Real-time expense management provides instant tracking and categorization of business expenditures, allowing companies to monitor cash flow and enforce budgeting policies efficiently. Corporate card reconciliation focuses on matching card transactions with recorded expenses, reducing errors and preventing fraud by ensuring accurate ledger entries. Explore deeper insights into optimizing financial workflows through these tools.

Why it is important

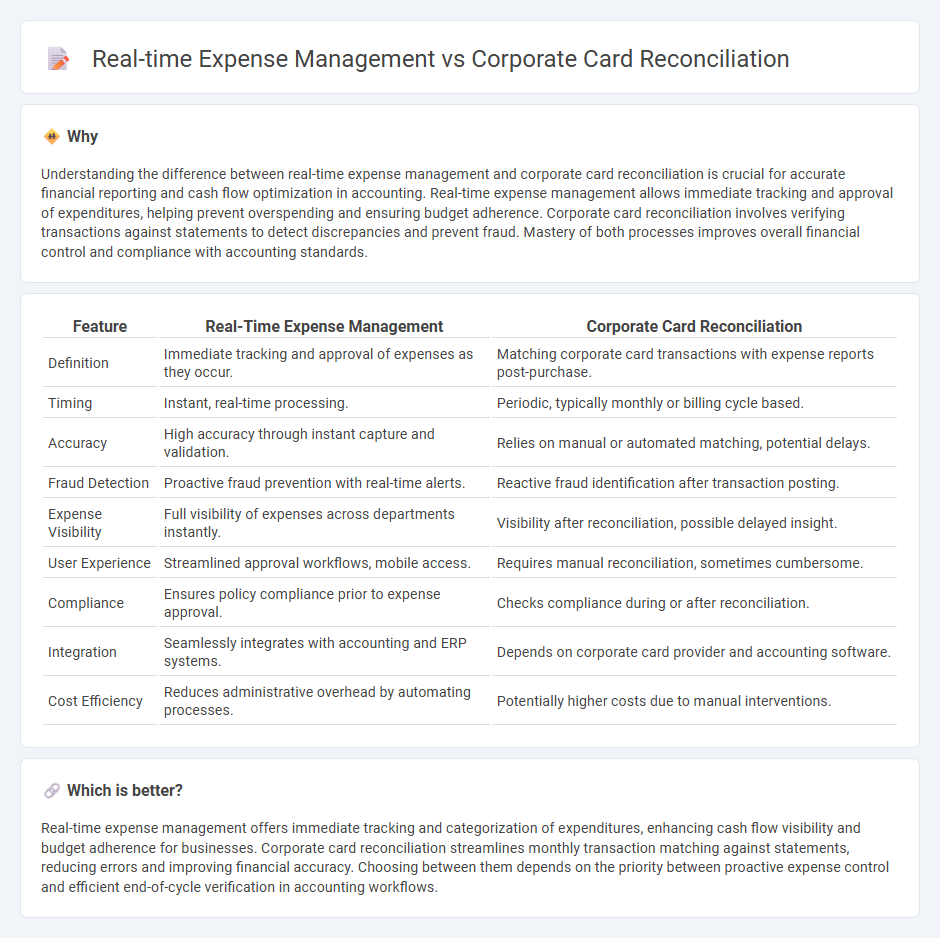

Understanding the difference between real-time expense management and corporate card reconciliation is crucial for accurate financial reporting and cash flow optimization in accounting. Real-time expense management allows immediate tracking and approval of expenditures, helping prevent overspending and ensuring budget adherence. Corporate card reconciliation involves verifying transactions against statements to detect discrepancies and prevent fraud. Mastery of both processes improves overall financial control and compliance with accounting standards.

Comparison Table

| Feature | Real-Time Expense Management | Corporate Card Reconciliation |

|---|---|---|

| Definition | Immediate tracking and approval of expenses as they occur. | Matching corporate card transactions with expense reports post-purchase. |

| Timing | Instant, real-time processing. | Periodic, typically monthly or billing cycle based. |

| Accuracy | High accuracy through instant capture and validation. | Relies on manual or automated matching, potential delays. |

| Fraud Detection | Proactive fraud prevention with real-time alerts. | Reactive fraud identification after transaction posting. |

| Expense Visibility | Full visibility of expenses across departments instantly. | Visibility after reconciliation, possible delayed insight. |

| User Experience | Streamlined approval workflows, mobile access. | Requires manual reconciliation, sometimes cumbersome. |

| Compliance | Ensures policy compliance prior to expense approval. | Checks compliance during or after reconciliation. |

| Integration | Seamlessly integrates with accounting and ERP systems. | Depends on corporate card provider and accounting software. |

| Cost Efficiency | Reduces administrative overhead by automating processes. | Potentially higher costs due to manual interventions. |

Which is better?

Real-time expense management offers immediate tracking and categorization of expenditures, enhancing cash flow visibility and budget adherence for businesses. Corporate card reconciliation streamlines monthly transaction matching against statements, reducing errors and improving financial accuracy. Choosing between them depends on the priority between proactive expense control and efficient end-of-cycle verification in accounting workflows.

Connection

Real-time expense management streamlines tracking and categorizing employee expenditures instantly, which enhances the accuracy and efficiency of corporate card reconciliation by providing up-to-date transaction data. Integrating these processes reduces manual errors and accelerates the closing cycle for financial reporting. Organizations leveraging automated workflows between expense management systems and corporate card platforms achieve improved compliance and detailed audit trails.

Key Terms

Transaction Matching

Corporate card reconciliation centers on matching transactions against statements post-purchase, ensuring accuracy and compliance. Real-time expense management emphasizes immediate transaction matching, allowing instant flagging and categorization for streamlined reporting. Explore more to optimize your expense processes with advanced transaction matching solutions.

Policy Compliance

Corporate card reconciliation primarily addresses post-transaction review, ensuring expenses align with company policies through detailed audits and reporting. Real-time expense management integrates instant transaction monitoring with automated policy enforcement, reducing policy violations and enabling proactive compliance control. Explore advanced solutions to enhance policy adherence and streamline corporate spending.

Cash Flow Visibility

Corporate card reconciliation involves verifying transactions after they occur, which can delay cash flow insights and impact timely financial decisions. Real-time expense management provides instant tracking of expenditures, enhancing cash flow visibility and enabling proactive budget control. Explore how integrating real-time solutions can transform your financial oversight today.

Source and External Links

What is Corporate Card Reconciliation? | Paylocity - Corporate card reconciliation is the process of reviewing and verifying company credit card transactions to ensure they match internal financial records, helping maintain accuracy, transparency, and compliance.

Harmony in Transactions: Reconciliation with Corporate Cards | Airbase - This process involves systematically matching corporate card transactions with internal documents to confirm expense legitimacy and proper classification, reducing errors and enhancing fraud detection.

Complete Guide to Credit Card Reconciliation in 2025 | Ramp - Effective reconciliation requires tracking all card expenses, obtaining supporting documentation, and resolving discrepancies between statements and receipts to ensure accurate financial reporting.

dowidth.com

dowidth.com