Carbon accounting quantifies greenhouse gas emissions to assess environmental impact, while accrual accounting records financial transactions when they occur, regardless of cash flow timing. Both frameworks serve distinct purposes--carbon accounting supports sustainability reporting and regulatory compliance, whereas accrual accounting underpins accurate financial performance tracking and decision-making. Explore further to understand how these methodologies influence corporate strategy and reporting standards.

Why it is important

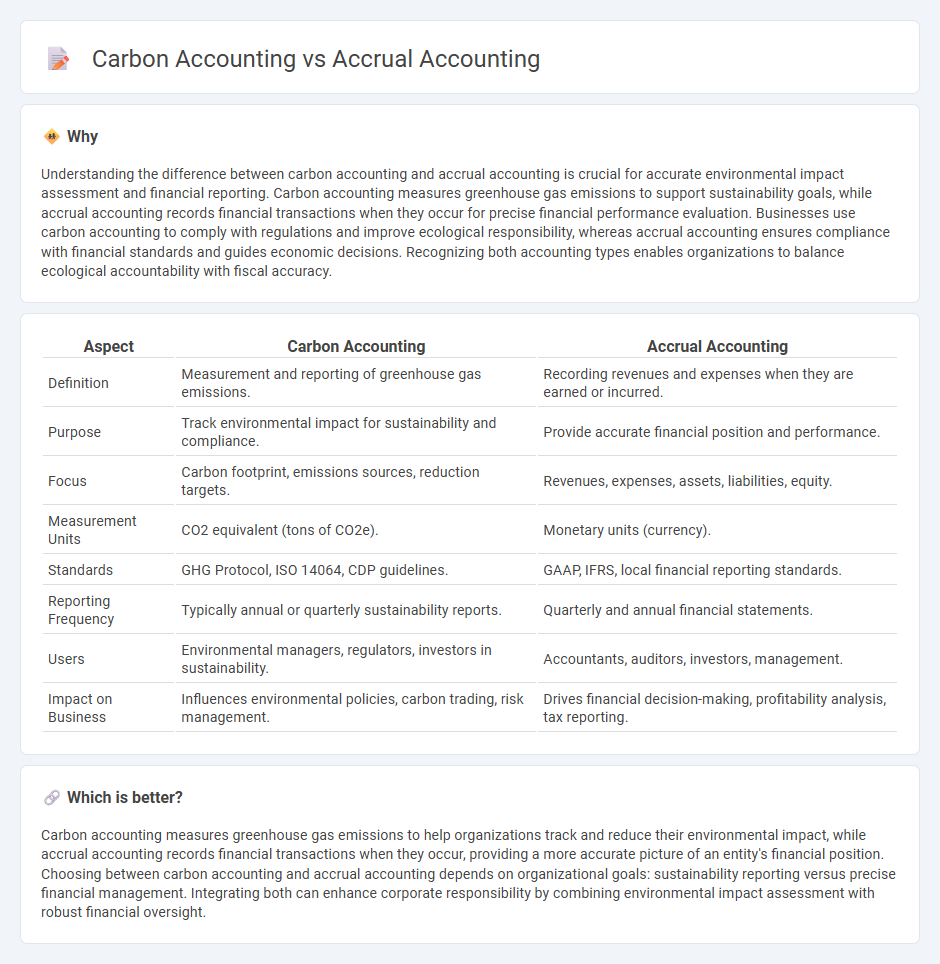

Understanding the difference between carbon accounting and accrual accounting is crucial for accurate environmental impact assessment and financial reporting. Carbon accounting measures greenhouse gas emissions to support sustainability goals, while accrual accounting records financial transactions when they occur for precise financial performance evaluation. Businesses use carbon accounting to comply with regulations and improve ecological responsibility, whereas accrual accounting ensures compliance with financial standards and guides economic decisions. Recognizing both accounting types enables organizations to balance ecological accountability with fiscal accuracy.

Comparison Table

| Aspect | Carbon Accounting | Accrual Accounting |

|---|---|---|

| Definition | Measurement and reporting of greenhouse gas emissions. | Recording revenues and expenses when they are earned or incurred. |

| Purpose | Track environmental impact for sustainability and compliance. | Provide accurate financial position and performance. |

| Focus | Carbon footprint, emissions sources, reduction targets. | Revenues, expenses, assets, liabilities, equity. |

| Measurement Units | CO2 equivalent (tons of CO2e). | Monetary units (currency). |

| Standards | GHG Protocol, ISO 14064, CDP guidelines. | GAAP, IFRS, local financial reporting standards. |

| Reporting Frequency | Typically annual or quarterly sustainability reports. | Quarterly and annual financial statements. |

| Users | Environmental managers, regulators, investors in sustainability. | Accountants, auditors, investors, management. |

| Impact on Business | Influences environmental policies, carbon trading, risk management. | Drives financial decision-making, profitability analysis, tax reporting. |

Which is better?

Carbon accounting measures greenhouse gas emissions to help organizations track and reduce their environmental impact, while accrual accounting records financial transactions when they occur, providing a more accurate picture of an entity's financial position. Choosing between carbon accounting and accrual accounting depends on organizational goals: sustainability reporting versus precise financial management. Integrating both can enhance corporate responsibility by combining environmental impact assessment with robust financial oversight.

Connection

Carbon accounting integrates with accrual accounting by recording carbon emissions as liabilities or expenses in the financial statements when they are incurred, regardless of cash flow timing. This alignment ensures that environmental costs are matched with the activities causing emissions, promoting accurate sustainability reporting alongside financial performance. Companies use this connection to enhance transparency in carbon footprint management and support regulatory compliance under frameworks like the Greenhouse Gas Protocol.

Key Terms

Revenue Recognition

Accrual accounting recognizes revenue when it is earned, regardless of cash receipt, ensuring accurate financial statements that reflect company performance within a given period. Carbon accounting, while primarily focused on measuring greenhouse gas emissions, intersects with revenue recognition by attributing emissions costs to products or services during revenue measurement. Explore further to understand how these accounting methods impact sustainability reporting and financial transparency.

Emissions Measurement

Accrual accounting tracks financial transactions when they are incurred, while carbon accounting focuses on measuring, reporting, and managing greenhouse gas emissions to gauge environmental impact. Emissions measurement in carbon accounting involves quantifying carbon dioxide equivalents (CO2e) across scopes 1, 2, and 3 emissions to provide a comprehensive carbon footprint analysis. Discover how integrating emissions data improves sustainability strategies and regulatory compliance by exploring advanced carbon accounting methodologies.

Matching Principle

Accrual accounting adheres to the Matching Principle by recognizing revenues and expenses when they are incurred, ensuring financial statements reflect true economic activity within a specific period. Carbon accounting applies a similar matching concept to environmental impacts, linking greenhouse gas emissions to the activities or processes that generate them, enabling accurate tracking of an organization's carbon footprint. Explore how these accounting principles align to improve sustainability reporting and financial transparency.

Source and External Links

Accrual-Based Accounting Explained - This article explains accrual basis accounting, which recognizes revenue and expenses when they are earned or incurred, providing a more accurate financial picture of a company's operations.

Accrual Accounting - Guide, How it Works, Definition - This guide defines accrual accounting, detailing how it involves recognizing revenues and expenses when they occur, regardless of cash transactions, and includes examples of accrued revenues and expenses.

Accrual Accounting Explained - This article provides explanations, examples, and journal entries for accrual accounting, including components like prepaid expenses and accruals to ensure accurate financial reporting.

dowidth.com

dowidth.com