Forensic analytics employs advanced data analysis techniques to detect anomalies and patterns indicative of financial misconduct, enhancing the accuracy and efficiency of investigations. Fraud examination involves a comprehensive process of identifying, investigating, and preventing fraud through evidence collection and legal procedures. Explore how integrating forensic analytics and fraud examination strengthens financial integrity and fraud prevention strategies.

Why it is important

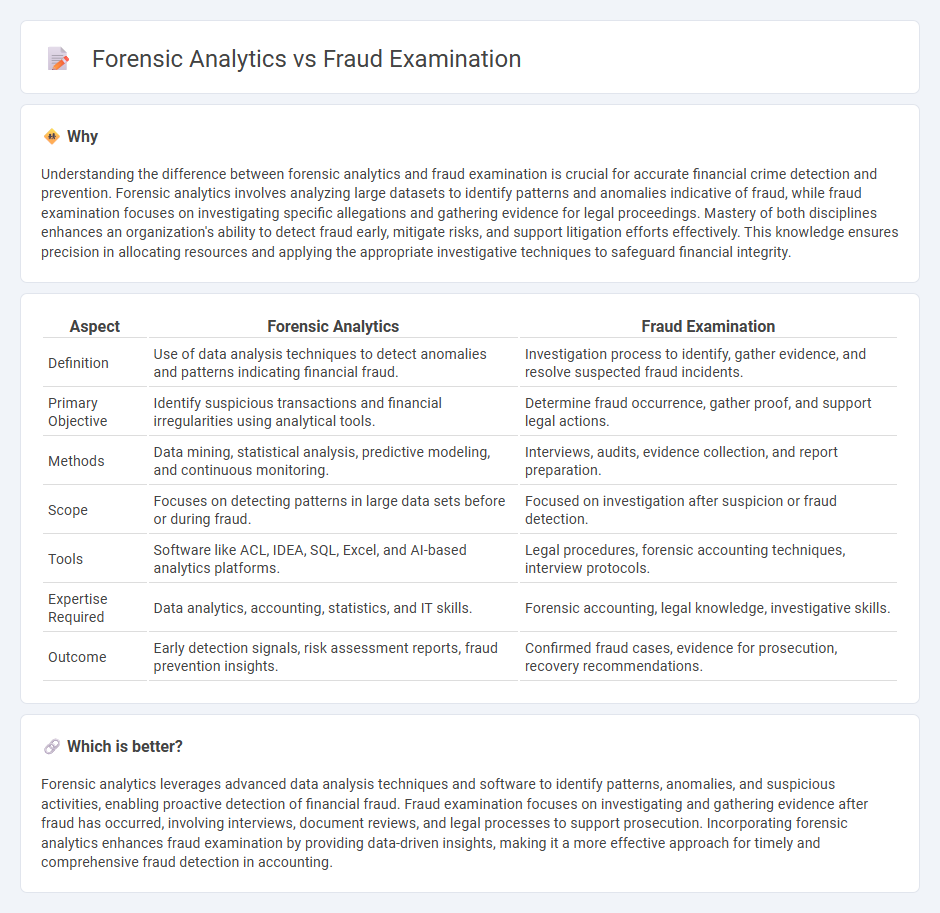

Understanding the difference between forensic analytics and fraud examination is crucial for accurate financial crime detection and prevention. Forensic analytics involves analyzing large datasets to identify patterns and anomalies indicative of fraud, while fraud examination focuses on investigating specific allegations and gathering evidence for legal proceedings. Mastery of both disciplines enhances an organization's ability to detect fraud early, mitigate risks, and support litigation efforts effectively. This knowledge ensures precision in allocating resources and applying the appropriate investigative techniques to safeguard financial integrity.

Comparison Table

| Aspect | Forensic Analytics | Fraud Examination |

|---|---|---|

| Definition | Use of data analysis techniques to detect anomalies and patterns indicating financial fraud. | Investigation process to identify, gather evidence, and resolve suspected fraud incidents. |

| Primary Objective | Identify suspicious transactions and financial irregularities using analytical tools. | Determine fraud occurrence, gather proof, and support legal actions. |

| Methods | Data mining, statistical analysis, predictive modeling, and continuous monitoring. | Interviews, audits, evidence collection, and report preparation. |

| Scope | Focuses on detecting patterns in large data sets before or during fraud. | Focused on investigation after suspicion or fraud detection. |

| Tools | Software like ACL, IDEA, SQL, Excel, and AI-based analytics platforms. | Legal procedures, forensic accounting techniques, interview protocols. |

| Expertise Required | Data analytics, accounting, statistics, and IT skills. | Forensic accounting, legal knowledge, investigative skills. |

| Outcome | Early detection signals, risk assessment reports, fraud prevention insights. | Confirmed fraud cases, evidence for prosecution, recovery recommendations. |

Which is better?

Forensic analytics leverages advanced data analysis techniques and software to identify patterns, anomalies, and suspicious activities, enabling proactive detection of financial fraud. Fraud examination focuses on investigating and gathering evidence after fraud has occurred, involving interviews, document reviews, and legal processes to support prosecution. Incorporating forensic analytics enhances fraud examination by providing data-driven insights, making it a more effective approach for timely and comprehensive fraud detection in accounting.

Connection

Forensic analytics utilizes data analysis techniques to detect anomalies, patterns, and inconsistencies that indicate potential fraudulent activities within financial records. Fraud examination relies on these analytical insights to investigate and substantiate instances of financial misconduct, providing evidence for legal proceedings. Together, they enhance the effectiveness of identifying, preventing, and mitigating fraud in accounting systems.

Key Terms

Fraud Examination:

Fraud examination is a systematic process focused on detecting, investigating, and preventing fraudulent activities within organizations by analyzing evidence, interviewing suspects, and preparing findings for legal proceedings. Forensic analytics complements this by using advanced data analysis techniques and algorithms to identify patterns and anomalies indicative of fraud in large datasets. Explore more about how fraud examination integrates with forensic analytics to strengthen organizational defense against financial crime.

Misappropriation

Fraud examination primarily targets identifying and investigating misappropriation of assets through detailed evidence gathering and interviews, focusing on internal theft or embezzlement within organizations. Forensic analytics uses advanced data analysis techniques to detect patterns and anomalies indicative of fraudulent misappropriation, enabling proactive identification and prevention. Discover how integrating these approaches enhances misappropriation detection and strengthens financial controls.

Interviewing

Fraud examination emphasizes structured interviewing techniques to obtain direct admissions and identify inconsistencies in suspects' statements, often relying on behavioral cues and psychological strategies to detect deception. Forensic analytics complements this process by analyzing large datasets to uncover patterns and anomalies that inform targeted and effective interview questions. Discover how integrating forensic analytics enhances the precision and outcomes of fraud examination interviews.

Source and External Links

What is Forensic Accounting and Fraud Examination - Fraud examination involves the systematic analysis of financial and non-financial information to detect, investigate, and uncover fraudulent schemes, misappropriation of assets, or deceptive practices.

How to Become a Certified Fraud Examiner - Certified Fraud Examiners investigate and prevent financial crimes by analyzing records, identifying suspicious activity, gathering evidence, and collaborating with law enforcement to recover lost assets.

Forensic and Fraud Examination, M.S. - Graduate programs in forensic and fraud examination prepare students to detect, investigate, and prevent financial fraud and white-collar crime through an interdisciplinary curriculum covering business, law, accounting, and technology.

dowidth.com

dowidth.com