Cryptofinance reconciliation involves verifying and matching digital asset transactions recorded on blockchain ledgers with internal accounting records, ensuring accuracy amidst volatile markets and complex crypto protocols. General ledger reconciliation focuses on validating entries within a company's traditional accounting system to maintain financial integrity and compliance with regulatory standards. Explore how mastering both techniques can enhance financial transparency and control in modern accounting practices.

Why it is important

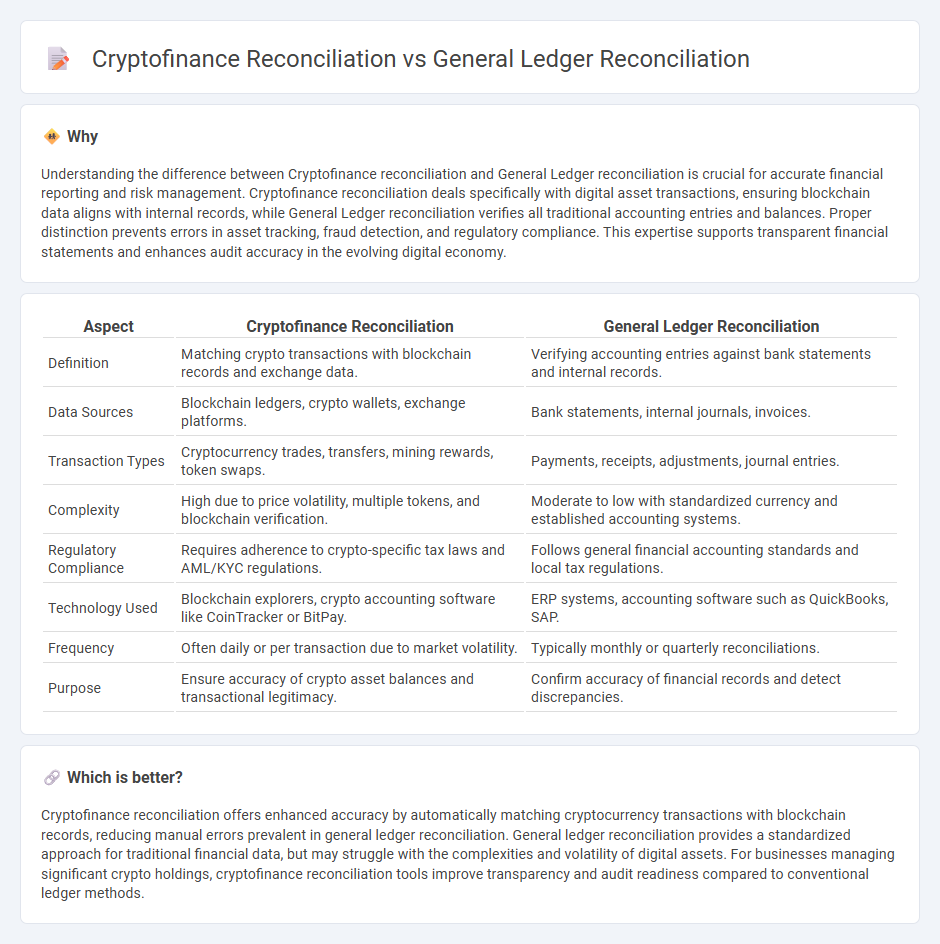

Understanding the difference between Cryptofinance reconciliation and General Ledger reconciliation is crucial for accurate financial reporting and risk management. Cryptofinance reconciliation deals specifically with digital asset transactions, ensuring blockchain data aligns with internal records, while General Ledger reconciliation verifies all traditional accounting entries and balances. Proper distinction prevents errors in asset tracking, fraud detection, and regulatory compliance. This expertise supports transparent financial statements and enhances audit accuracy in the evolving digital economy.

Comparison Table

| Aspect | Cryptofinance Reconciliation | General Ledger Reconciliation |

|---|---|---|

| Definition | Matching crypto transactions with blockchain records and exchange data. | Verifying accounting entries against bank statements and internal records. |

| Data Sources | Blockchain ledgers, crypto wallets, exchange platforms. | Bank statements, internal journals, invoices. |

| Transaction Types | Cryptocurrency trades, transfers, mining rewards, token swaps. | Payments, receipts, adjustments, journal entries. |

| Complexity | High due to price volatility, multiple tokens, and blockchain verification. | Moderate to low with standardized currency and established accounting systems. |

| Regulatory Compliance | Requires adherence to crypto-specific tax laws and AML/KYC regulations. | Follows general financial accounting standards and local tax regulations. |

| Technology Used | Blockchain explorers, crypto accounting software like CoinTracker or BitPay. | ERP systems, accounting software such as QuickBooks, SAP. |

| Frequency | Often daily or per transaction due to market volatility. | Typically monthly or quarterly reconciliations. |

| Purpose | Ensure accuracy of crypto asset balances and transactional legitimacy. | Confirm accuracy of financial records and detect discrepancies. |

Which is better?

Cryptofinance reconciliation offers enhanced accuracy by automatically matching cryptocurrency transactions with blockchain records, reducing manual errors prevalent in general ledger reconciliation. General ledger reconciliation provides a standardized approach for traditional financial data, but may struggle with the complexities and volatility of digital assets. For businesses managing significant crypto holdings, cryptofinance reconciliation tools improve transparency and audit readiness compared to conventional ledger methods.

Connection

Cryptofinance reconciliation and General Ledger reconciliation are connected through their shared goal of ensuring accurate financial records by verifying transactions between blockchain-based crypto assets and traditional accounting ledgers. Cryptofinance reconciliation involves matching crypto wallet transactions with exchange reports to detect discrepancies, while General Ledger reconciliation aligns these validated records with overall accounting entries. Effective integration of both processes is essential for maintaining comprehensive financial integrity and regulatory compliance in organizations dealing with digital assets.

Key Terms

**General ledger reconciliation:**

General ledger reconciliation involves systematically verifying and matching account balances with supporting documentation to ensure accuracy and completeness in financial records. It focuses on traditional accounting principles, encompassing bank statements, invoices, and internal entries, providing a clear audit trail for compliance and reporting requirements. Explore more about how general ledger reconciliation enhances financial integrity and supports regulatory adherence.

Trial Balance

General ledger reconciliation involves verifying that all debit and credit entries balance in the trial balance to ensure accurate financial statements. Cryptofinance reconciliation focuses on aligning blockchain transactions with internal records to confirm asset holdings and values match within the trial balance. Explore the critical differences and processes in depth for a clearer understanding of both reconciliation methods.

Journal Entries

General ledger reconciliation involves ensuring journal entries accurately reflect all financial transactions, maintaining balance and consistency within accounting records, while cryptofinance reconciliation focuses on verifying blockchain transactions and their corresponding journal entries to address unique challenges like transaction immutability and crypto asset volatility. Journal entries in cryptofinance reconciliation require specialized accounting treatments, including recognizing crypto gains, losses, and fair value adjustments, which differ from traditional financial assets accounted for in general ledger reconciliation. Explore the nuances of journal entries in both reconciliation types to optimize your accounting accuracy in cryptocurrency and traditional finance.

Source and External Links

General ledger reconciliation: A simple guide - Sage Advice US - General ledger reconciliation involves gathering financial documents, comparing accounts against supporting records, identifying errors, and making adjusting journal entries to ensure accuracy before publishing financial statements.

A complete guide to general ledger reconciliation - The process includes identifying accounts, comparing balances to sub-ledgers or independent sources, investigating discrepancies, noting reconciling items, and review/approval, typically performed monthly or quarterly depending on transaction volume and risk.

What Is General Ledger Reconciliation: Types, Best Practices and ... - General ledger reconciliation ensures financial integrity, transparency, and compliance by verifying ledger balances against actual transactions and records, enabling error detection and supporting informed management decisions.

dowidth.com

dowidth.com