Embedded finance compliance mandates adherence to financial regulations within non-bank platforms integrating payment services, focusing on consumer protection, anti-money laundering (AML), and data privacy. Digital banking regulations encompass broader supervisory frameworks governing licensed banks, addressing capital requirements, cybersecurity, and transaction transparency. Explore the distinctions and regulatory impacts between these evolving financial frameworks to enhance strategic compliance.

Why it is important

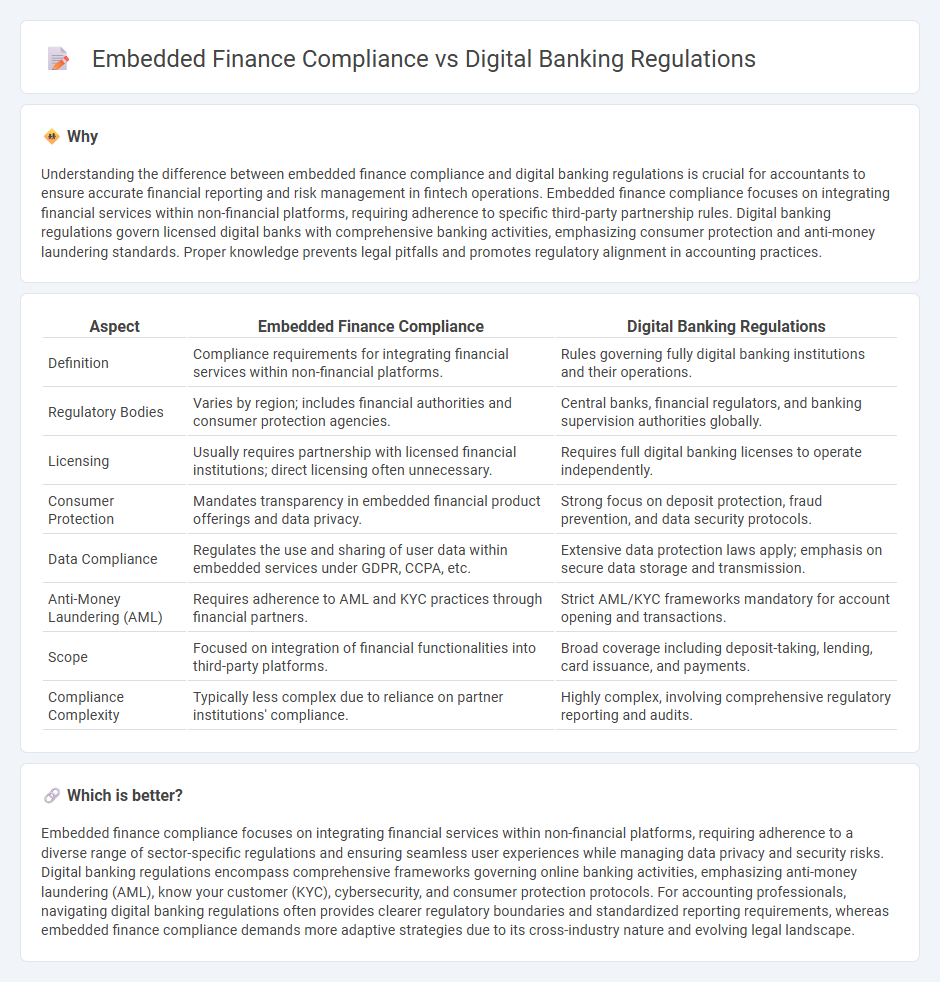

Understanding the difference between embedded finance compliance and digital banking regulations is crucial for accountants to ensure accurate financial reporting and risk management in fintech operations. Embedded finance compliance focuses on integrating financial services within non-financial platforms, requiring adherence to specific third-party partnership rules. Digital banking regulations govern licensed digital banks with comprehensive banking activities, emphasizing consumer protection and anti-money laundering standards. Proper knowledge prevents legal pitfalls and promotes regulatory alignment in accounting practices.

Comparison Table

| Aspect | Embedded Finance Compliance | Digital Banking Regulations |

|---|---|---|

| Definition | Compliance requirements for integrating financial services within non-financial platforms. | Rules governing fully digital banking institutions and their operations. |

| Regulatory Bodies | Varies by region; includes financial authorities and consumer protection agencies. | Central banks, financial regulators, and banking supervision authorities globally. |

| Licensing | Usually requires partnership with licensed financial institutions; direct licensing often unnecessary. | Requires full digital banking licenses to operate independently. |

| Consumer Protection | Mandates transparency in embedded financial product offerings and data privacy. | Strong focus on deposit protection, fraud prevention, and data security protocols. |

| Data Compliance | Regulates the use and sharing of user data within embedded services under GDPR, CCPA, etc. | Extensive data protection laws apply; emphasis on secure data storage and transmission. |

| Anti-Money Laundering (AML) | Requires adherence to AML and KYC practices through financial partners. | Strict AML/KYC frameworks mandatory for account opening and transactions. |

| Scope | Focused on integration of financial functionalities into third-party platforms. | Broad coverage including deposit-taking, lending, card issuance, and payments. |

| Compliance Complexity | Typically less complex due to reliance on partner institutions' compliance. | Highly complex, involving comprehensive regulatory reporting and audits. |

Which is better?

Embedded finance compliance focuses on integrating financial services within non-financial platforms, requiring adherence to a diverse range of sector-specific regulations and ensuring seamless user experiences while managing data privacy and security risks. Digital banking regulations encompass comprehensive frameworks governing online banking activities, emphasizing anti-money laundering (AML), know your customer (KYC), cybersecurity, and consumer protection protocols. For accounting professionals, navigating digital banking regulations often provides clearer regulatory boundaries and standardized reporting requirements, whereas embedded finance compliance demands more adaptive strategies due to its cross-industry nature and evolving legal landscape.

Connection

Embedded finance compliance and digital banking regulations are interconnected through their shared requirement for stringent data security measures and customer authentication protocols. Both frameworks mandate adherence to anti-money laundering (AML) and know your customer (KYC) standards to prevent fraud and ensure transparency. Regulatory alignment ensures seamless integration of financial services within digital platforms while maintaining legal and operational safeguards.

Key Terms

KYC (Know Your Customer)

KYC regulations in digital banking require rigorous identity verification, customer due diligence, and continuous monitoring to prevent fraud and ensure regulatory compliance. Embedded finance compliance integrates these KYC standards within third-party platforms, necessitating seamless data sharing and robust security protocols to maintain trust and meet legal requirements. Explore how evolving KYC frameworks shape both digital banking and embedded finance ecosystems.

AML (Anti-Money Laundering)

Digital banking regulations impose stringent AML protocols that require comprehensive customer due diligence, transaction monitoring, and reporting mechanisms to prevent financial crimes. Embedded finance providers must also comply with AML requirements but face unique challenges integrating these controls within third-party platforms and ensuring consistent oversight. Explore further to understand the nuanced AML compliance landscape for digital banking and embedded finance solutions.

API Security

Digital banking regulations mandate stringent API security standards to protect customer data and prevent unauthorized access, often requiring multi-factor authentication and encryption protocols. Embedded finance compliance emphasizes secure API integration within third-party platforms, ensuring transparent data sharing and minimizing risks associated with open banking ecosystems. Explore detailed insights into API security frameworks and regulatory requirements shaping the future of digital finance.

Source and External Links

Regulatory Compliance for Digital Banks - Overview of key regulatory requirements for digital banks, including KYC, AML, and data privacy.

CFPB Finalizes Rule on Federal Oversight of Popular Digital Payment Apps - Details on CFPB's new rule to supervise nonbank companies offering digital payment services.

Lessons from the Rapidly Evolving Regulation of Digital Banking - Insights into the evolving regulatory frameworks for digital banking globally.

dowidth.com

dowidth.com