Real-time expense management offers instantaneous tracking and analysis of financial transactions, enabling businesses to monitor cash flow with precision and reduce the risk of overspending. Mobile expense apps provide on-the-go expense capturing, seamless receipt scanning, and automated approval workflows, enhancing convenience for employees and accuracy in reporting. Explore how integrating these solutions can streamline your accounting processes and boost financial control.

Why it is important

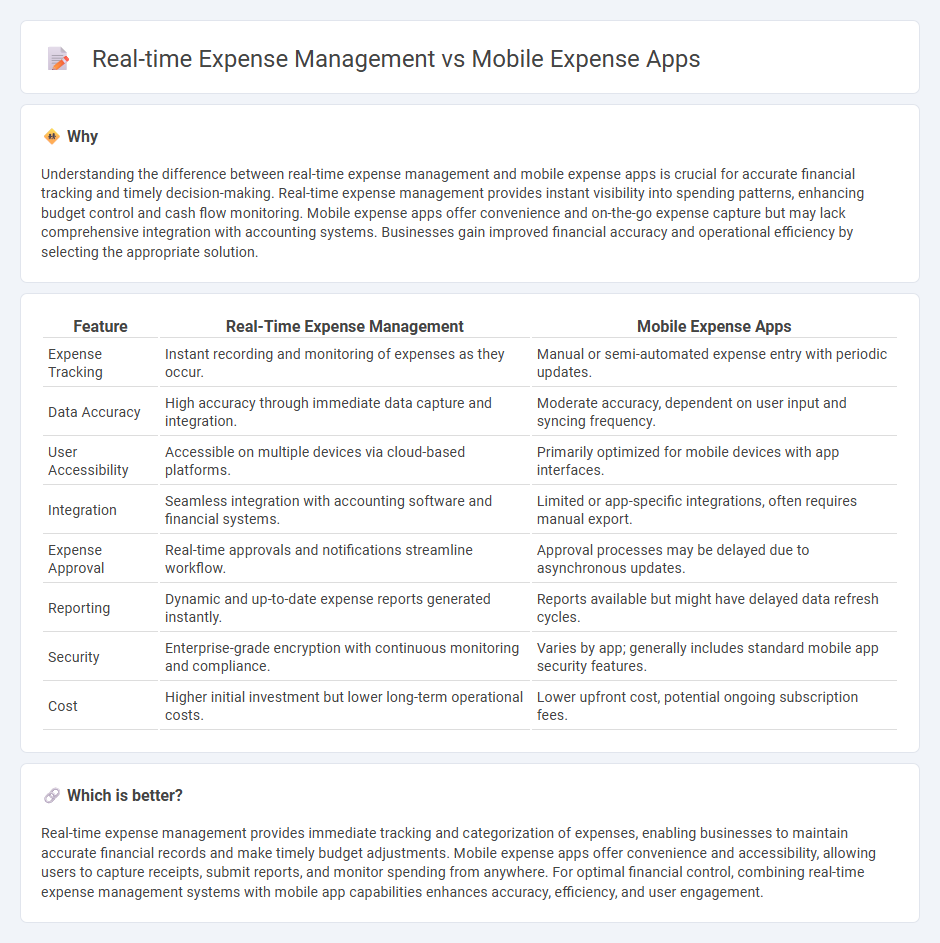

Understanding the difference between real-time expense management and mobile expense apps is crucial for accurate financial tracking and timely decision-making. Real-time expense management provides instant visibility into spending patterns, enhancing budget control and cash flow monitoring. Mobile expense apps offer convenience and on-the-go expense capture but may lack comprehensive integration with accounting systems. Businesses gain improved financial accuracy and operational efficiency by selecting the appropriate solution.

Comparison Table

| Feature | Real-Time Expense Management | Mobile Expense Apps |

|---|---|---|

| Expense Tracking | Instant recording and monitoring of expenses as they occur. | Manual or semi-automated expense entry with periodic updates. |

| Data Accuracy | High accuracy through immediate data capture and integration. | Moderate accuracy, dependent on user input and syncing frequency. |

| User Accessibility | Accessible on multiple devices via cloud-based platforms. | Primarily optimized for mobile devices with app interfaces. |

| Integration | Seamless integration with accounting software and financial systems. | Limited or app-specific integrations, often requires manual export. |

| Expense Approval | Real-time approvals and notifications streamline workflow. | Approval processes may be delayed due to asynchronous updates. |

| Reporting | Dynamic and up-to-date expense reports generated instantly. | Reports available but might have delayed data refresh cycles. |

| Security | Enterprise-grade encryption with continuous monitoring and compliance. | Varies by app; generally includes standard mobile app security features. |

| Cost | Higher initial investment but lower long-term operational costs. | Lower upfront cost, potential ongoing subscription fees. |

Which is better?

Real-time expense management provides immediate tracking and categorization of expenses, enabling businesses to maintain accurate financial records and make timely budget adjustments. Mobile expense apps offer convenience and accessibility, allowing users to capture receipts, submit reports, and monitor spending from anywhere. For optimal financial control, combining real-time expense management systems with mobile app capabilities enhances accuracy, efficiency, and user engagement.

Connection

Real-time expense management leverages mobile expense apps to capture, track, and categorize expenditures immediately as transactions occur, ensuring accurate and up-to-date financial records. These apps integrate with accounting systems to automate expense reporting, reduce manual errors, and enhance budget control. Utilizing features like receipt scanning and GPS tracking, mobile expense apps facilitate seamless compliance with company policies and streamline audit processes.

Key Terms

Automation

Mobile expense apps streamline receipt capture and expense reporting through automation, reducing manual entry errors and speeding up reimbursement processes. Real-time expense management platforms offer continuous monitoring and instant approval workflows, enhancing accuracy and compliance in corporate spending. Explore how automation transforms financial operations by diving deeper into the latest expense management innovations.

Reconciliation

Mobile expense apps streamline receipt capture but often lack seamless integration for real-time reconciliation, leading to delayed expense approval and inaccurate budgets. Real-time expense management solutions automate transaction matching and instant data syncing with accounting systems, reducing errors and enhancing financial visibility. Explore how advanced reconciliation features in expense management can transform your finance workflow.

Policy Compliance

Mobile expense apps streamline the submission and approval of expenses but often lack robust real-time controls to enforce company policy compliance continuously. Real-time expense management platforms provide dynamic monitoring and automated alerts, ensuring all transactions adhere to predefined policy rules instantly. Discover how integrating real-time expense management can enhance compliance and reduce costly violations.

Source and External Links

6 Best Personal Expense Tracker Apps of 2025 - NerdWallet - This article reviews several top mobile apps for personal expense tracking, including EveryDollar, YNAB, Expensify, and Rocket Money, highlighting their features and pricing.

Top 8 Expense Management Mobile Apps for 2025 - Emburse - The list includes Emburse, Expensify, SAP Concur, and Zoho Expense, focusing on business expense management solutions.

Manage Spending on-the-go with the SAP Concur Mobile App - This app allows users to manage expenses, travel, and invoices securely from their smartphones, including features like automatic receipt processing with ExpenseIt.

dowidth.com

dowidth.com