Neobank reconciliation focuses on verifying digital transactions and account balances within online banking platforms, ensuring accuracy in real-time financial data. Loan account reconciliation involves matching loan disbursements, repayments, and interest calculations to maintain precise records of outstanding balances and payment history. Explore the distinctions between these reconciliation processes to optimize your accounting practices.

Why it is important

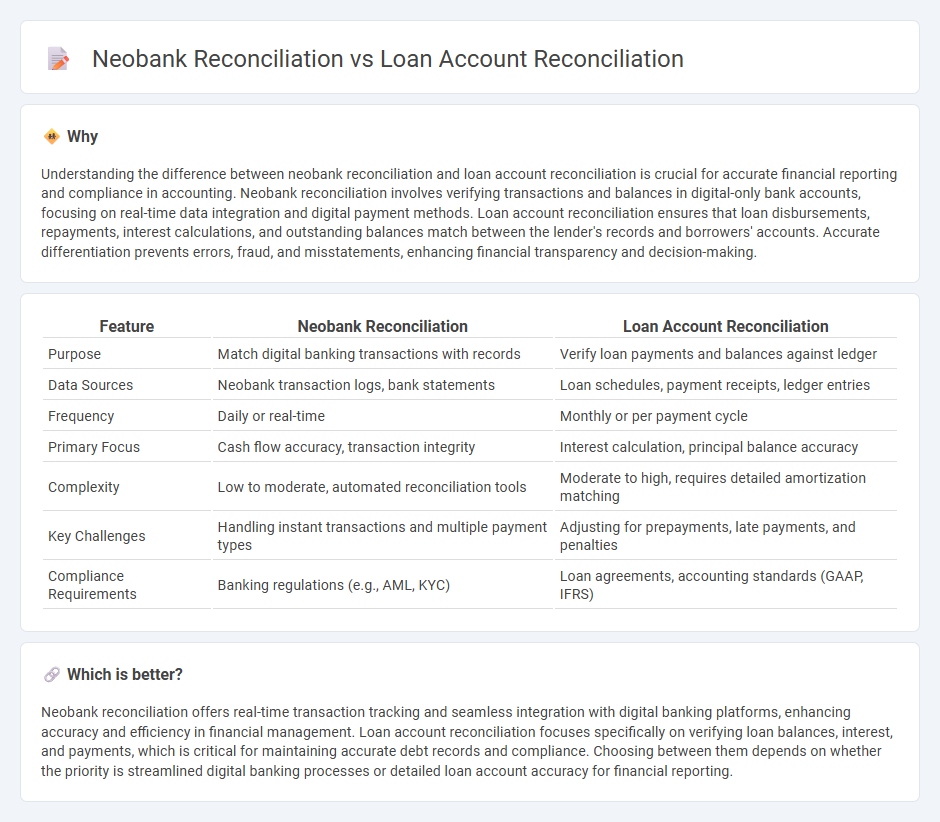

Understanding the difference between neobank reconciliation and loan account reconciliation is crucial for accurate financial reporting and compliance in accounting. Neobank reconciliation involves verifying transactions and balances in digital-only bank accounts, focusing on real-time data integration and digital payment methods. Loan account reconciliation ensures that loan disbursements, repayments, interest calculations, and outstanding balances match between the lender's records and borrowers' accounts. Accurate differentiation prevents errors, fraud, and misstatements, enhancing financial transparency and decision-making.

Comparison Table

| Feature | Neobank Reconciliation | Loan Account Reconciliation |

|---|---|---|

| Purpose | Match digital banking transactions with records | Verify loan payments and balances against ledger |

| Data Sources | Neobank transaction logs, bank statements | Loan schedules, payment receipts, ledger entries |

| Frequency | Daily or real-time | Monthly or per payment cycle |

| Primary Focus | Cash flow accuracy, transaction integrity | Interest calculation, principal balance accuracy |

| Complexity | Low to moderate, automated reconciliation tools | Moderate to high, requires detailed amortization matching |

| Key Challenges | Handling instant transactions and multiple payment types | Adjusting for prepayments, late payments, and penalties |

| Compliance Requirements | Banking regulations (e.g., AML, KYC) | Loan agreements, accounting standards (GAAP, IFRS) |

Which is better?

Neobank reconciliation offers real-time transaction tracking and seamless integration with digital banking platforms, enhancing accuracy and efficiency in financial management. Loan account reconciliation focuses specifically on verifying loan balances, interest, and payments, which is critical for maintaining accurate debt records and compliance. Choosing between them depends on whether the priority is streamlined digital banking processes or detailed loan account accuracy for financial reporting.

Connection

Neobank reconciliation and loan account reconciliation are interconnected through the accurate matching of financial transactions and loan payments within digital banking platforms. Effective neobank reconciliation ensures that all deposits, withdrawals, and loan disbursements are correctly recorded, facilitating precise loan account balances and payment histories. This integration enhances financial accuracy, reduces errors, and supports seamless audit trails in modern financial management.

Key Terms

Principal & Interest Matching

Loan account reconciliation emphasizes accurate Principal & Interest Matching to ensure precise allocation of repayments against outstanding loan balances, minimizing accounting discrepancies. Neobank reconciliation integrates automated matching algorithms within digital platforms to streamline Principal & Interest tracking, enhancing real-time accuracy and customer transparency. Explore the latest methodologies and tools driving efficient reconciliation processes in modern lending environments.

Transaction Categorization

Loan account reconciliation emphasizes accurate matching of loan disbursements, repayments, and interest calculations to ensure precise financial tracking, utilizing detailed transaction categorization for principal and interest components. Neobank reconciliation centers on real-time transaction categorization, leveraging AI-driven automation to classify diverse spending activities and enhance user financial insights. Explore in-depth comparisons to understand how transaction categorization impacts efficiency and accuracy in both reconciliation processes.

Automated Statement Imports

Loan account reconciliation automates the matching of loan disbursements, repayments, and interest calculations against bank statements to ensure accuracy and reduce manual errors. Neobank reconciliation leverages automated statement imports from multiple financial accounts, integrating diverse transaction data in real-time for streamlined cash flow management and faster financial closing. Discover how automated statement imports can revolutionize reconciliation processes across loan management and neobanking platforms.

Source and External Links

Automating the Loan Reconciliation Process - This webpage provides guidance on automating the loan reconciliation process to ensure accuracy in financial statements.

Reconciliation Accounts - This resource explains how reconciliation accounts are used in loan management to ensure consistent and accurate financial records.

Loan Reconciliation for Businesses - This guide outlines the steps and importance of loan reconciliation for businesses to ensure accuracy between internal records and lender statements.

dowidth.com

dowidth.com