Real-time expense recognition records costs immediately as transactions occur, enhancing accuracy in financial statements by reflecting current liabilities. In contrast, provisioning estimates future expenses based on anticipated obligations, improving financial planning and risk management. Explore how these accounting methods impact organizational transparency and decision-making.

Why it is important

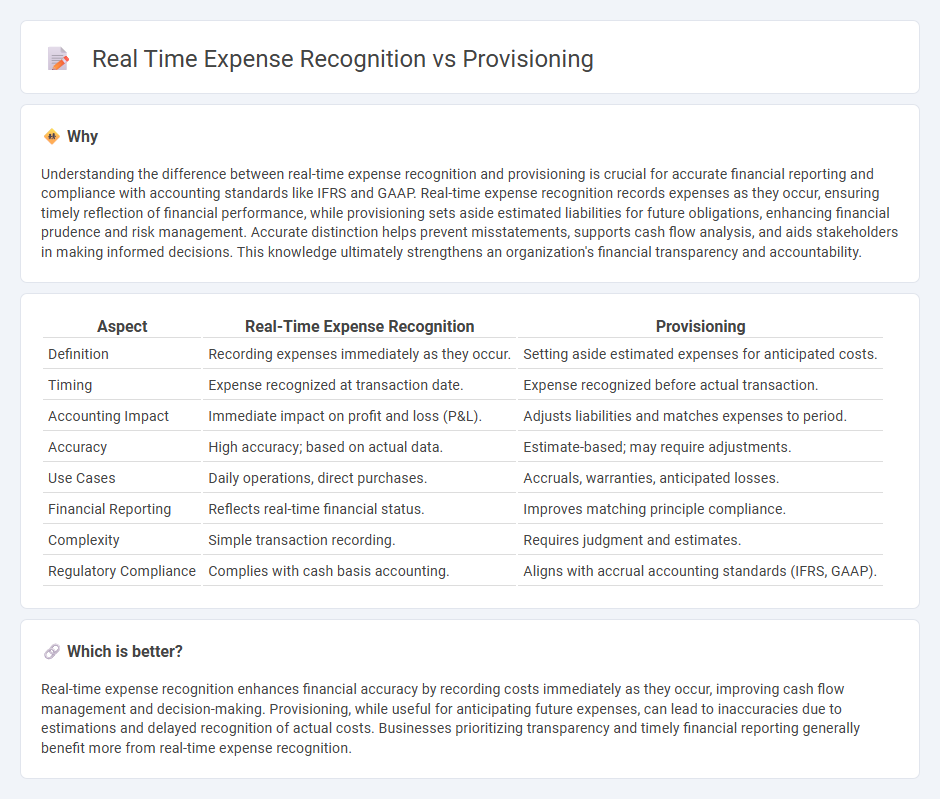

Understanding the difference between real-time expense recognition and provisioning is crucial for accurate financial reporting and compliance with accounting standards like IFRS and GAAP. Real-time expense recognition records expenses as they occur, ensuring timely reflection of financial performance, while provisioning sets aside estimated liabilities for future obligations, enhancing financial prudence and risk management. Accurate distinction helps prevent misstatements, supports cash flow analysis, and aids stakeholders in making informed decisions. This knowledge ultimately strengthens an organization's financial transparency and accountability.

Comparison Table

| Aspect | Real-Time Expense Recognition | Provisioning |

|---|---|---|

| Definition | Recording expenses immediately as they occur. | Setting aside estimated expenses for anticipated costs. |

| Timing | Expense recognized at transaction date. | Expense recognized before actual transaction. |

| Accounting Impact | Immediate impact on profit and loss (P&L). | Adjusts liabilities and matches expenses to period. |

| Accuracy | High accuracy; based on actual data. | Estimate-based; may require adjustments. |

| Use Cases | Daily operations, direct purchases. | Accruals, warranties, anticipated losses. |

| Financial Reporting | Reflects real-time financial status. | Improves matching principle compliance. |

| Complexity | Simple transaction recording. | Requires judgment and estimates. |

| Regulatory Compliance | Complies with cash basis accounting. | Aligns with accrual accounting standards (IFRS, GAAP). |

Which is better?

Real-time expense recognition enhances financial accuracy by recording costs immediately as they occur, improving cash flow management and decision-making. Provisioning, while useful for anticipating future expenses, can lead to inaccuracies due to estimations and delayed recognition of actual costs. Businesses prioritizing transparency and timely financial reporting generally benefit more from real-time expense recognition.

Connection

Real-time expense recognition enhances accuracy in financial reporting by immediately recording expenses as they occur, ensuring up-to-date financial statements. Provisioning relies on this timely data to create precise reserves for anticipated liabilities, such as bad debts or warranty claims. Together, they improve financial transparency and support proactive decision-making in accounting.

Key Terms

Accrual Accounting

Provisioning in accrual accounting involves estimating and recording expenses before actual payment, ensuring liabilities are recognized in the correct accounting period. Real-time expense recognition records expenses as they occur, offering immediate reflection of financial activities and enhancing accuracy. Explore more to understand how these approaches impact financial reporting and decision-making.

Matching Principle

Provisioning involves estimating expenses in advance to align costs with the revenue of the same period, supporting the Matching Principle by ensuring expenses are recorded when incurred rather than when paid. Real-time expense recognition records costs as they occur, potentially misaligning expenses with related revenues and weakening adherence to the Matching Principle. Explore detailed insights on how each method impacts financial accuracy and compliance with accounting standards.

Expense Recognition

Expense recognition accurately reflects incurred costs in financial statements, distinguishing between provisioning and real-time expense recognition. Provisioning records estimated future expenses, creating liabilities based on anticipated obligations, while real-time recognition captures expenses simultaneously as they occur. Explore the nuances and impacts of these methods on financial accuracy and compliance in detail.

Source and External Links

What is Provisioning? - ServiceNow - Provisioning is the process of establishing IT infrastructure at network, server, application, and user levels, enabling proper setup and management of IT resources essential for business operations.

What is Provisioning? | IBM - Provisioning refers to setting up IT infrastructure like hardware, networks, and virtual machines, making resources available to users, and is distinct from configuration but a critical early step in IT deployment.

Understanding Provisioning In IT: A Complete Guide For 2025 - Provisioning involves preparing, assigning, and activating IT resources such as servers, storage, and networks according to user requirements, using methods like manual, automated, or self-service provisioning.

dowidth.com

dowidth.com