Payroll crypto taxation requires accurate tracking of cryptocurrency payments and adherence to tax regulations set by authorities like the IRS or HMRC. Payroll reporting focuses on documenting employee earnings, including wages, bonuses, and benefits, for compliance and auditing purposes. Explore detailed guides to understand the differences and ensure proper accounting for both payroll crypto taxation and payroll reporting.

Why it is important

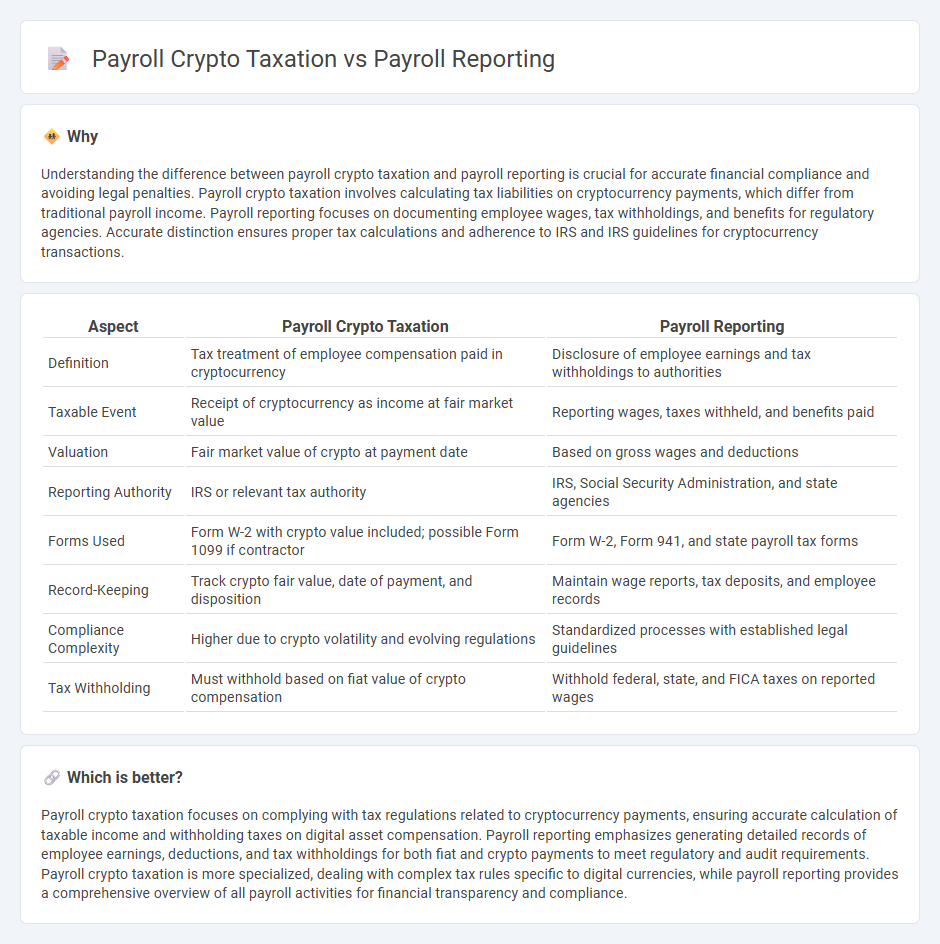

Understanding the difference between payroll crypto taxation and payroll reporting is crucial for accurate financial compliance and avoiding legal penalties. Payroll crypto taxation involves calculating tax liabilities on cryptocurrency payments, which differ from traditional payroll income. Payroll reporting focuses on documenting employee wages, tax withholdings, and benefits for regulatory agencies. Accurate distinction ensures proper tax calculations and adherence to IRS and IRS guidelines for cryptocurrency transactions.

Comparison Table

| Aspect | Payroll Crypto Taxation | Payroll Reporting |

|---|---|---|

| Definition | Tax treatment of employee compensation paid in cryptocurrency | Disclosure of employee earnings and tax withholdings to authorities |

| Taxable Event | Receipt of cryptocurrency as income at fair market value | Reporting wages, taxes withheld, and benefits paid |

| Valuation | Fair market value of crypto at payment date | Based on gross wages and deductions |

| Reporting Authority | IRS or relevant tax authority | IRS, Social Security Administration, and state agencies |

| Forms Used | Form W-2 with crypto value included; possible Form 1099 if contractor | Form W-2, Form 941, and state payroll tax forms |

| Record-Keeping | Track crypto fair value, date of payment, and disposition | Maintain wage reports, tax deposits, and employee records |

| Compliance Complexity | Higher due to crypto volatility and evolving regulations | Standardized processes with established legal guidelines |

| Tax Withholding | Must withhold based on fiat value of crypto compensation | Withhold federal, state, and FICA taxes on reported wages |

Which is better?

Payroll crypto taxation focuses on complying with tax regulations related to cryptocurrency payments, ensuring accurate calculation of taxable income and withholding taxes on digital asset compensation. Payroll reporting emphasizes generating detailed records of employee earnings, deductions, and tax withholdings for both fiat and crypto payments to meet regulatory and audit requirements. Payroll crypto taxation is more specialized, dealing with complex tax rules specific to digital currencies, while payroll reporting provides a comprehensive overview of all payroll activities for financial transparency and compliance.

Connection

Payroll crypto taxation involves calculating and reporting the taxable value of cryptocurrency payments made to employees, which directly impacts payroll reporting accuracy. Employers must integrate crypto compensation data into payroll systems to ensure compliance with tax regulations and precise tax withholding. Accurate payroll reporting reflects these transactions, enabling proper tax filings and avoiding potential penalties.

Key Terms

**Payroll Reporting:**

Payroll reporting involves the systematic documentation and submission of employee compensation data to government agencies to ensure compliance with tax laws and labor regulations. It includes tracking wages, tax withholdings, benefits, and deductions to accurately calculate payroll taxes and generate mandatory reports such as W-2s and 1099s. Explore more to understand the critical distinctions between traditional payroll reporting and the emerging complexities of payroll crypto taxation.

Withholding Tax

Payroll reporting involves accurately documenting employee earnings, deductions, and withholding tax for compliance with government regulations, while payroll crypto taxation deals with calculating withholding tax on cryptocurrency payments made to employees. Withholding tax in payroll ensures timely remittance of income tax obligations, whereas in crypto payroll, it requires specialized knowledge of tax laws governing digital assets and their valuation at the time of payment. Explore detailed guidelines on withholding tax treatment for both traditional payroll and cryptocurrency compensation to ensure compliance and optimize tax reporting.

Gross Pay

Gross Pay represents the total earnings of an employee before deductions and is a critical figure in payroll reporting, ensuring accurate wage documentation and compliance with labor regulations. Payroll crypto taxation involves calculating taxable income when wages are paid in cryptocurrency, requiring precise valuation of Gross Pay based on current crypto market rates to determine tax liabilities. Explore detailed guidelines to understand how Gross Pay impacts both traditional payroll reporting and payroll crypto taxation frameworks.

Source and External Links

7 Types of Payroll Reports for Employers - A payroll report is a document submitted to government agencies like the IRS to report payroll and employment tax liabilities, including employee wages, hours worked, tax withholdings, and employer tax contributions, which helps ensure compliance and accurate payroll cost tracking.

What Are Payroll Reports? Types, Examples & Template - Payroll reports detail employee wages, deductions, and taxes for a pay period and are best created using payroll software, with regular audits and up-to-date employee data to ensure accuracy and compliance.

What is a Payroll Report? A Complete Guide for Employers - Payroll reports summarize pay periods by gathering employee data, calculating gross and net pay, factoring employer tax contributions, reviewing accuracy, and then printing or exporting the report for filings or employee review.

dowidth.com

dowidth.com