Embedded finance accounting integrates financial services directly into existing platforms, streamlining transaction recording and reconciliation within a unified system. Microservice architecture accounting separates accounting functions into independent services, allowing for scalability and flexibility in managing distinct financial operations. Explore how these approaches impact efficiency and accuracy in modern accounting systems.

Why it is important

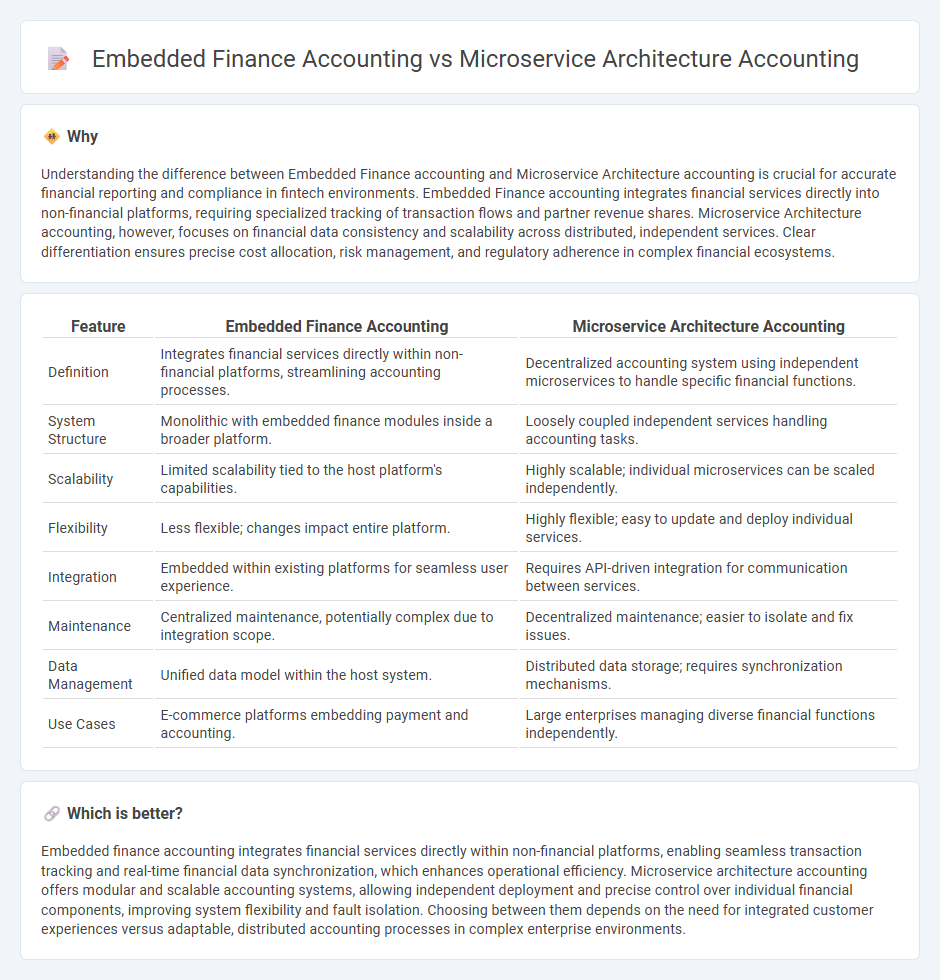

Understanding the difference between Embedded Finance accounting and Microservice Architecture accounting is crucial for accurate financial reporting and compliance in fintech environments. Embedded Finance accounting integrates financial services directly into non-financial platforms, requiring specialized tracking of transaction flows and partner revenue shares. Microservice Architecture accounting, however, focuses on financial data consistency and scalability across distributed, independent services. Clear differentiation ensures precise cost allocation, risk management, and regulatory adherence in complex financial ecosystems.

Comparison Table

| Feature | Embedded Finance Accounting | Microservice Architecture Accounting |

|---|---|---|

| Definition | Integrates financial services directly within non-financial platforms, streamlining accounting processes. | Decentralized accounting system using independent microservices to handle specific financial functions. |

| System Structure | Monolithic with embedded finance modules inside a broader platform. | Loosely coupled independent services handling accounting tasks. |

| Scalability | Limited scalability tied to the host platform's capabilities. | Highly scalable; individual microservices can be scaled independently. |

| Flexibility | Less flexible; changes impact entire platform. | Highly flexible; easy to update and deploy individual services. |

| Integration | Embedded within existing platforms for seamless user experience. | Requires API-driven integration for communication between services. |

| Maintenance | Centralized maintenance, potentially complex due to integration scope. | Decentralized maintenance; easier to isolate and fix issues. |

| Data Management | Unified data model within the host system. | Distributed data storage; requires synchronization mechanisms. |

| Use Cases | E-commerce platforms embedding payment and accounting. | Large enterprises managing diverse financial functions independently. |

Which is better?

Embedded finance accounting integrates financial services directly within non-financial platforms, enabling seamless transaction tracking and real-time financial data synchronization, which enhances operational efficiency. Microservice architecture accounting offers modular and scalable accounting systems, allowing independent deployment and precise control over individual financial components, improving system flexibility and fault isolation. Choosing between them depends on the need for integrated customer experiences versus adaptable, distributed accounting processes in complex enterprise environments.

Connection

Embedded finance accounting integrates financial services directly into non-financial platforms, streamlining transaction recording and reconciliation within the existing accounting systems. Microservice architecture accounting breaks down accounting functions into modular, independently deployable services, enhancing scalability and real-time data processing. The connection lies in leveraging microservices to support embedded finance by enabling flexible, efficient, and accurate handling of diverse financial transactions across integrated platforms.

Key Terms

Revenue Recognition

Microservice architecture accounting enhances revenue recognition by enabling granular tracking of each service's performance and transactions, ensuring precise allocation and compliance with IFRS 15 standards. Embedded finance accounting integrates financial services directly into non-financial platforms, requiring specialized revenue recognition methods to capture diverse income streams from bundled offerings and partner commissions. Explore detailed comparisons to optimize revenue processes in your financial systems.

Transaction Settlement

Microservice architecture accounting enables scalable and decentralized transaction settlement by isolating financial processes into discrete, independently deployable services, enhancing flexibility and fault tolerance. Embedded finance accounting integrates financial services directly into non-financial platforms, streamlining transaction settlement through seamless user experience and real-time processing. Explore the nuances and benefits of each approach to optimize your transaction settlement strategy.

Inter-service Reconciliation

Microservice architecture accounting enables granular control over financial data by isolating transactions within individual service boundaries, enhancing inter-service reconciliation through APIs and event-driven data synchronization. Embedded finance accounting integrates financial services directly into non-financial platforms, necessitating robust reconciliation mechanisms to handle complex cross-service transactions and maintain consistency. Explore detailed strategies and tools to optimize inter-service reconciliation in both architectures.

Source and External Links

Microservices-based tax and labor systems using AWS - Microservices break down accounting functions into independent, decoupled services (e.g., tax revenue accounting, return processing) that communicate via APIs, enabling scalability, independent upgrades, and easier integration of new modules using serverless components.

Microservices Architecture Style | Microsoft Learn - Each accounting microservice is a small, autonomous unit focused on a single business capability (like invoicing or ledger management), operates within its own bounded context, and manages its own domain database, communicating through APIs and event-driven messaging for resilience and independent deployment.

Microservices architecture and design: A complete overview - In cloud-native accounting systems, microservices are stateless, ephemeral, and leverage purpose-built data stores, enabling dynamic scaling, cost efficiency, and rapid updates without disrupting the entire accounting workflow.

dowidth.com

dowidth.com