Supply chain finance accounting focuses on optimizing cash flow and managing payables and receivables within the procurement and supplier ecosystem, while inventory accounting centers on tracking, valuing, and managing stock levels to ensure accurate financial reporting. Key methodologies in supply chain finance include dynamic discounting and reverse factoring, contrasting with inventory methods such as FIFO, LIFO, and weighted average cost. Discover more about how these accounting practices impact operational efficiency and financial health.

Why it is important

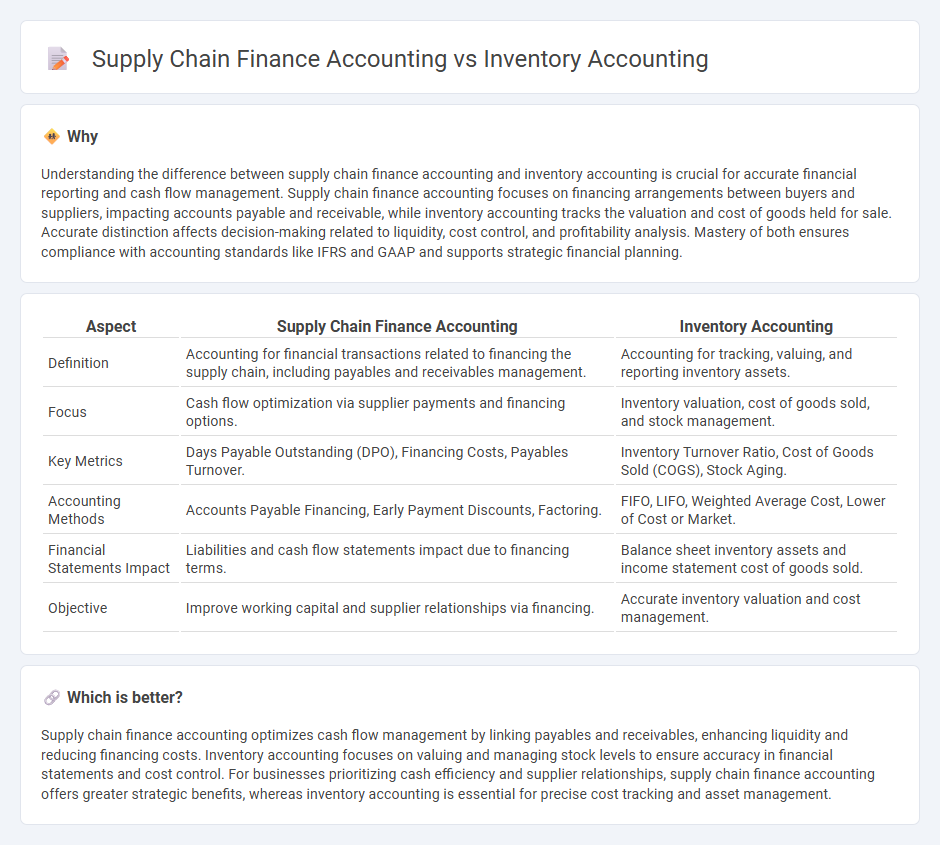

Understanding the difference between supply chain finance accounting and inventory accounting is crucial for accurate financial reporting and cash flow management. Supply chain finance accounting focuses on financing arrangements between buyers and suppliers, impacting accounts payable and receivable, while inventory accounting tracks the valuation and cost of goods held for sale. Accurate distinction affects decision-making related to liquidity, cost control, and profitability analysis. Mastery of both ensures compliance with accounting standards like IFRS and GAAP and supports strategic financial planning.

Comparison Table

| Aspect | Supply Chain Finance Accounting | Inventory Accounting |

|---|---|---|

| Definition | Accounting for financial transactions related to financing the supply chain, including payables and receivables management. | Accounting for tracking, valuing, and reporting inventory assets. |

| Focus | Cash flow optimization via supplier payments and financing options. | Inventory valuation, cost of goods sold, and stock management. |

| Key Metrics | Days Payable Outstanding (DPO), Financing Costs, Payables Turnover. | Inventory Turnover Ratio, Cost of Goods Sold (COGS), Stock Aging. |

| Accounting Methods | Accounts Payable Financing, Early Payment Discounts, Factoring. | FIFO, LIFO, Weighted Average Cost, Lower of Cost or Market. |

| Financial Statements Impact | Liabilities and cash flow statements impact due to financing terms. | Balance sheet inventory assets and income statement cost of goods sold. |

| Objective | Improve working capital and supplier relationships via financing. | Accurate inventory valuation and cost management. |

Which is better?

Supply chain finance accounting optimizes cash flow management by linking payables and receivables, enhancing liquidity and reducing financing costs. Inventory accounting focuses on valuing and managing stock levels to ensure accuracy in financial statements and cost control. For businesses prioritizing cash efficiency and supplier relationships, supply chain finance accounting offers greater strategic benefits, whereas inventory accounting is essential for precise cost tracking and asset management.

Connection

Supply chain finance accounting and inventory accounting are interconnected through the management of working capital and cost control within the supply chain. Accurate recording of inventory levels impacts accounts payable and receivable, influencing cash flow statements and financing decisions in supply chain finance. Integration of these accounting practices enhances financial visibility, enabling optimized payment terms and inventory turnover analysis.

Key Terms

**Inventory accounting:**

Inventory accounting tracks the value of raw materials, work-in-progress, and finished goods to report accurate financial statements, using methods like FIFO, LIFO, or weighted average cost for cost measurement. It ensures compliance with accounting standards such as GAAP or IFRS, impacting profitability and tax obligations by accurately reflecting inventory costs. Explore more about how inventory accounting influences financial health and decision-making in business operations.

Cost of Goods Sold (COGS)

Inventory accounting directly impacts the calculation of Cost of Goods Sold (COGS) by tracking the acquisition, storage, and usage of raw materials and finished goods, ensuring accurate valuation based on methods like FIFO, LIFO, or weighted average. Supply chain finance accounting influences COGS through financing costs, payment terms, and supplier relationships, affecting cash flow and operational efficiency but indirectly impacting the cost structure associated with goods sold. Explore in-depth how integrating these accounting practices optimizes financial performance and inventory management strategies.

Inventory Valuation (FIFO/LIFO/Weighted Average)

Inventory accounting primarily emphasizes accurate inventory valuation methods such as FIFO, LIFO, and Weighted Average to reflect cost flow assumptions and impact gross profit and tax liabilities. Supply chain finance accounting integrates these valuation techniques with cash flow optimization and financing strategies, enhancing working capital management by leveraging inventory as collateral for financing. Explore more about how these valuation methods influence financial statements and supply chain liquidity.

Source and External Links

A Guide to Inventory Accounting - Inventory accounting assigns value to inventory on financial statements to accurately show inventory as an asset on the balance sheet and compute cost of goods sold on the income statement, which influences profitability and cash flow management in sectors like manufacturing and retail.

Inventory Accounting Guide: Methods, Formulas, & How it Works - Key best practices include using appropriate cost flow assumptions (FIFO, LIFO, average cost), perpetually valuing inventory for continuous accuracy, and estimating landed costs to value inventory and cost of goods sold effectively.

How inventory accounting works - Inventory accounting involves journal entries that record purchases, movements between raw materials, work in progress, finished goods, and recognize cost of goods sold and revenue when items are sold, ensuring precise financial tracking of inventory transactions.

dowidth.com

dowidth.com