Supply chain finance accounting focuses on managing payments and financing solutions between buyers and suppliers to optimize working capital and improve cash flow efficiency. Trade receivables accounting involves tracking and managing outstanding customer invoices to ensure accurate revenue recognition and effective credit control. Discover more about how these accounting methods impact business liquidity and financial health.

Why it is important

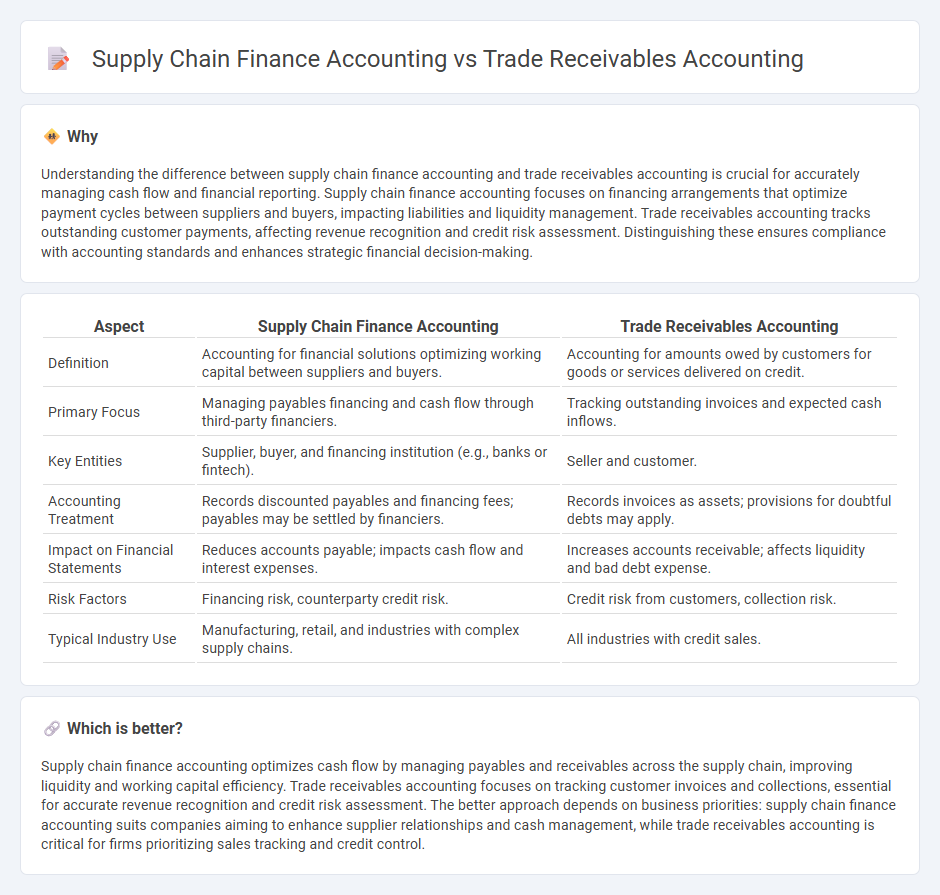

Understanding the difference between supply chain finance accounting and trade receivables accounting is crucial for accurately managing cash flow and financial reporting. Supply chain finance accounting focuses on financing arrangements that optimize payment cycles between suppliers and buyers, impacting liabilities and liquidity management. Trade receivables accounting tracks outstanding customer payments, affecting revenue recognition and credit risk assessment. Distinguishing these ensures compliance with accounting standards and enhances strategic financial decision-making.

Comparison Table

| Aspect | Supply Chain Finance Accounting | Trade Receivables Accounting |

|---|---|---|

| Definition | Accounting for financial solutions optimizing working capital between suppliers and buyers. | Accounting for amounts owed by customers for goods or services delivered on credit. |

| Primary Focus | Managing payables financing and cash flow through third-party financiers. | Tracking outstanding invoices and expected cash inflows. |

| Key Entities | Supplier, buyer, and financing institution (e.g., banks or fintech). | Seller and customer. |

| Accounting Treatment | Records discounted payables and financing fees; payables may be settled by financiers. | Records invoices as assets; provisions for doubtful debts may apply. |

| Impact on Financial Statements | Reduces accounts payable; impacts cash flow and interest expenses. | Increases accounts receivable; affects liquidity and bad debt expense. |

| Risk Factors | Financing risk, counterparty credit risk. | Credit risk from customers, collection risk. |

| Typical Industry Use | Manufacturing, retail, and industries with complex supply chains. | All industries with credit sales. |

Which is better?

Supply chain finance accounting optimizes cash flow by managing payables and receivables across the supply chain, improving liquidity and working capital efficiency. Trade receivables accounting focuses on tracking customer invoices and collections, essential for accurate revenue recognition and credit risk assessment. The better approach depends on business priorities: supply chain finance accounting suits companies aiming to enhance supplier relationships and cash management, while trade receivables accounting is critical for firms prioritizing sales tracking and credit control.

Connection

Supply chain finance accounting and trade receivables accounting are interconnected through the management and optimization of cash flow between buyers and suppliers. Supply chain finance accounting tracks financing arrangements that enable suppliers to receive early payments on their trade receivables, improving liquidity and reducing credit risk. Efficient recording of these financing transactions ensures accurate reflection of payables, receivables, and related interest expenses in financial statements.

Key Terms

**Trade receivables accounting:**

Trade receivables accounting involves recording amounts owed by customers for goods or services delivered on credit, reflecting these as current assets on the balance sheet. It emphasizes the accurate recognition, valuation, and aging analysis of receivables to ensure proper revenue recognition and cash flow management. Discover how effective trade receivables accounting can optimize working capital and improve financial statements accuracy.

Accounts Receivable

Trade receivables accounting involves the recording and management of amounts owed by customers for goods or services delivered, emphasizing accurate aging reports and impairment assessments under standards like IFRS 9. Supply chain finance accounting shifts the focus to early payment solutions, where financing providers settle payables on behalf of buyers, impacting the presentation of accounts receivable and payables on the balance sheet through factoring or reverse factoring arrangements. Explore detailed comparisons and best practices to optimize cash flow and financial reporting accuracy in your receivables management.

Invoice Discounting

Trade receivables accounting records outstanding customer invoices as assets on the balance sheet, reflecting amounts owed for goods or services delivered. Supply chain finance accounting, particularly in invoice discounting, involves selling receivables to a third party at a discount to improve cash flow and reduce credit risk. Explore the distinctions and benefits of each method to optimize your working capital management.

Source and External Links

What Are Trade Receivables? (With Tips for Reducing Them) - Trade receivables represent outstanding payments a company's customers owe for goods or services, recorded as current or noncurrent assets depending on maturity; accounting for trade receivables involves adding bills receivable and debtors, and calculating payment times to manage cash flow effectively.

Trade Receivable: Definition, Types, and Formula - Trade receivables are amounts owed from credit sales, calculated as gross receivables (opening receivables + credit sales - collections) or net receivables (gross receivables minus allowance for doubtful accounts), and are influenced by credit sales volume, collection efficiency, credit terms, doubtful allowances, and seasonality.

Trade receivables definition - AccountingTools - Trade receivables are amounts billed to customers on delivery of goods or services, recorded as debits to accounts receivable and credits to sales, presented as current assets on the balance sheet, often netted against allowances for doubtful accounts, and monitored via accounts receivable aging reports.

dowidth.com

dowidth.com