compliance requires adherence to financial reporting standards tailored to integrated payment and banking services within non-financial platforms, focusing on real-time transaction accuracy and regulatory reporting specific to fintech operations. Discover more about how these compliance frameworks impact your financial reporting requirements and operational strategies.

Source and External Links

What is SOX Compliance? Requirements, Checklist & Benefits - SOX compliance requires public companies to annually audit and secure their financial data through formal policies, internal controls, and IT security measures including access controls, data backups, and change management.

2025 SOX Compliance Checklist - BitSight Technologies - SOX compliance enforces publicly traded companies to establish and audit robust internal controls ensuring accuracy and security of financial reporting and requires regular SEC filings and annual audits.

SOX Compliance: Requirements and Checklist - Exabeam - Key SOX sections include 302 (management responsibility for accurate reports), 404 (assessment of internal controls), 409 (real-time disclosures), 802 (criminal penalties for document alteration), and 906 (corporate responsibility), forming the regulatory backbone for compliance.

dowidth.com

dowidth.com