Blockchain bookkeeping enhances transparency and security by recording transactions on a decentralized ledger, reducing the risk of errors and fraud inherent in manual bookkeeping. Manual bookkeeping relies on traditional methods of recording financial data, often leading to increased chances of human error and time-consuming reconciliation processes. Explore the advantages and challenges of blockchain versus manual bookkeeping to optimize your accounting practices.

Why it is important

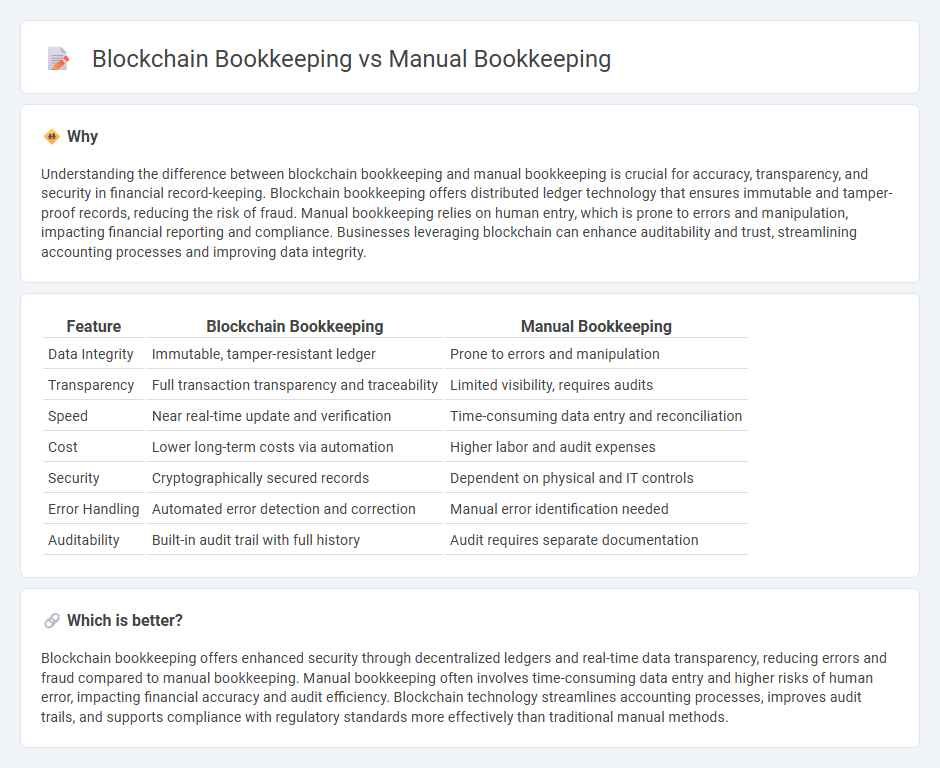

Understanding the difference between blockchain bookkeeping and manual bookkeeping is crucial for accuracy, transparency, and security in financial record-keeping. Blockchain bookkeeping offers distributed ledger technology that ensures immutable and tamper-proof records, reducing the risk of fraud. Manual bookkeeping relies on human entry, which is prone to errors and manipulation, impacting financial reporting and compliance. Businesses leveraging blockchain can enhance auditability and trust, streamlining accounting processes and improving data integrity.

Comparison Table

| Feature | Blockchain Bookkeeping | Manual Bookkeeping |

|---|---|---|

| Data Integrity | Immutable, tamper-resistant ledger | Prone to errors and manipulation |

| Transparency | Full transaction transparency and traceability | Limited visibility, requires audits |

| Speed | Near real-time update and verification | Time-consuming data entry and reconciliation |

| Cost | Lower long-term costs via automation | Higher labor and audit expenses |

| Security | Cryptographically secured records | Dependent on physical and IT controls |

| Error Handling | Automated error detection and correction | Manual error identification needed |

| Auditability | Built-in audit trail with full history | Audit requires separate documentation |

Which is better?

Blockchain bookkeeping offers enhanced security through decentralized ledgers and real-time data transparency, reducing errors and fraud compared to manual bookkeeping. Manual bookkeeping often involves time-consuming data entry and higher risks of human error, impacting financial accuracy and audit efficiency. Blockchain technology streamlines accounting processes, improves audit trails, and supports compliance with regulatory standards more effectively than traditional manual methods.

Connection

Blockchain bookkeeping and manual bookkeeping are connected through their fundamental role in recording financial transactions and maintaining accurate financial records. Both methods ensure transparency, accuracy, and accountability in accounting, with blockchain offering automated, tamper-resistant ledger capabilities, while manual bookkeeping relies on traditional, human-entered data processes. Integrating blockchain technology enhances manual bookkeeping by reducing errors, improving audit trails, and increasing overall financial data integrity.

Key Terms

Ledger

Manual bookkeeping relies on physical ledgers or spreadsheets to record financial transactions, often requiring extensive human effort and prone to errors or data manipulation. Blockchain bookkeeping uses a decentralized digital ledger that securely records transactions in immutable blocks, enhancing transparency, accuracy, and real-time updates. Explore the advantages of blockchain ledgers over traditional methods to streamline your accounting processes.

Double-entry

Manual double-entry bookkeeping involves recording financial transactions by hand, ensuring each debit has a corresponding credit to maintain balanced accounts. Blockchain bookkeeping automates this process by securely recording transactions in an immutable, decentralized ledger, reducing errors and enhancing transparency. Explore the advantages of blockchain double-entry bookkeeping to optimize your financial management.

Immutability

Manual bookkeeping relies on physical records or digital spreadsheets prone to errors, alterations, and fraud, lacking true immutability. Blockchain bookkeeping ensures data immutability through cryptographic hashes and decentralized ledger technology, making entries tamper-proof and verifiable by all participants. Explore the revolutionary impact of immutability in blockchain bookkeeping to understand how it transforms financial transparency and security.

Source and External Links

An Easy-to-Use Manual Bookkeeping System - Manual bookkeeping involves using physical folders and paper records--labeled for income and expenses--to organize receipts, invoices, and bank statements, making it suitable for small businesses favoring simplicity and minimal tech use.

Is Manual Bookkeeping a Thing of the Past? - Manual bookkeeping relies on spreadsheets and handwritten journals, offering a low-cost, human-centric approach ideal for small operations, but lacks the efficiency and accuracy of automated systems.

The Complete Guide to Manual Bookkeeping - This method requires collecting source documents and manually entering transaction details into various ledgers and journals, a process prone to errors and time-consuming but foundational for traditional financial record-keeping.

dowidth.com

dowidth.com