Intercompany automation streamlines financial transactions and reconciliations between subsidiaries, reducing manual errors and accelerating closing cycles. Accounts payable automation focuses on enhancing invoice processing, approval workflows, and payment accuracy to improve cash flow management. Explore the key differences and benefits of these automation solutions to optimize your accounting processes.

Why it is important

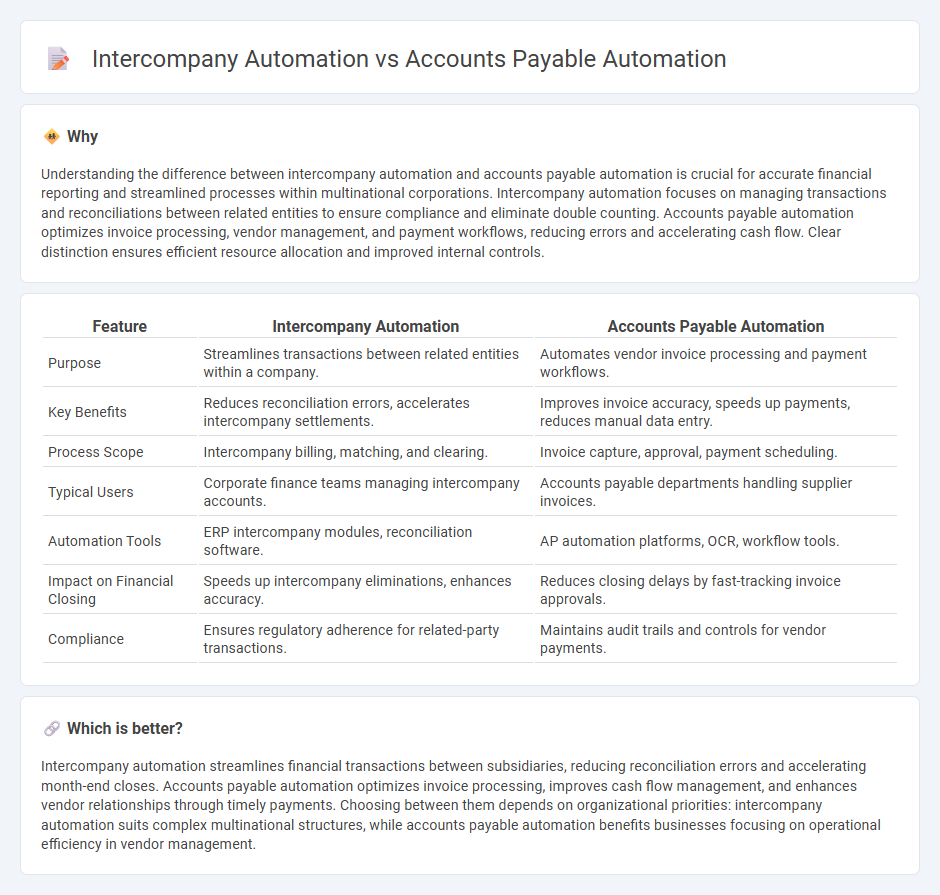

Understanding the difference between intercompany automation and accounts payable automation is crucial for accurate financial reporting and streamlined processes within multinational corporations. Intercompany automation focuses on managing transactions and reconciliations between related entities to ensure compliance and eliminate double counting. Accounts payable automation optimizes invoice processing, vendor management, and payment workflows, reducing errors and accelerating cash flow. Clear distinction ensures efficient resource allocation and improved internal controls.

Comparison Table

| Feature | Intercompany Automation | Accounts Payable Automation |

|---|---|---|

| Purpose | Streamlines transactions between related entities within a company. | Automates vendor invoice processing and payment workflows. |

| Key Benefits | Reduces reconciliation errors, accelerates intercompany settlements. | Improves invoice accuracy, speeds up payments, reduces manual data entry. |

| Process Scope | Intercompany billing, matching, and clearing. | Invoice capture, approval, payment scheduling. |

| Typical Users | Corporate finance teams managing intercompany accounts. | Accounts payable departments handling supplier invoices. |

| Automation Tools | ERP intercompany modules, reconciliation software. | AP automation platforms, OCR, workflow tools. |

| Impact on Financial Closing | Speeds up intercompany eliminations, enhances accuracy. | Reduces closing delays by fast-tracking invoice approvals. |

| Compliance | Ensures regulatory adherence for related-party transactions. | Maintains audit trails and controls for vendor payments. |

Which is better?

Intercompany automation streamlines financial transactions between subsidiaries, reducing reconciliation errors and accelerating month-end closes. Accounts payable automation optimizes invoice processing, improves cash flow management, and enhances vendor relationships through timely payments. Choosing between them depends on organizational priorities: intercompany automation suits complex multinational structures, while accounts payable automation benefits businesses focusing on operational efficiency in vendor management.

Connection

Intercompany automation and accounts payable automation streamline financial processes by enhancing data accuracy and reducing manual reconciliation tasks. Automated accounts payable systems facilitate real-time invoice processing and payment approvals, which directly improves the efficiency of intercompany transactions and eliminates discrepancies. Integration of these systems accelerates closing cycles and ensures compliance with corporate accounting standards across multiple entities.

Key Terms

**Accounts Payable Automation:**

Accounts payable automation streamlines invoice processing, reduces manual errors, and accelerates payment cycles by leveraging AI and machine learning technologies. It integrates with ERP systems to enhance cash flow management and improve vendor relationships through accurate, timely payments. Explore how accounts payable automation can transform your financial operations and drive efficiency.

Invoice Processing

Accounts payable automation streamlines invoice processing by electronically capturing, validating, and paying vendor invoices, enhancing accuracy and reducing manual errors. Intercompany automation optimizes invoice reconciliation and settlement between affiliated entities, improving financial transparency and compliance across corporate structures. Explore how these automation solutions can transform your invoice processing workflows and drive operational efficiency.

Payment Workflow

Accounts payable automation streamlines invoice processing, approval, and vendor payment, reducing manual errors and accelerating cash flow, while intercompany automation focuses on reconciling and settling transactions between different entities within a corporate group to enhance transparency and compliance. Payment workflow in accounts payable automation typically involves vendor invoice matching, approval routing, and disbursement scheduling, whereas intercompany automation centers on balancing inter-entity financial records and automating settlement payments to avoid discrepancies. Explore in-depth insights to optimize your payment workflows through tailored automation solutions.

Source and External Links

What Is AP Automation and How Does it Work? - NetSuite - AP automation automates routine accounts payable tasks such as data entry, invoice matching, coding, approval routing, payment execution, vendor management, fraud detection, reconciliation, tax compliance, and reporting, improving speed, accuracy, and cost savings.

AP Automation: Benefits to the Accounts Payable Process - JPMorgan - AP automation applies AI-powered technology to digitize invoice and payment workflows, reducing manual errors, speeding processing, enhancing compliance and security, and enabling real-time access and analysis across departments.

What is AP Automation? - Basware - AP automation digitizes accounts payable by receiving invoices electronically or scanning paper with AI/OCR, automatically matching and routing invoices for approval, and securely archiving all documents and audit trails.

dowidth.com

dowidth.com