Intercompany automation streamlines the reconciliation process between multiple subsidiaries by reducing manual errors and accelerating transaction matching, while ledger integration ensures real-time synchronization of financial data across different accounting systems. Together, these technologies enhance accuracy, compliance, and financial visibility in complex corporate structures. Discover how leveraging intercompany automation alongside ledger integration can transform your accounting operations.

Why it is important

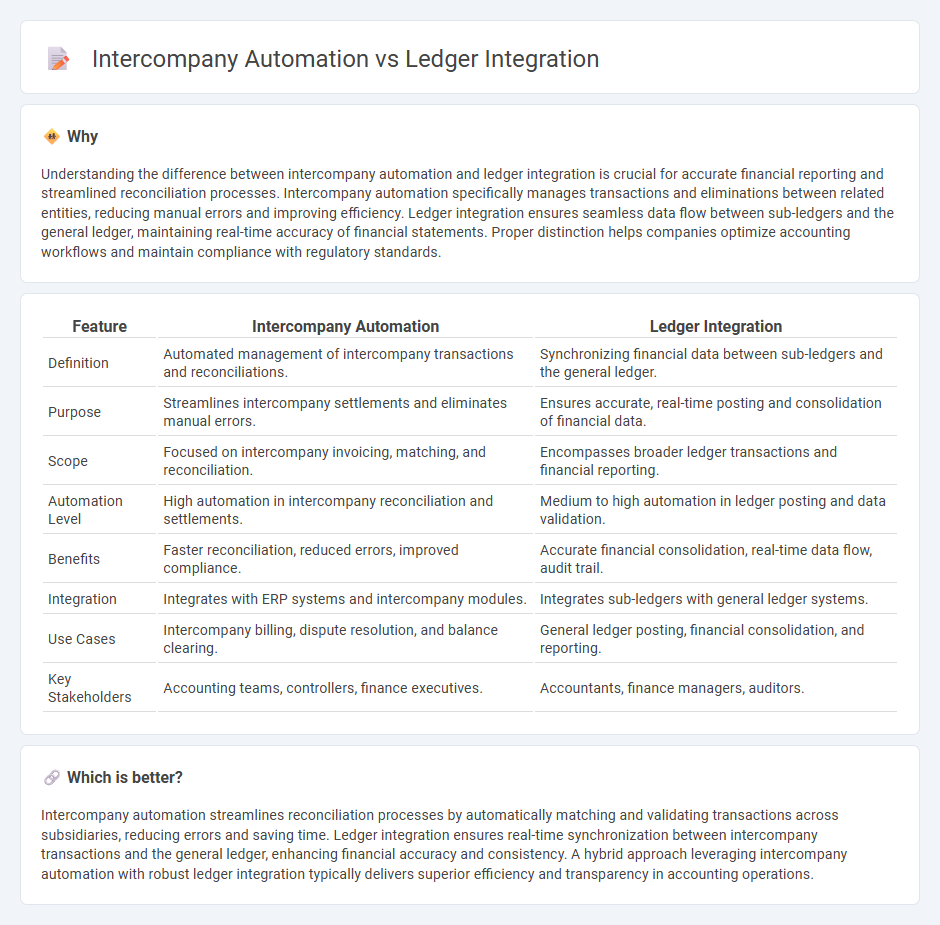

Understanding the difference between intercompany automation and ledger integration is crucial for accurate financial reporting and streamlined reconciliation processes. Intercompany automation specifically manages transactions and eliminations between related entities, reducing manual errors and improving efficiency. Ledger integration ensures seamless data flow between sub-ledgers and the general ledger, maintaining real-time accuracy of financial statements. Proper distinction helps companies optimize accounting workflows and maintain compliance with regulatory standards.

Comparison Table

| Feature | Intercompany Automation | Ledger Integration |

|---|---|---|

| Definition | Automated management of intercompany transactions and reconciliations. | Synchronizing financial data between sub-ledgers and the general ledger. |

| Purpose | Streamlines intercompany settlements and eliminates manual errors. | Ensures accurate, real-time posting and consolidation of financial data. |

| Scope | Focused on intercompany invoicing, matching, and reconciliation. | Encompasses broader ledger transactions and financial reporting. |

| Automation Level | High automation in intercompany reconciliation and settlements. | Medium to high automation in ledger posting and data validation. |

| Benefits | Faster reconciliation, reduced errors, improved compliance. | Accurate financial consolidation, real-time data flow, audit trail. |

| Integration | Integrates with ERP systems and intercompany modules. | Integrates sub-ledgers with general ledger systems. |

| Use Cases | Intercompany billing, dispute resolution, and balance clearing. | General ledger posting, financial consolidation, and reporting. |

| Key Stakeholders | Accounting teams, controllers, finance executives. | Accountants, finance managers, auditors. |

Which is better?

Intercompany automation streamlines reconciliation processes by automatically matching and validating transactions across subsidiaries, reducing errors and saving time. Ledger integration ensures real-time synchronization between intercompany transactions and the general ledger, enhancing financial accuracy and consistency. A hybrid approach leveraging intercompany automation with robust ledger integration typically delivers superior efficiency and transparency in accounting operations.

Connection

Intercompany automation streamlines transaction processing between affiliated entities by enabling real-time data exchange and standardized workflows. Ledger integration ensures that these automated entries are accurately reflected across each entity's general ledger, promoting consistency and reducing reconciliation errors. Together, they enhance financial accuracy and operational efficiency within consolidated accounting processes.

Key Terms

Consolidation

Ledger integration streamlines data flow by synchronizing financial transactions directly from source systems into the general ledger, ensuring real-time accuracy and consistency within consolidation processes. Intercompany automation enhances consolidation by automating eliminations, matching, and reconciliations of intercompany transactions, significantly reducing manual errors and cycle times. Explore how these solutions optimize consolidation efficiency and accuracy to transform your financial close process.

Reconciliation

Ledger integration streamlines data synchronization across multiple accounting systems, ensuring accurate and real-time financial records that reduce manual errors during reconciliation. Intercompany automation enhances the reconciliation process by automating transaction matching, eliminating discrepancies, and accelerating period-end closing cycles between subsidiaries. Discover how advanced reconciliation tools can elevate your intercompany accounting practices for improved financial accuracy and efficiency.

Journal Entries

Ledger integration streamlines the synchronization of financial data between subledgers and the general ledger, ensuring accuracy and real-time updates of journal entries. Intercompany automation specifically targets the elimination of manual processes in recording and reconciling intercompany journal entries, reducing errors and accelerating month-end close. Explore how these solutions enhance journal entry management and financial consolidation efficiency.

Source and External Links

General Ledger Integration Introduction - SYSPRO Help - SYSPRO allows you to automate or manually post journal entries from sub-ledgers (such as Accounts Payable, Inventory, and Assets) into the General Ledger, enabling real-time financial reporting and reducing manual data entry.

General Ledger Integrations - Oracle Help Center - Oracle PeopleSoft General Ledger supports integration via database tables, application messaging, flat file imports, and XML over the internet, allowing flexible data flow from subsystem applications into the core financial system.

Ledger Live integrations - Developers can integrate their blockchain projects with Ledger Live to make their currencies visible and manageable within the Ledger Live "Accounts" section, provided they follow the specific integration documentation.

dowidth.com

dowidth.com