Cryptotax regulations determine how cryptocurrency transactions are taxed, directly impacting cost basis calculations used to report capital gains or losses. Accurate cost basis tracking is essential for compliance with tax authorities and optimizing tax liabilities. Explore detailed comparisons of cryptotax methods and cost basis strategies to enhance your financial planning.

Why it is important

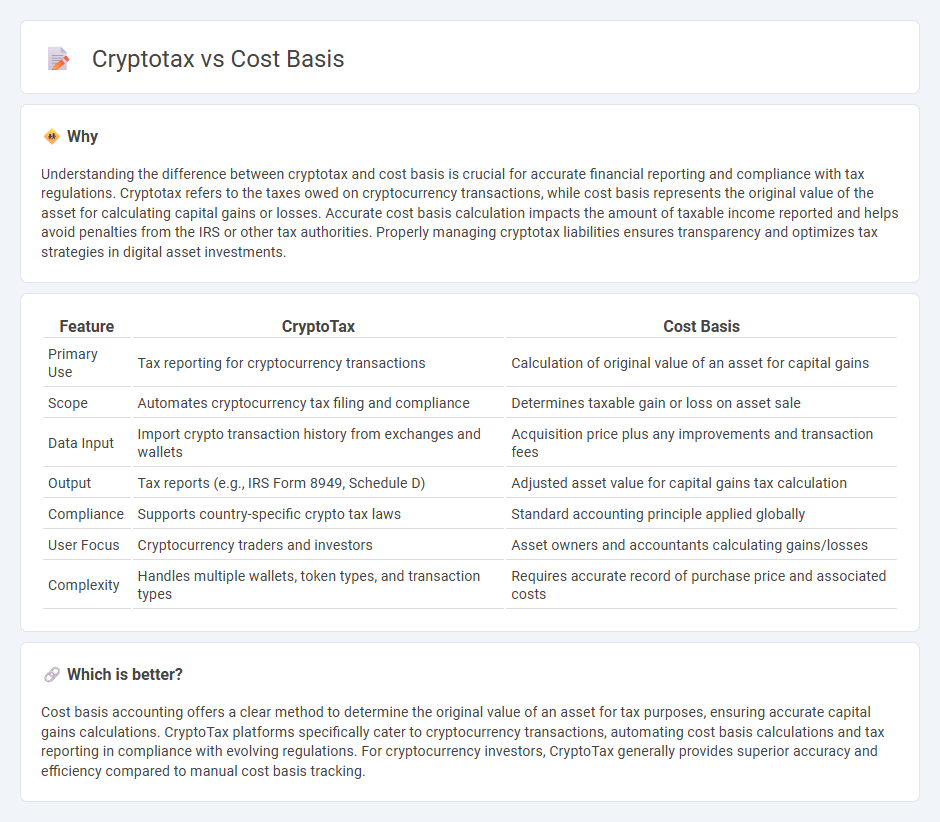

Understanding the difference between cryptotax and cost basis is crucial for accurate financial reporting and compliance with tax regulations. Cryptotax refers to the taxes owed on cryptocurrency transactions, while cost basis represents the original value of the asset for calculating capital gains or losses. Accurate cost basis calculation impacts the amount of taxable income reported and helps avoid penalties from the IRS or other tax authorities. Properly managing cryptotax liabilities ensures transparency and optimizes tax strategies in digital asset investments.

Comparison Table

| Feature | CryptoTax | Cost Basis |

|---|---|---|

| Primary Use | Tax reporting for cryptocurrency transactions | Calculation of original value of an asset for capital gains |

| Scope | Automates cryptocurrency tax filing and compliance | Determines taxable gain or loss on asset sale |

| Data Input | Import crypto transaction history from exchanges and wallets | Acquisition price plus any improvements and transaction fees |

| Output | Tax reports (e.g., IRS Form 8949, Schedule D) | Adjusted asset value for capital gains tax calculation |

| Compliance | Supports country-specific crypto tax laws | Standard accounting principle applied globally |

| User Focus | Cryptocurrency traders and investors | Asset owners and accountants calculating gains/losses |

| Complexity | Handles multiple wallets, token types, and transaction types | Requires accurate record of purchase price and associated costs |

Which is better?

Cost basis accounting offers a clear method to determine the original value of an asset for tax purposes, ensuring accurate capital gains calculations. CryptoTax platforms specifically cater to cryptocurrency transactions, automating cost basis calculations and tax reporting in compliance with evolving regulations. For cryptocurrency investors, CryptoTax generally provides superior accuracy and efficiency compared to manual cost basis tracking.

Connection

Cryptotax regulations require accurate reporting of capital gains and losses, which depends on the precise calculation of the cost basis for cryptocurrency transactions. The cost basis, representing the original value of the crypto asset, determines the taxable amount when assets are sold or exchanged. Proper accounting and tracking of cost basis are essential for compliance with tax laws and minimizing the risk of audits or penalties.

Key Terms

Cost Basis

Cost basis in cryptocurrency refers to the original value of an asset for tax purposes, determining capital gains or losses upon its sale. Accurate tracking of cost basis is essential for calculating tax liabilities and ensuring compliance with IRS regulations. Explore detailed strategies to optimize your cost basis and minimize your crypto tax burden.

Capital Gains

Capital gains represent the profit earned from selling cryptocurrency, calculated by subtracting the cost basis--the original purchase price plus any associated fees--from the sale price. Accurate tracking of cost basis is crucial for correctly reporting capital gains on crypto tax returns, minimizing tax liabilities and avoiding compliance issues. Discover detailed strategies for managing cost basis and capital gains reporting in crypto tax frameworks.

Taxable Events

Taxable events, such as sales, trades, or conversions of cryptocurrency, directly impact the cost basis calculation, determining the capital gains or losses for tax reporting. The cost basis represents the original purchase price plus any associated fees, serving as the reference point for calculating taxable gains during these events. Explore detailed insights on managing cost basis to optimize cryptotax compliance and reduce tax liabilities effectively.

Source and External Links

Cost Basis: How It Works, Calculation and Examples - NerdWallet - This article explains how cost basis works, its calculation methods such as FIFO, average cost, and specific shares, and provides examples for understanding its application in investments.

Cost basis - Wikipedia - This Wikipedia entry describes cost basis in the context of U.S. tax law, explaining its role in determining capital gains and losses when assets are sold.

Save on Taxes: Know Your Cost Basis - Charles Schwab - This article discusses the importance of knowing your cost basis to save on taxes, including how brokerage fees and commissions affect it.

dowidth.com

dowidth.com