Cryptocurrency taxation involves accurately reporting digital asset transactions, gains, and losses according to IRS guidelines, while FATCA compliance requires foreign financial institutions to disclose American account holders' information to the IRS. Understanding the distinctions between these regulatory frameworks is essential for proper tax compliance and avoiding penalties. Explore further to master the complexities of cryptocurrency taxation and FATCA regulations.

Why it is important

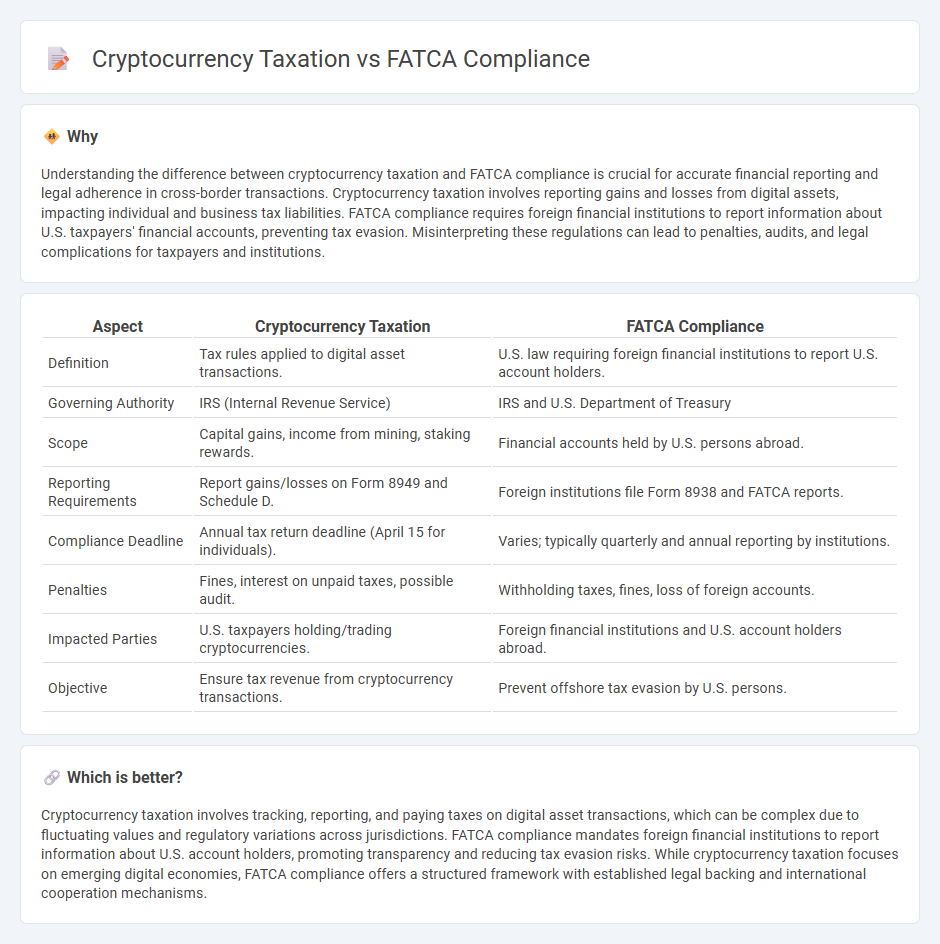

Understanding the difference between cryptocurrency taxation and FATCA compliance is crucial for accurate financial reporting and legal adherence in cross-border transactions. Cryptocurrency taxation involves reporting gains and losses from digital assets, impacting individual and business tax liabilities. FATCA compliance requires foreign financial institutions to report information about U.S. taxpayers' financial accounts, preventing tax evasion. Misinterpreting these regulations can lead to penalties, audits, and legal complications for taxpayers and institutions.

Comparison Table

| Aspect | Cryptocurrency Taxation | FATCA Compliance |

|---|---|---|

| Definition | Tax rules applied to digital asset transactions. | U.S. law requiring foreign financial institutions to report U.S. account holders. |

| Governing Authority | IRS (Internal Revenue Service) | IRS and U.S. Department of Treasury |

| Scope | Capital gains, income from mining, staking rewards. | Financial accounts held by U.S. persons abroad. |

| Reporting Requirements | Report gains/losses on Form 8949 and Schedule D. | Foreign institutions file Form 8938 and FATCA reports. |

| Compliance Deadline | Annual tax return deadline (April 15 for individuals). | Varies; typically quarterly and annual reporting by institutions. |

| Penalties | Fines, interest on unpaid taxes, possible audit. | Withholding taxes, fines, loss of foreign accounts. |

| Impacted Parties | U.S. taxpayers holding/trading cryptocurrencies. | Foreign financial institutions and U.S. account holders abroad. |

| Objective | Ensure tax revenue from cryptocurrency transactions. | Prevent offshore tax evasion by U.S. persons. |

Which is better?

Cryptocurrency taxation involves tracking, reporting, and paying taxes on digital asset transactions, which can be complex due to fluctuating values and regulatory variations across jurisdictions. FATCA compliance mandates foreign financial institutions to report information about U.S. account holders, promoting transparency and reducing tax evasion risks. While cryptocurrency taxation focuses on emerging digital economies, FATCA compliance offers a structured framework with established legal backing and international cooperation mechanisms.

Connection

Cryptocurrency taxation requires accurate reporting of digital asset transactions to tax authorities, aligning closely with FATCA compliance, which mandates disclosure of foreign financial assets by U.S. taxpayers. Both frameworks emphasize transparency to prevent tax evasion, with the IRS increasingly scrutinizing cryptocurrency holdings through FATCA reporting mechanisms. Ensuring adherence to FATCA regulations helps taxpayers avoid penalties while maintaining proper tax reporting on cryptocurrency gains and holdings.

Key Terms

Reporting Requirements

FATCA compliance mandates detailed reporting of foreign financial assets to the IRS, primarily targeting traditional financial institutions and accounts held by U.S. taxpayers overseas, whereas cryptocurrency taxation hinges on reporting transactions and capital gains from digital assets, requiring accurate record-keeping of wallet addresses and transaction histories. The IRS treats cryptocurrencies as property, necessitating disclosure of tax events such as sales, exchanges, and income received in crypto under specific IRS forms like 8949 and Schedule D, while FATCA requires Form 8938 for foreign asset reporting. Explore comprehensive guidelines to navigate the complexities of FATCA and cryptocurrency tax reporting requirements effectively.

Identification of Beneficial Owners

FATCA compliance mandates rigorous identification of beneficial owners to prevent tax evasion through foreign accounts, requiring financial institutions to report account information of U.S. persons. In cryptocurrency taxation, identifying beneficial owners poses challenges due to pseudonymous blockchain transactions and decentralized exchanges, complicating regulatory efforts. Explore effective strategies to reconcile FATCA requirements with cryptocurrency ownership transparency for enhanced compliance.

Withholding Tax

FATCA compliance mandates U.S. taxpayers to report foreign financial assets, impacting cryptocurrency holdings by requiring disclosure to avoid penalties, while cryptocurrency taxation involves tracking capital gains and income subject to withholding tax based on jurisdictional rules. Withholding tax on cryptocurrency transactions varies globally, with some countries imposing rates on transfers, payments, or token sales, necessitating precise reporting and compliance strategies. Explore detailed guidelines and regional regulations to effectively manage FATCA requirements and cryptocurrency withholding tax obligations.

Source and External Links

Foreign Account Tax Compliance Act - Wikipedia - FATCA is a 2010 US law requiring foreign financial institutions to identify and report accounts held by US persons to the IRS, imposing a 30% withholding tax on non-compliant institutions.

Foreign Account Tax Compliance Act - Treasury Department - FATCA mandates that foreign financial institutions report financial accounts held by US taxpayers or entities with substantial US ownership, either by registering with the IRS or complying with intergovernmental agreements.

FATCA: Understanding the Impact of the Foreign Account Tax Compliance Act - FATCA requires foreign institutions to report US account holders' tax information to their governments, which share it with the IRS; non-compliance can result in penalties, with regulations implemented in countries like India under intergovernmental agreements.

dowidth.com

dowidth.com