Cryptocurrency taxation involves complex regulations due to its classification as property or digital assets, differing significantly from traditional commodities taxation governed by established IRS guidelines. While commodities taxation focuses on tangible goods like metals and agricultural products with clear cost basis and holding period rules, cryptocurrency requires meticulous tracking of transaction dates, fair market value, and capital gains treatment. Explore the nuances of tax implications for both asset types to ensure compliance and optimize financial strategy.

Why it is important

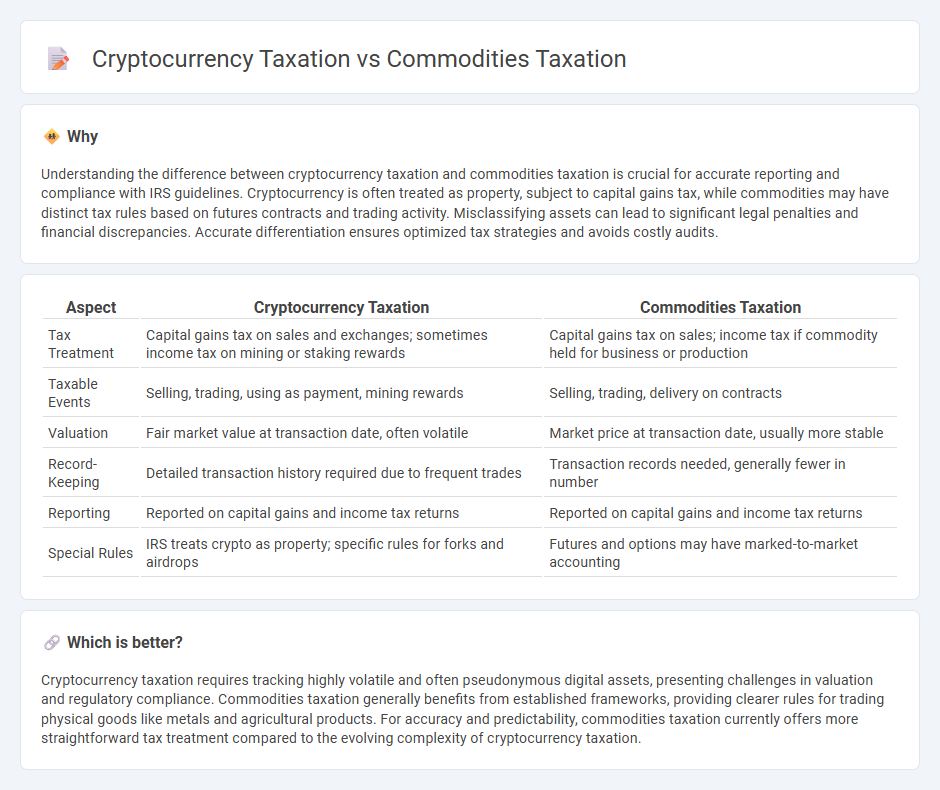

Understanding the difference between cryptocurrency taxation and commodities taxation is crucial for accurate reporting and compliance with IRS guidelines. Cryptocurrency is often treated as property, subject to capital gains tax, while commodities may have distinct tax rules based on futures contracts and trading activity. Misclassifying assets can lead to significant legal penalties and financial discrepancies. Accurate differentiation ensures optimized tax strategies and avoids costly audits.

Comparison Table

| Aspect | Cryptocurrency Taxation | Commodities Taxation |

|---|---|---|

| Tax Treatment | Capital gains tax on sales and exchanges; sometimes income tax on mining or staking rewards | Capital gains tax on sales; income tax if commodity held for business or production |

| Taxable Events | Selling, trading, using as payment, mining rewards | Selling, trading, delivery on contracts |

| Valuation | Fair market value at transaction date, often volatile | Market price at transaction date, usually more stable |

| Record-Keeping | Detailed transaction history required due to frequent trades | Transaction records needed, generally fewer in number |

| Reporting | Reported on capital gains and income tax returns | Reported on capital gains and income tax returns |

| Special Rules | IRS treats crypto as property; specific rules for forks and airdrops | Futures and options may have marked-to-market accounting |

Which is better?

Cryptocurrency taxation requires tracking highly volatile and often pseudonymous digital assets, presenting challenges in valuation and regulatory compliance. Commodities taxation generally benefits from established frameworks, providing clearer rules for trading physical goods like metals and agricultural products. For accuracy and predictability, commodities taxation currently offers more straightforward tax treatment compared to the evolving complexity of cryptocurrency taxation.

Connection

Cryptocurrency taxation is often treated similarly to commodities taxation because many tax authorities classify cryptocurrencies as property or financial assets rather than currency. Both involve tracking gains and losses on transactions, requiring detailed record-keeping of purchase prices, sale prices, and dates to calculate taxable events accurately. The shared principles in taxable event recognition, cost basis determination, and capital gains reporting link cryptocurrency taxation directly to established commodities taxation frameworks.

Key Terms

Capital Gains

Capital gains taxation on commodities involves levying taxes on profits from trading physical goods like gold, oil, and agricultural products, often subject to specific holding periods and rates defined by jurisdictions. Cryptocurrency taxation treats digital assets as property, requiring reporting of capital gains realized from buying, selling, or exchanging cryptocurrencies like Bitcoin and Ethereum, with tax implications varying based on transaction type and duration of ownership. Explore detailed comparisons of tax regulations, compliance strategies, and reporting requirements to optimize your capital gains management.

Value Added Tax (VAT)

Value Added Tax (VAT) on commodities typically applies to the sale of physical goods, where a fixed percentage is levied at each stage of production and distribution, ensuring tax is collected on the value added. In contrast, cryptocurrency transactions often face ambiguous VAT treatment across jurisdictions, with many countries exempting digital currencies from VAT to avoid double taxation, especially when cryptocurrencies are used as a means of payment. Explore the evolving regulatory frameworks and VAT implications on digital assets for a comprehensive understanding.

Classification of Asset

Commodities taxation typically classifies assets as tangible goods like gold, oil, or agricultural products subject to capital gains tax or excise duties, depending on the jurisdiction. Cryptocurrency taxation, on the other hand, often treats digital assets as property, subject to capital gains tax, with specific regulations emerging around classification as currency, security, or commodity. Explore detailed insights on asset classification to optimize your tax strategy in these evolving markets.

Source and External Links

What is commodity tax? - A commodity tax is a special consumption tax levied on specific goods such as rubber, cement, and beverages.

Tax on Commodity Trading Guide - The guide explains the 60/40 tax rule for commodity trading in the US, affecting futures and options contracts.

Filing Taxes on Commodities Trading - This resource provides guidance on filing taxes for commodity trading, highlighting the use of the 60/40 rule.

dowidth.com

dowidth.com