On-demand accruals represent expenses recorded when the exact amount or timing is uncertain but the obligation is likely to occur, ensuring accurate matching of revenues and expenses. Contingent liabilities are potential obligations depending on the outcome of future events, requiring disclosure unless the likelihood is remote. Explore the nuances and accounting treatment differences between on-demand accruals and contingent liabilities to enhance financial reporting accuracy.

Why it is important

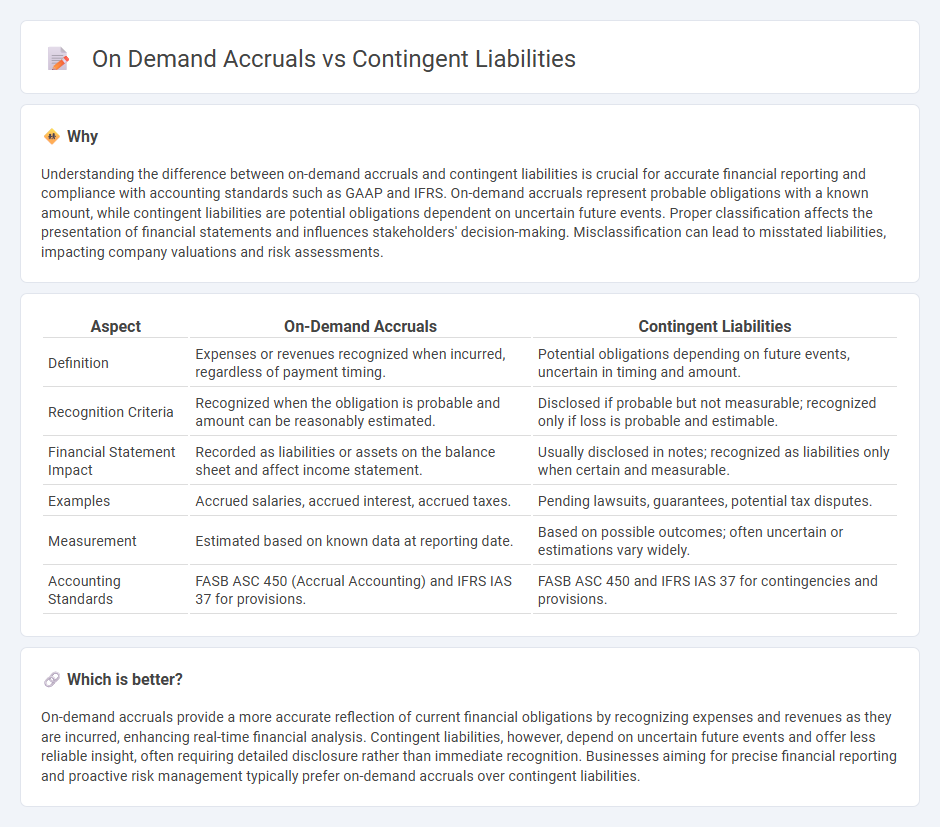

Understanding the difference between on-demand accruals and contingent liabilities is crucial for accurate financial reporting and compliance with accounting standards such as GAAP and IFRS. On-demand accruals represent probable obligations with a known amount, while contingent liabilities are potential obligations dependent on uncertain future events. Proper classification affects the presentation of financial statements and influences stakeholders' decision-making. Misclassification can lead to misstated liabilities, impacting company valuations and risk assessments.

Comparison Table

| Aspect | On-Demand Accruals | Contingent Liabilities |

|---|---|---|

| Definition | Expenses or revenues recognized when incurred, regardless of payment timing. | Potential obligations depending on future events, uncertain in timing and amount. |

| Recognition Criteria | Recognized when the obligation is probable and amount can be reasonably estimated. | Disclosed if probable but not measurable; recognized only if loss is probable and estimable. |

| Financial Statement Impact | Recorded as liabilities or assets on the balance sheet and affect income statement. | Usually disclosed in notes; recognized as liabilities only when certain and measurable. |

| Examples | Accrued salaries, accrued interest, accrued taxes. | Pending lawsuits, guarantees, potential tax disputes. |

| Measurement | Estimated based on known data at reporting date. | Based on possible outcomes; often uncertain or estimations vary widely. |

| Accounting Standards | FASB ASC 450 (Accrual Accounting) and IFRS IAS 37 for provisions. | FASB ASC 450 and IFRS IAS 37 for contingencies and provisions. |

Which is better?

On-demand accruals provide a more accurate reflection of current financial obligations by recognizing expenses and revenues as they are incurred, enhancing real-time financial analysis. Contingent liabilities, however, depend on uncertain future events and offer less reliable insight, often requiring detailed disclosure rather than immediate recognition. Businesses aiming for precise financial reporting and proactive risk management typically prefer on-demand accruals over contingent liabilities.

Connection

On-demand accruals represent expenses recognized in accounting when the exact amount or timing is uncertain, closely relating to contingent liabilities, which are potential obligations dependent on future events. Both require careful estimation and disclosure in financial statements to ensure accurate representation of a company's financial position under accounting standards like IFRS and GAAP. Proper management of on-demand accruals and contingent liabilities enhances transparency and aids stakeholders in assessing potential risks and obligations.

Key Terms

Probability (Likelihood of occurrence)

Contingent liabilities are potential obligations dependent on uncertain future events, recognized only when the likelihood of occurrence is probable and the amount can be reasonably estimated. On demand accruals represent liabilities that are more certain, usually recorded immediately due to a present obligation without significant uncertainty regarding timing or amount. Explore further to understand how probability thresholds influence financial reporting decisions.

Recognition (Accounting treatment)

Contingent liabilities require recognition in financial statements only when the liability is probable and the amount can be reasonably estimated, following IAS 37 guidelines. On-demand accruals, conversely, are recognized immediately as liabilities since they represent obligations payable upon demand or after services rendered. Explore detailed accounting treatments and criteria to differentiate these liabilities clearly.

Timing (When the liability is settled/recorded)

Contingent liabilities are potential obligations recorded only when the liability is probable and the amount can be reasonably estimated, with settlement timing uncertain until a future event occurs. On-demand accruals are recognized immediately when the liability is incurred and expected to be settled in the near term, reflecting precise timing for financial reporting. Explore further differences in accounting treatment and impact on financial statements.

Source and External Links

Contingent Liabilities Meaning, Examples, and Accounting Entries - Contingent liabilities are potential future obligations dependent on uncertain events, recognized in accounting if probable and reasonably estimable, otherwise disclosed in financial statement footnotes, with classifications including probable, reasonably possible, and remote.

Contingent liability - Wikipedia - In accounting, contingent liabilities depend on the outcome of uncertain events like lawsuits and are disclosed in notes if not recognized in accounts, classified into explicit and implicit types, with examples such as legal claims and product warranties.

On the Radar Contingencies, Loss Recoveries, and Guarantees - A contingent liability must be recognized when a loss is probable and the amount can be reasonably estimated, requiring judgment and accrual of the estimated loss in financial statements.

dowidth.com

dowidth.com